If anyone is on the Daily Reckoning subscriber list, they saw this weekend’s usual urgent message by the gold bug crew over at Agora Publishing in Maryland: Jim Rickards, one of the more well-known gold bulls out there, thinks U.S. politics will move gold higher. And of course if you’re into the Daily Reckoning, you know all of this is going to happen…NOW!

If anyone is on the Daily Reckoning subscriber list, they saw this weekend’s usual urgent message by the gold bug crew over at Agora Publishing in Maryland: Jim Rickards, one of the more well-known gold bulls out there, thinks U.S. politics will move gold higher. And of course if you’re into the Daily Reckoning, you know all of this is going to happen…NOW!

Well, Rickards and the drama team at Agora may have a point.

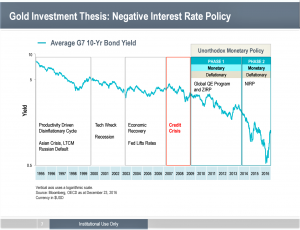

“There is no shortage of macro events that will have an impact on gold going forward, from negative interest rate policies and rate hikes in U.S., to fundamentals of gold miners,” says Edward Coyne, national sales for Sprott Asset Management in Toronto. They run a number of gold-centric closed end and ETF funds, like their Sprott Physical Gold (PHYS 16,68 +0,15 +0,91%) fund, up 5% this year. He says investors are liking the fact that gold and gold equity are cheaper than the S&P 500 these days.

The market tends to think too short-term when it comes to gold. Over the long haul, gold investors have been rewarded. The SPDR Gold (GLD 211,52 -1,22 -0,57%) is up 78.5% in the last 10 years.

Gold is a political play. It has its fans. Guys like Rickard like to think of gold as the Armegeddon metal: you buy it because you believe all hell is about to break loose.

“If you’re nervous about debt loads and easy monetary policy ending and geopolitics today, then gold fits your plans,” says Trey Reik, a senior fund manager for Sprott. They’re thinking that once all of these negative and zero interest rate policies die their slow death, a lot of companies are going to be faced with higher rates. There is going to be a credit problem somewhere. They didn’t go all-in at Sprott during a webinar last week in calling for a full blow crisis, but they believe higher rates will be painful for some and had some charts to prove their point.

“Gold is a way to get a little money out of the financial system,” says Reik. “We all have stocks and bonds and commodities and real estate but gold allows you to take large amounts of capital out of the system. When you think of it as an alternative asset…gold is liquid and transparent and clients know what it is,” he says.

A 10% allocation to gold lowers standard deviation by roughly 200 basis points.

Sprott ran a webcast on March 6 with RIA Channel on the subject of gold investing. It is available for reply here, along with the slide show presentation. WATCH THE REPLY NOW.