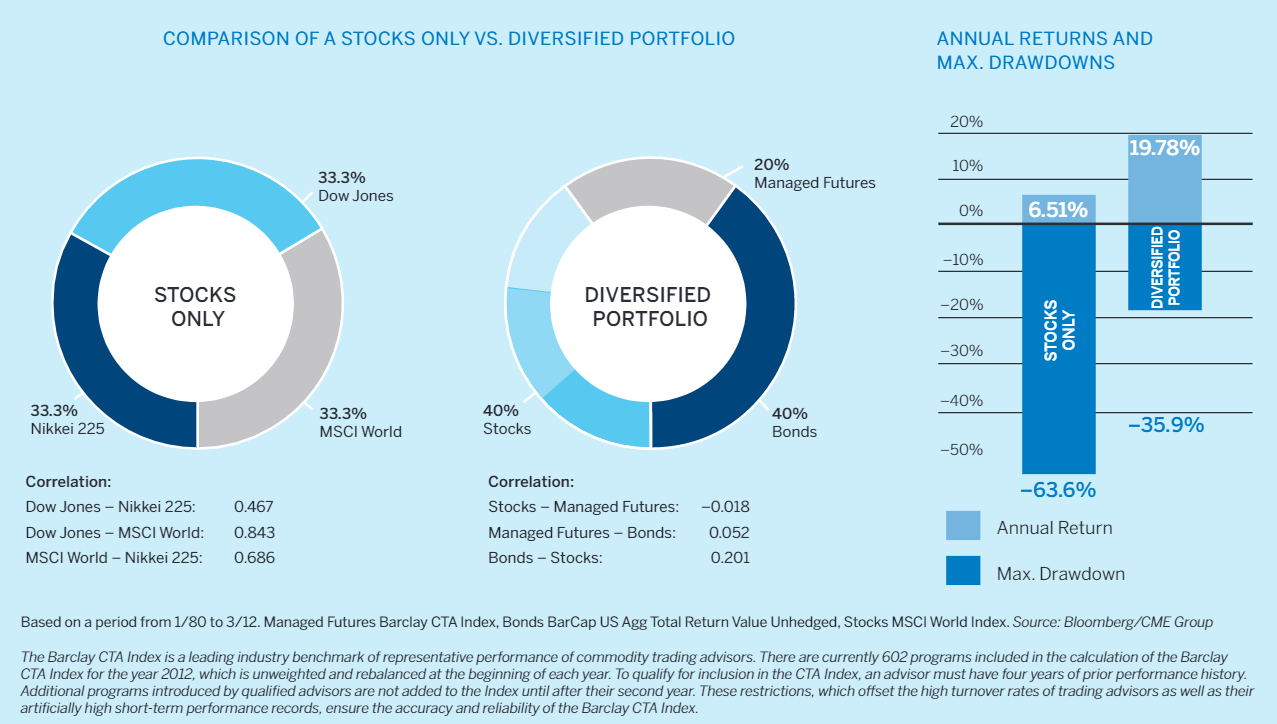

In a study by the CME Group taking a diversified global stock and bond fund and comparing it to one holding a 20% weighting to managed futures contracts between January 1980 and March 2012, the diversified fund wins.

“Many investors don’t even know that since 1974, when IRAs were put into effect, they have had more options to invest other than stocks and bonds,” says Houle. “There are options to diversify — whether it is in real-estate, private equity or in commodities. Every investment has risk, but the biggest risk is the lack of education in opportunities and managing risk.”

Some commodities have enough liquidity to go out years in advance on futures contracts, but market forces constantly change the outlook for prices. In 2008 for instance, oil futures for 2020 contracts were surely priced over $180 a barrel. If you’re still holding out for $180 a barrel, you’re not getting it three years from now. The January 2020 oil futures contract is now priced at just $49.

“Most futures are held for under a year,” says Houle. Capital gains on futures are taxed at a blended short-term, long-term rate.

Icon works one-on-one with investors to go over the best derivative play for their risk appetite. They have their own product platform that allows clients access to tradable managed futures products. The platform displays manager’s history, combined multi-product hypothetical performance and important product metrics such as market correlations, peak-to-valley drawdowns.

“If a client has their own strategy in mind, we will build a customized trading plan for them,” Houle says.

There are a number of mutual funds in this space as well. Here’s a random list of five.

In a study by the CME Group taking a diversified global stock and bond fund and comparing it to one holding a 20% weighting to managed futures contracts between January 1980 and March 2012, the diversified fund wins.

“Many investors don’t even know that since 1974, when IRAs were put into effect, they have had more options to invest other than stocks and bonds,” says Houle. “There are options to diversify — whether it is in real-estate, private equity or in commodities. Every investment has risk, but the biggest risk is the lack of education in opportunities and managing risk.”

Some commodities have enough liquidity to go out years in advance on futures contracts, but market forces constantly change the outlook for prices. In 2008 for instance, oil futures for 2020 contracts were surely priced over $180 a barrel. If you’re still holding out for $180 a barrel, you’re not getting it three years from now. The January 2020 oil futures contract is now priced at just $49.

“Most futures are held for under a year,” says Houle. Capital gains on futures are taxed at a blended short-term, long-term rate.

Icon works one-on-one with investors to go over the best derivative play for their risk appetite. They have their own product platform that allows clients access to tradable managed futures products. The platform displays manager’s history, combined multi-product hypothetical performance and important product metrics such as market correlations, peak-to-valley drawdowns.

“If a client has their own strategy in mind, we will build a customized trading plan for them,” Houle says.

There are a number of mutual funds in this space as well. Here’s a random list of five.

| Mutual fund | AUM | YTD | Inception |

|---|---|---|---|

| AQR Managed Futures Strategy (AQMIX) | $12.7b | -3.22% | -9.44% |

| Altegris Managed Futures Strategy (MFTAX) | $172.2m | -1.43% | -16.16% |

| Guggenheim Series Trust Futures (RYMTX) | $97.4m | 2.41% | -15.37% |

| Natixis ASG Managed Futures (AMFAX) | $3.04b | 0.51% | -3.15% |

| Equinox MutualHedge Futures (MHFCX) | $278.7m | 2.93% | -13.98% |

Most of these funds are under 10 years old. The Auspice Managed Futures Excess Return Index is down 12.75% year to date. The index was back tested starting in 2000 and launched in 2011. Based on the indices performance table this year, 2017 has not been the best year for managed futures. The index is down all four months. It rose 4.87% in 2016. Its best year was the crisis year of 2008, rising 42.65%.