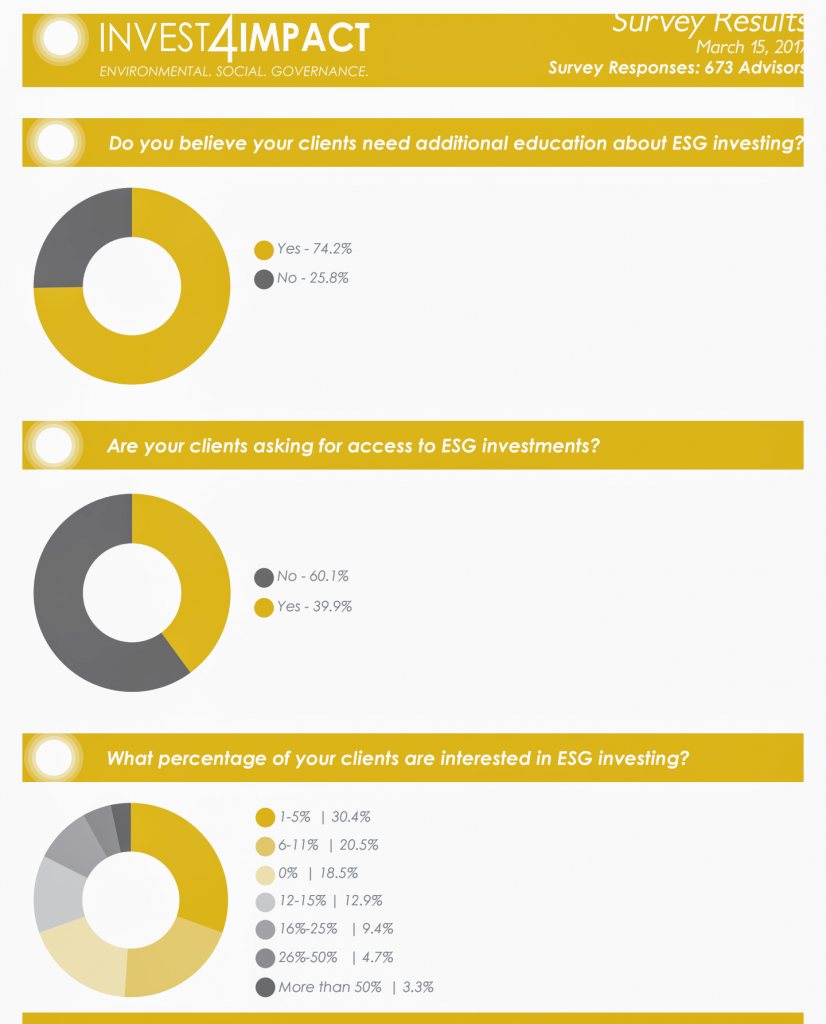

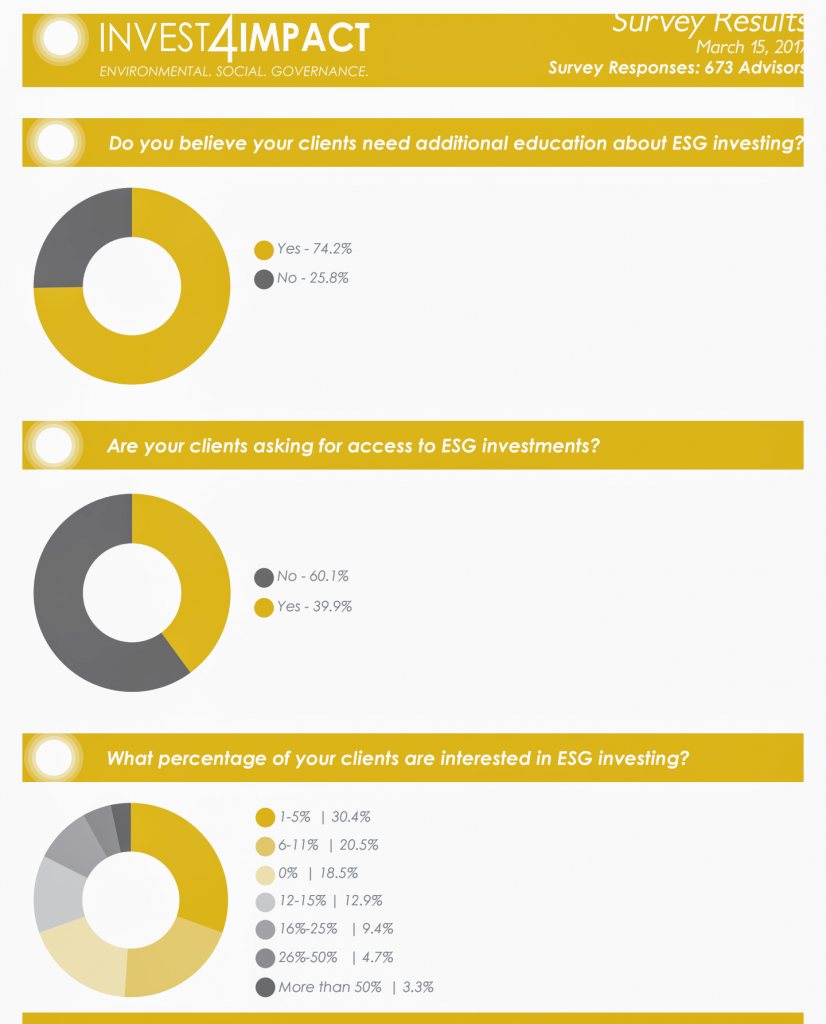

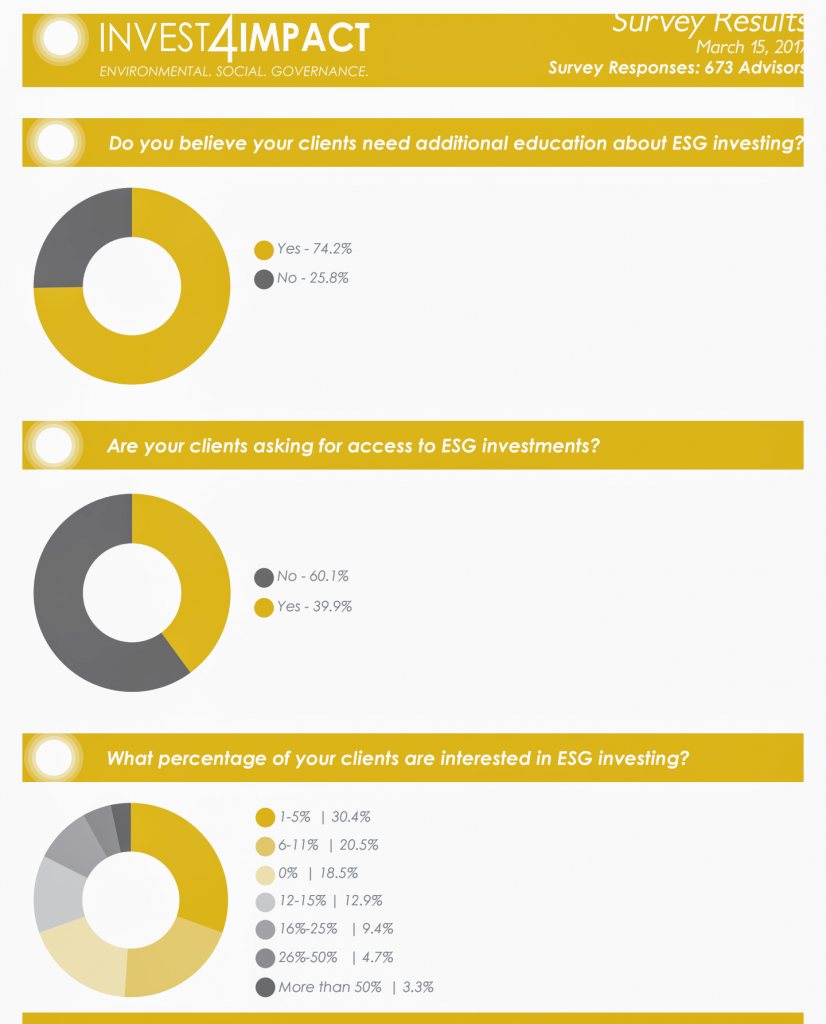

Based on a March survey of investment advisors nationwide, 60% said that their clients were not inquiring about so-called environmental, social and corporate governance-focused funds, best known as ESG. In fact, when asked what percentage of their clients are interested in ESG, the top three replies were (sadly for the ESG fund manager) zero percent, 1-5% and 6-11%. In other words, the vast majority are not all that interested.

Yet, a resounding majority of the independent advisors out there – 61.3% to be exact – are still curious about funds that invest in companies fighting climate change or bombing some village into next week.

Some 48.5% of those surveyed say they have heard of ESG. But nearly everyone thinks they’re either a performance laggard or are not sure how to really use them in a client’s overall portfolio.

ESG has been popular among university and foundation endowments for years thanks to student-led shareholder activism that has forced at least some money to be allocated into companies deemed good for the planet and for labor. That leaves out defense contractors, for example. It may even leave out investments in bonds from companies or nation-states with unsavory characters at the helm.

ESG is like armchair activism. If you like to donate to Conservation International, why not invest in companies that make most of their money from clean water technologies? Instead of writing to your congressman, an act in futility for most, why not invest in the companies that are using natural ingredients in our food?

Some funds will also be run by managers who take an activist approach for their shareholder base, getting companies to hire more women and reduce waste. Other times there are single issue products, like green bonds, that invest in thing like renewable energy.

Annual issuance of green bonds hit $49 billion last year; a record, according to Natixis Asset Management. They estimate that the total market size for green bonds is now close to $112 billion based on issues of at least $200 million (meaning the actual size of the market may be a bit larger).

Still, most of this is market is being sold to the institutional investor and less so to the retail client. The advisor community knows little about it, because the institutional community was first made aware of it through academia and an activist student body.

Of all the things the ESG world invests in, environmental impact investing is the one retail advisors are most interested, with 47% saying so versus 24% for green bonds. General education and social impact investing were in the top three.

“Municipal bonds are going to be one of the best way to play water investing because 98% of water treatment facilities are municipally owned…and there are 14,780 of them,” says Barnet Sherman, senior managing partner of Boston-based Tenbar Capital.

There are a handful of water-centric ETFs out there now for people who think water is like the next oil. PowerShares Water Resources (PHO 63,28 +0,15 +0,24%) is up 19.4% over the last 12 months ending April 10 (outperforming the S&P 500) and the Claymore S&P Global Water Index (CGW 54,08 +0,09 +0,16%) rose 11.75% in the same period (underperforming the S&P 500).

Other bleeding-heart funds focus on women in the workplace. There’s the Pax Ellevate Global Women’s Index Fund (PXWIX 31,66 -0,01 -0,03%). It’s up nearly 10% over the last 12 months and rose over 26% in five years.

“We think there is an opportunity for financial advisors in bringing a gender lens to your portfolio,” Kathleen McQuiggan, senior vice president at Pax World Management, says.

She says this because consulting firm McKinsey estimates that $12 trillion will be added to global GDP by 2025 via gender equality, with two-thirds of millionaires in the U.S. expected to be women within a generation. High net worth women are looking to use their wealth not only for financial independence, but to use their money to make an impact on the world. That includes investing in companies that they deem match their social values when it comes to women in the workplace.

ESG is not entirely out in left field.

Morningstar now has a sustainability rating system for mutual funds. They partnered with the research firm Sustainalytics to help rate ESG funds versus their Morningstar category peers. RIAs can now compare both fund performance and its manager’s ESG street cred on a large number of funds before committing to one. This might help ESG savvy investment advisors build their own portfolio for their clients.

Last month, the RIA Channel hosted an online seminar called Invest4Impact where fund managers gave their ideas on how to put client money in ESG funds. A replay of the show can be seen here.

ESG doesn’t have to be a benchmark beater all the time. These are funds that are targeting a particular set of social values first. Institutional investors seem willing to pay a premium for that. As these are not a core holding, ESG is more likely to become a feel-good fund for a mix of global opportunists (water scarcity plays) and social causes (women at work). Judging by the RIA community’s interest, there is an ever-expanding market for the environmental and social justice warrior shareholder.

Based on a March survey of investment advisors nationwide, 60% said that their clients were not inquiring about so-called environmental, social and corporate governance-focused funds, best known as ESG. In fact, when asked what percentage of their clients are interested in ESG, the top three replies were (sadly for the ESG fund manager) zero percent, 1-5% and 6-11%. In other words, the vast majority are not all that interested.

Yet, a resounding majority of the independent advisors out there – 61.3% to be exact – are still curious about funds that invest in companies fighting climate change or bombing some village into next week.

Some 48.5% of those surveyed say they have heard of ESG. But nearly everyone thinks they’re either a performance laggard or are not sure how to really use them in a client’s overall portfolio.

ESG has been popular among university and foundation endowments for years thanks to student-led shareholder activism that has forced at least some money to be allocated into companies deemed good for the planet and for labor. That leaves out defense contractors, for example. It may even leave out investments in bonds from companies or nation-states with unsavory characters at the helm.

ESG is like armchair activism. If you like to donate to Conservation International, why not invest in companies that make most of their money from clean water technologies? Instead of writing to your congressman, an act in futility for most, why not invest in the companies that are using natural ingredients in our food?

Some funds will also be run by managers who take an activist approach for their shareholder base, getting companies to hire more women and reduce waste. Other times there are single issue products, like green bonds, that invest in thing like renewable energy.

Annual issuance of green bonds hit $49 billion last year; a record, according to Natixis Asset Management. They estimate that the total market size for green bonds is now close to $112 billion based on issues of at least $200 million (meaning the actual size of the market may be a bit larger).

Still, most of this is market is being sold to the institutional investor and less so to the retail client. The advisor community knows little about it, because the institutional community was first made aware of it through academia and an activist student body.

Of all the things the ESG world invests in, environmental impact investing is the one retail advisors are most interested, with 47% saying so versus 24% for green bonds. General education and social impact investing were in the top three.

“Municipal bonds are going to be one of the best way to play water investing because 98% of water treatment facilities are municipally owned…and there are 14,780 of them,” says Barnet Sherman, senior managing partner of Boston-based Tenbar Capital.

There are a handful of water-centric ETFs out there now for people who think water is like the next oil. PowerShares Water Resources (PHO 63,28 +0,15 +0,24%) is up 19.4% over the last 12 months ending April 10 (outperforming the S&P 500) and the Claymore S&P Global Water Index (CGW 54,08 +0,09 +0,16%) rose 11.75% in the same period (underperforming the S&P 500).

Other bleeding-heart funds focus on women in the workplace. There’s the Pax Ellevate Global Women’s Index Fund (PXWIX 31,66 -0,01 -0,03%). It’s up nearly 10% over the last 12 months and rose over 26% in five years.

“We think there is an opportunity for financial advisors in bringing a gender lens to your portfolio,” Kathleen McQuiggan, senior vice president at Pax World Management, says.

She says this because consulting firm McKinsey estimates that $12 trillion will be added to global GDP by 2025 via gender equality, with two-thirds of millionaires in the U.S. expected to be women within a generation. High net worth women are looking to use their wealth not only for financial independence, but to use their money to make an impact on the world. That includes investing in companies that they deem match their social values when it comes to women in the workplace.

ESG is not entirely out in left field.

Morningstar now has a sustainability rating system for mutual funds. They partnered with the research firm Sustainalytics to help rate ESG funds versus their Morningstar category peers. RIAs can now compare both fund performance and its manager’s ESG street cred on a large number of funds before committing to one. This might help ESG savvy investment advisors build their own portfolio for their clients.

Last month, the RIA Channel hosted an online seminar called Invest4Impact where fund managers gave their ideas on how to put client money in ESG funds. A replay of the show can be seen here.

ESG doesn’t have to be a benchmark beater all the time. These are funds that are targeting a particular set of social values first. Institutional investors seem willing to pay a premium for that. As these are not a core holding, ESG is more likely to become a feel-good fund for a mix of global opportunists (water scarcity plays) and social causes (women at work). Judging by the RIA community’s interest, there is an ever-expanding market for the environmental and social justice warrior shareholder. Do Investors Really Care About The Environment, Gender-Issues?

Let’s face it: there are only two things investors really care about. One is protecting their wealth. The other is growing it. And while a myriad of products has propped up over the years to entice investors into socially conscious mutual funds (ETFs have also gotten in on the acts), we still see that on the retail side, the advisor community is a bit more interested in this than their clients.

Based on a March survey of investment advisors nationwide, 60% said that their clients were not inquiring about so-called environmental, social and corporate governance-focused funds, best known as ESG. In fact, when asked what percentage of their clients are interested in ESG, the top three replies were (sadly for the ESG fund manager) zero percent, 1-5% and 6-11%. In other words, the vast majority are not all that interested.

Yet, a resounding majority of the independent advisors out there – 61.3% to be exact – are still curious about funds that invest in companies fighting climate change or bombing some village into next week.

Some 48.5% of those surveyed say they have heard of ESG. But nearly everyone thinks they’re either a performance laggard or are not sure how to really use them in a client’s overall portfolio.

ESG has been popular among university and foundation endowments for years thanks to student-led shareholder activism that has forced at least some money to be allocated into companies deemed good for the planet and for labor. That leaves out defense contractors, for example. It may even leave out investments in bonds from companies or nation-states with unsavory characters at the helm.

ESG is like armchair activism. If you like to donate to Conservation International, why not invest in companies that make most of their money from clean water technologies? Instead of writing to your congressman, an act in futility for most, why not invest in the companies that are using natural ingredients in our food?

Some funds will also be run by managers who take an activist approach for their shareholder base, getting companies to hire more women and reduce waste. Other times there are single issue products, like green bonds, that invest in thing like renewable energy.

Annual issuance of green bonds hit $49 billion last year; a record, according to Natixis Asset Management. They estimate that the total market size for green bonds is now close to $112 billion based on issues of at least $200 million (meaning the actual size of the market may be a bit larger).

Still, most of this is market is being sold to the institutional investor and less so to the retail client. The advisor community knows little about it, because the institutional community was first made aware of it through academia and an activist student body.

Of all the things the ESG world invests in, environmental impact investing is the one retail advisors are most interested, with 47% saying so versus 24% for green bonds. General education and social impact investing were in the top three.

“Municipal bonds are going to be one of the best way to play water investing because 98% of water treatment facilities are municipally owned…and there are 14,780 of them,” says Barnet Sherman, senior managing partner of Boston-based Tenbar Capital.

There are a handful of water-centric ETFs out there now for people who think water is like the next oil. PowerShares Water Resources (PHO 63,28 +0,15 +0,24%) is up 19.4% over the last 12 months ending April 10 (outperforming the S&P 500) and the Claymore S&P Global Water Index (CGW 54,08 +0,09 +0,16%) rose 11.75% in the same period (underperforming the S&P 500).

Other bleeding-heart funds focus on women in the workplace. There’s the Pax Ellevate Global Women’s Index Fund (PXWIX 31,66 -0,01 -0,03%). It’s up nearly 10% over the last 12 months and rose over 26% in five years.

“We think there is an opportunity for financial advisors in bringing a gender lens to your portfolio,” Kathleen McQuiggan, senior vice president at Pax World Management, says.

She says this because consulting firm McKinsey estimates that $12 trillion will be added to global GDP by 2025 via gender equality, with two-thirds of millionaires in the U.S. expected to be women within a generation. High net worth women are looking to use their wealth not only for financial independence, but to use their money to make an impact on the world. That includes investing in companies that they deem match their social values when it comes to women in the workplace.

ESG is not entirely out in left field.

Morningstar now has a sustainability rating system for mutual funds. They partnered with the research firm Sustainalytics to help rate ESG funds versus their Morningstar category peers. RIAs can now compare both fund performance and its manager’s ESG street cred on a large number of funds before committing to one. This might help ESG savvy investment advisors build their own portfolio for their clients.

Last month, the RIA Channel hosted an online seminar called Invest4Impact where fund managers gave their ideas on how to put client money in ESG funds. A replay of the show can be seen here.

ESG doesn’t have to be a benchmark beater all the time. These are funds that are targeting a particular set of social values first. Institutional investors seem willing to pay a premium for that. As these are not a core holding, ESG is more likely to become a feel-good fund for a mix of global opportunists (water scarcity plays) and social causes (women at work). Judging by the RIA community’s interest, there is an ever-expanding market for the environmental and social justice warrior shareholder.

Based on a March survey of investment advisors nationwide, 60% said that their clients were not inquiring about so-called environmental, social and corporate governance-focused funds, best known as ESG. In fact, when asked what percentage of their clients are interested in ESG, the top three replies were (sadly for the ESG fund manager) zero percent, 1-5% and 6-11%. In other words, the vast majority are not all that interested.

Yet, a resounding majority of the independent advisors out there – 61.3% to be exact – are still curious about funds that invest in companies fighting climate change or bombing some village into next week.

Some 48.5% of those surveyed say they have heard of ESG. But nearly everyone thinks they’re either a performance laggard or are not sure how to really use them in a client’s overall portfolio.

ESG has been popular among university and foundation endowments for years thanks to student-led shareholder activism that has forced at least some money to be allocated into companies deemed good for the planet and for labor. That leaves out defense contractors, for example. It may even leave out investments in bonds from companies or nation-states with unsavory characters at the helm.

ESG is like armchair activism. If you like to donate to Conservation International, why not invest in companies that make most of their money from clean water technologies? Instead of writing to your congressman, an act in futility for most, why not invest in the companies that are using natural ingredients in our food?

Some funds will also be run by managers who take an activist approach for their shareholder base, getting companies to hire more women and reduce waste. Other times there are single issue products, like green bonds, that invest in thing like renewable energy.

Annual issuance of green bonds hit $49 billion last year; a record, according to Natixis Asset Management. They estimate that the total market size for green bonds is now close to $112 billion based on issues of at least $200 million (meaning the actual size of the market may be a bit larger).

Still, most of this is market is being sold to the institutional investor and less so to the retail client. The advisor community knows little about it, because the institutional community was first made aware of it through academia and an activist student body.

Of all the things the ESG world invests in, environmental impact investing is the one retail advisors are most interested, with 47% saying so versus 24% for green bonds. General education and social impact investing were in the top three.

“Municipal bonds are going to be one of the best way to play water investing because 98% of water treatment facilities are municipally owned…and there are 14,780 of them,” says Barnet Sherman, senior managing partner of Boston-based Tenbar Capital.

There are a handful of water-centric ETFs out there now for people who think water is like the next oil. PowerShares Water Resources (PHO 63,28 +0,15 +0,24%) is up 19.4% over the last 12 months ending April 10 (outperforming the S&P 500) and the Claymore S&P Global Water Index (CGW 54,08 +0,09 +0,16%) rose 11.75% in the same period (underperforming the S&P 500).

Other bleeding-heart funds focus on women in the workplace. There’s the Pax Ellevate Global Women’s Index Fund (PXWIX 31,66 -0,01 -0,03%). It’s up nearly 10% over the last 12 months and rose over 26% in five years.

“We think there is an opportunity for financial advisors in bringing a gender lens to your portfolio,” Kathleen McQuiggan, senior vice president at Pax World Management, says.

She says this because consulting firm McKinsey estimates that $12 trillion will be added to global GDP by 2025 via gender equality, with two-thirds of millionaires in the U.S. expected to be women within a generation. High net worth women are looking to use their wealth not only for financial independence, but to use their money to make an impact on the world. That includes investing in companies that they deem match their social values when it comes to women in the workplace.

ESG is not entirely out in left field.

Morningstar now has a sustainability rating system for mutual funds. They partnered with the research firm Sustainalytics to help rate ESG funds versus their Morningstar category peers. RIAs can now compare both fund performance and its manager’s ESG street cred on a large number of funds before committing to one. This might help ESG savvy investment advisors build their own portfolio for their clients.

Last month, the RIA Channel hosted an online seminar called Invest4Impact where fund managers gave their ideas on how to put client money in ESG funds. A replay of the show can be seen here.

ESG doesn’t have to be a benchmark beater all the time. These are funds that are targeting a particular set of social values first. Institutional investors seem willing to pay a premium for that. As these are not a core holding, ESG is more likely to become a feel-good fund for a mix of global opportunists (water scarcity plays) and social causes (women at work). Judging by the RIA community’s interest, there is an ever-expanding market for the environmental and social justice warrior shareholder.

Based on a March survey of investment advisors nationwide, 60% said that their clients were not inquiring about so-called environmental, social and corporate governance-focused funds, best known as ESG. In fact, when asked what percentage of their clients are interested in ESG, the top three replies were (sadly for the ESG fund manager) zero percent, 1-5% and 6-11%. In other words, the vast majority are not all that interested.

Yet, a resounding majority of the independent advisors out there – 61.3% to be exact – are still curious about funds that invest in companies fighting climate change or bombing some village into next week.

Some 48.5% of those surveyed say they have heard of ESG. But nearly everyone thinks they’re either a performance laggard or are not sure how to really use them in a client’s overall portfolio.

ESG has been popular among university and foundation endowments for years thanks to student-led shareholder activism that has forced at least some money to be allocated into companies deemed good for the planet and for labor. That leaves out defense contractors, for example. It may even leave out investments in bonds from companies or nation-states with unsavory characters at the helm.

ESG is like armchair activism. If you like to donate to Conservation International, why not invest in companies that make most of their money from clean water technologies? Instead of writing to your congressman, an act in futility for most, why not invest in the companies that are using natural ingredients in our food?

Some funds will also be run by managers who take an activist approach for their shareholder base, getting companies to hire more women and reduce waste. Other times there are single issue products, like green bonds, that invest in thing like renewable energy.

Annual issuance of green bonds hit $49 billion last year; a record, according to Natixis Asset Management. They estimate that the total market size for green bonds is now close to $112 billion based on issues of at least $200 million (meaning the actual size of the market may be a bit larger).

Still, most of this is market is being sold to the institutional investor and less so to the retail client. The advisor community knows little about it, because the institutional community was first made aware of it through academia and an activist student body.

Of all the things the ESG world invests in, environmental impact investing is the one retail advisors are most interested, with 47% saying so versus 24% for green bonds. General education and social impact investing were in the top three.

“Municipal bonds are going to be one of the best way to play water investing because 98% of water treatment facilities are municipally owned…and there are 14,780 of them,” says Barnet Sherman, senior managing partner of Boston-based Tenbar Capital.

There are a handful of water-centric ETFs out there now for people who think water is like the next oil. PowerShares Water Resources (PHO 63,28 +0,15 +0,24%) is up 19.4% over the last 12 months ending April 10 (outperforming the S&P 500) and the Claymore S&P Global Water Index (CGW 54,08 +0,09 +0,16%) rose 11.75% in the same period (underperforming the S&P 500).

Other bleeding-heart funds focus on women in the workplace. There’s the Pax Ellevate Global Women’s Index Fund (PXWIX 31,66 -0,01 -0,03%). It’s up nearly 10% over the last 12 months and rose over 26% in five years.

“We think there is an opportunity for financial advisors in bringing a gender lens to your portfolio,” Kathleen McQuiggan, senior vice president at Pax World Management, says.

She says this because consulting firm McKinsey estimates that $12 trillion will be added to global GDP by 2025 via gender equality, with two-thirds of millionaires in the U.S. expected to be women within a generation. High net worth women are looking to use their wealth not only for financial independence, but to use their money to make an impact on the world. That includes investing in companies that they deem match their social values when it comes to women in the workplace.

ESG is not entirely out in left field.

Morningstar now has a sustainability rating system for mutual funds. They partnered with the research firm Sustainalytics to help rate ESG funds versus their Morningstar category peers. RIAs can now compare both fund performance and its manager’s ESG street cred on a large number of funds before committing to one. This might help ESG savvy investment advisors build their own portfolio for their clients.

Last month, the RIA Channel hosted an online seminar called Invest4Impact where fund managers gave their ideas on how to put client money in ESG funds. A replay of the show can be seen here.

ESG doesn’t have to be a benchmark beater all the time. These are funds that are targeting a particular set of social values first. Institutional investors seem willing to pay a premium for that. As these are not a core holding, ESG is more likely to become a feel-good fund for a mix of global opportunists (water scarcity plays) and social causes (women at work). Judging by the RIA community’s interest, there is an ever-expanding market for the environmental and social justice warrior shareholder.

Based on a March survey of investment advisors nationwide, 60% said that their clients were not inquiring about so-called environmental, social and corporate governance-focused funds, best known as ESG. In fact, when asked what percentage of their clients are interested in ESG, the top three replies were (sadly for the ESG fund manager) zero percent, 1-5% and 6-11%. In other words, the vast majority are not all that interested.

Yet, a resounding majority of the independent advisors out there – 61.3% to be exact – are still curious about funds that invest in companies fighting climate change or bombing some village into next week.

Some 48.5% of those surveyed say they have heard of ESG. But nearly everyone thinks they’re either a performance laggard or are not sure how to really use them in a client’s overall portfolio.

ESG has been popular among university and foundation endowments for years thanks to student-led shareholder activism that has forced at least some money to be allocated into companies deemed good for the planet and for labor. That leaves out defense contractors, for example. It may even leave out investments in bonds from companies or nation-states with unsavory characters at the helm.

ESG is like armchair activism. If you like to donate to Conservation International, why not invest in companies that make most of their money from clean water technologies? Instead of writing to your congressman, an act in futility for most, why not invest in the companies that are using natural ingredients in our food?

Some funds will also be run by managers who take an activist approach for their shareholder base, getting companies to hire more women and reduce waste. Other times there are single issue products, like green bonds, that invest in thing like renewable energy.

Annual issuance of green bonds hit $49 billion last year; a record, according to Natixis Asset Management. They estimate that the total market size for green bonds is now close to $112 billion based on issues of at least $200 million (meaning the actual size of the market may be a bit larger).

Still, most of this is market is being sold to the institutional investor and less so to the retail client. The advisor community knows little about it, because the institutional community was first made aware of it through academia and an activist student body.

Of all the things the ESG world invests in, environmental impact investing is the one retail advisors are most interested, with 47% saying so versus 24% for green bonds. General education and social impact investing were in the top three.

“Municipal bonds are going to be one of the best way to play water investing because 98% of water treatment facilities are municipally owned…and there are 14,780 of them,” says Barnet Sherman, senior managing partner of Boston-based Tenbar Capital.

There are a handful of water-centric ETFs out there now for people who think water is like the next oil. PowerShares Water Resources (PHO 63,28 +0,15 +0,24%) is up 19.4% over the last 12 months ending April 10 (outperforming the S&P 500) and the Claymore S&P Global Water Index (CGW 54,08 +0,09 +0,16%) rose 11.75% in the same period (underperforming the S&P 500).

Other bleeding-heart funds focus on women in the workplace. There’s the Pax Ellevate Global Women’s Index Fund (PXWIX 31,66 -0,01 -0,03%). It’s up nearly 10% over the last 12 months and rose over 26% in five years.

“We think there is an opportunity for financial advisors in bringing a gender lens to your portfolio,” Kathleen McQuiggan, senior vice president at Pax World Management, says.

She says this because consulting firm McKinsey estimates that $12 trillion will be added to global GDP by 2025 via gender equality, with two-thirds of millionaires in the U.S. expected to be women within a generation. High net worth women are looking to use their wealth not only for financial independence, but to use their money to make an impact on the world. That includes investing in companies that they deem match their social values when it comes to women in the workplace.

ESG is not entirely out in left field.

Morningstar now has a sustainability rating system for mutual funds. They partnered with the research firm Sustainalytics to help rate ESG funds versus their Morningstar category peers. RIAs can now compare both fund performance and its manager’s ESG street cred on a large number of funds before committing to one. This might help ESG savvy investment advisors build their own portfolio for their clients.

Last month, the RIA Channel hosted an online seminar called Invest4Impact where fund managers gave their ideas on how to put client money in ESG funds. A replay of the show can be seen here.

ESG doesn’t have to be a benchmark beater all the time. These are funds that are targeting a particular set of social values first. Institutional investors seem willing to pay a premium for that. As these are not a core holding, ESG is more likely to become a feel-good fund for a mix of global opportunists (water scarcity plays) and social causes (women at work). Judging by the RIA community’s interest, there is an ever-expanding market for the environmental and social justice warrior shareholder.