It’s hard to know how much you truly have of something, when you cannot see it. Water and the infrastructure associated with delivering it to Chinese city slickers in Shanghai or to Iowa farmers is disappearing. The pipes that carry water to American households are aging and breaking on the order of hundreds annually. One just broke in Boston last week. In early February, a water main break shut down bathrooms at the Charlotte airport in North Carolina.

It’s hard to know how much you truly have of something, when you cannot see it. Water and the infrastructure associated with delivering it to Chinese city slickers in Shanghai or to Iowa farmers is disappearing. The pipes that carry water to American households are aging and breaking on the order of hundreds annually. One just broke in Boston last week. In early February, a water main break shut down bathrooms at the Charlotte airport in North Carolina.

Washington has been absent from the repair scene. Either the water is going to vanish, spill over, and deteriorate in quality, or companies responsible for it are going to have to team up with states and municipalities to preserve and improve on what’s there.

On Wednesday, RIA Channel ran a 3.5 hour online symposium: Invest4Impact, which looked at investment opportunities for social and environmentally sound businesses. Water was the most urgent.

Just how urgent?

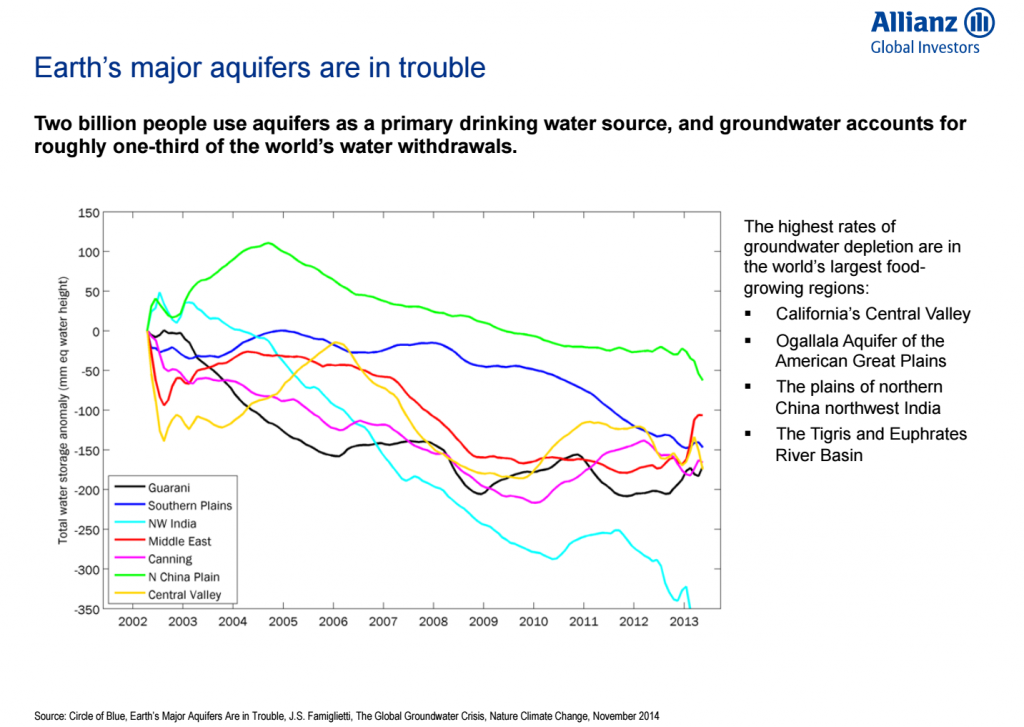

In the U.S. alone, ground water levels at the High Plains Aquifer – stretching from South Dakota to Texas — have been in decline for decades by at least 30%.

We’ve all heard of the drought in California and then the heavy rains of this year. That downpour over the last few months has reservoirs overflowing in northern California, but has not replenished the aquifer waters throughout the state.

Some Central Coast reservoirs remain at historic lows. Groundwater in the southern part of the Central Valley remains more than 10 million acre-feet below pre-drought levels, says Jay Lund, a U.C. Davis professor and director at their Center for Watershed Sciences. “Most of the groundwater deficit…would take decades to recover with long lasting effects on local wells,” he says here.

Markets are paying attention to this too, not just environmental justice warriors on college campuses.

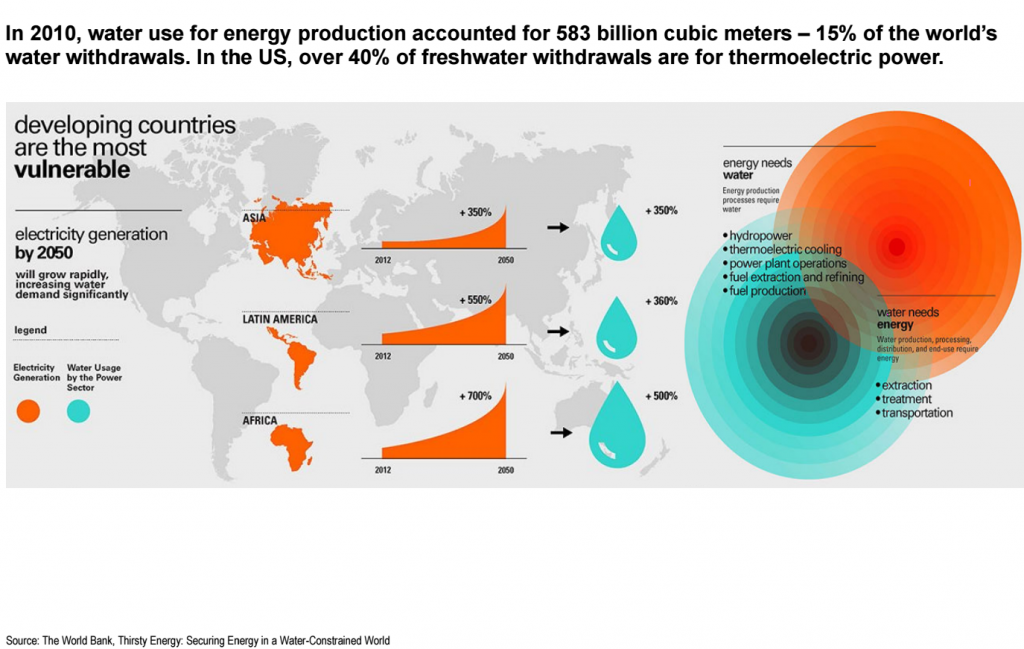

“Aquifiers worldwide are under the same stress, which the biggest stress going to regions where farmers rely on these underground aquifers,” says Kaitlyn Fischer, a product specialist for global water strategies at Allianz Global Investors. She reminded us that 70% of fresh water is used for agriculture.

“Aquifiers worldwide are under the same stress, which the biggest stress going to regions where farmers rely on these underground aquifers,” says Kaitlyn Fischer, a product specialist for global water strategies at Allianz Global Investors. She reminded us that 70% of fresh water is used for agriculture.

In an hour long panel, “Investing in Water,” moderated by Gary White, CEO of Water.org and WaterEquity, an NGO backed by actor Matt Damon that provides micro credits to fund clean water and water delivery services to the rural poor around the world, the idea was for investors to support this theme through the markets.

For Barnet Sherman, senior managing partner of Boston-based Tenbar Capital, municipal bonds are the way in.

“Muni bonds are going to be one of the best way to play it because 98% of water treatment facilities are municipally owned…and there are 14,780 of them,” Sherman says.

And Washington is not exactly throwing money at them either. That means if towns like Flint, Michigan, the nation’s new poster child for dirty water (Sorry, Boston), wants new underground piping and new water treatment plants, it has to fund most of it itself.

Theres been a 74% decline in Federal funding for water infrastructure since 1976 in this country.

In 1976, the federal government spent $16.9 billion on water infrastructure. In 2014, it was $.3 billion, going from $77.5 per capita to $12.96 per capita.

The state level has ballooned by comparison. In 1976, states spent $50 billion on water infrastructure. In 2014: $108 billion. How does it get paid? Muni bond offers.

“My suggestion is you look at the five to seven year maturities for water infrastructure projects,” Sherman says.

An estimated $126 billion is estimated to be needed over the next five years to fix and replace aging underground piping, water treatment and delivery services in the U.S. alone. A new policy combo of muni debt, federal loans and public private partnerships is likely under Trump, said Katie Fischer, Product Specialist at Allianz Global Investors.

“Even if the Environmental Protection Agency is weakened under Trump, states will be forced to reckon with water quality themselves,” says Fischer, who takes a global look at water resources. Emerging markets like China, for example, are becoming more urban. Getting water to Shanghai is not easy. Investing in companies that are doing so is long term prudent.

“We view this as a global story,” Fischer says. “There is so much happening in water that investing in an actively managed fund gives your manager a chance to shift based on valuation and on global trends. We believe that we are going to see water quality standards strengthen because of Flint and you want managers who can shift their exposure to those companies that will benefit from that,” she says, picking American Water Works (AWK) as one winner. It’s up 6.7% this year.

Other funds in this space include Powershares Water Resources (PHO 63,28 +0,15 +0,24%): 6.24% year-to-date, 21.1% in 12 months; Powershares Global Water Portfolio (PIO 42,22 +0,32 +0,76%): 7.18% YTD, 9.82% in 12 months and the Claymore S&P Global Water Index (CGW 54,08 +0,09 +0,16%), up 7.03% this year and 11.46% in 12 months. Meanwhile, the Dow Jones Water Index is up 6.4% and the S&P Global Water Index is up 5.34%.

For Gary White, water issues like we’ve seen in Flint, and infrastructure weakness as reflected by the recent scare of a breach of the Oroville Dam in California, should make water a red flag for everyone.

For the advisor community, the Invest4Impact symposium is available for CFP and IMCA credit for the remainder of the year.