So you thought ETFs were an easy trade, heh? Think again. They are not merely one big hybrid stock. There are ways to trade ETFs to get the best out of the bid/ask differential. And perhaps the best way to do this is to get someone whose job it is to understand how to trade certain funds.

So you thought ETFs were an easy trade, heh? Think again. They are not merely one big hybrid stock. There are ways to trade ETFs to get the best out of the bid/ask differential. And perhaps the best way to do this is to get someone whose job it is to understand how to trade certain funds.

Dan Zraly, chief trader at 3EDGE Asset Management, a new $500 million money manager, is laser focused on ETFs and has a system. They have their own proprietary “black box” that picks from a collection of ETFs. He also treats them like he would any individual stock and thinks savvy advisors should do the same.

“When you’re creating a portfolio of ETFs for your clients you are basically building a fund of funds and your duty is to do the due diligence,” he says. “What’s this fund all about that you’re buying: are they using leverage; what kind of risks and liberties can they take beyond the benchmark. But the big thing for us as traders is to have the relationships with brokers and market makers where I know when I look at my Bloomberg screen and see the price spread between bid and ask that I am getting the best price. It lowers execution cost and that helps client performance.”

Zraly was speaking on our March 9th webcast hosted by Deutsche Asset Management.

Zraly said that Deutsche’s head of ETF Capital Markets, Luke Oliver, was “the guy” to go to for advice on how to trade an ETF. Is it a week-long hold, a day trade? Is there arbitrage to be had in a particular ETF? There are variables at work beyond the market price, volume and thematics.

Zraly said that Deutsche’s head of ETF Capital Markets, Luke Oliver, was “the guy” to go to for advice on how to trade an ETF. Is it a week-long hold, a day trade? Is there arbitrage to be had in a particular ETF? There are variables at work beyond the market price, volume and thematics.

Since 1990, the U.S. has created some 1,800 ETFs with a value of around $1.6 trillion. Globally, there are 3,600 ETFs with an estimated $4.5 trillion under management.

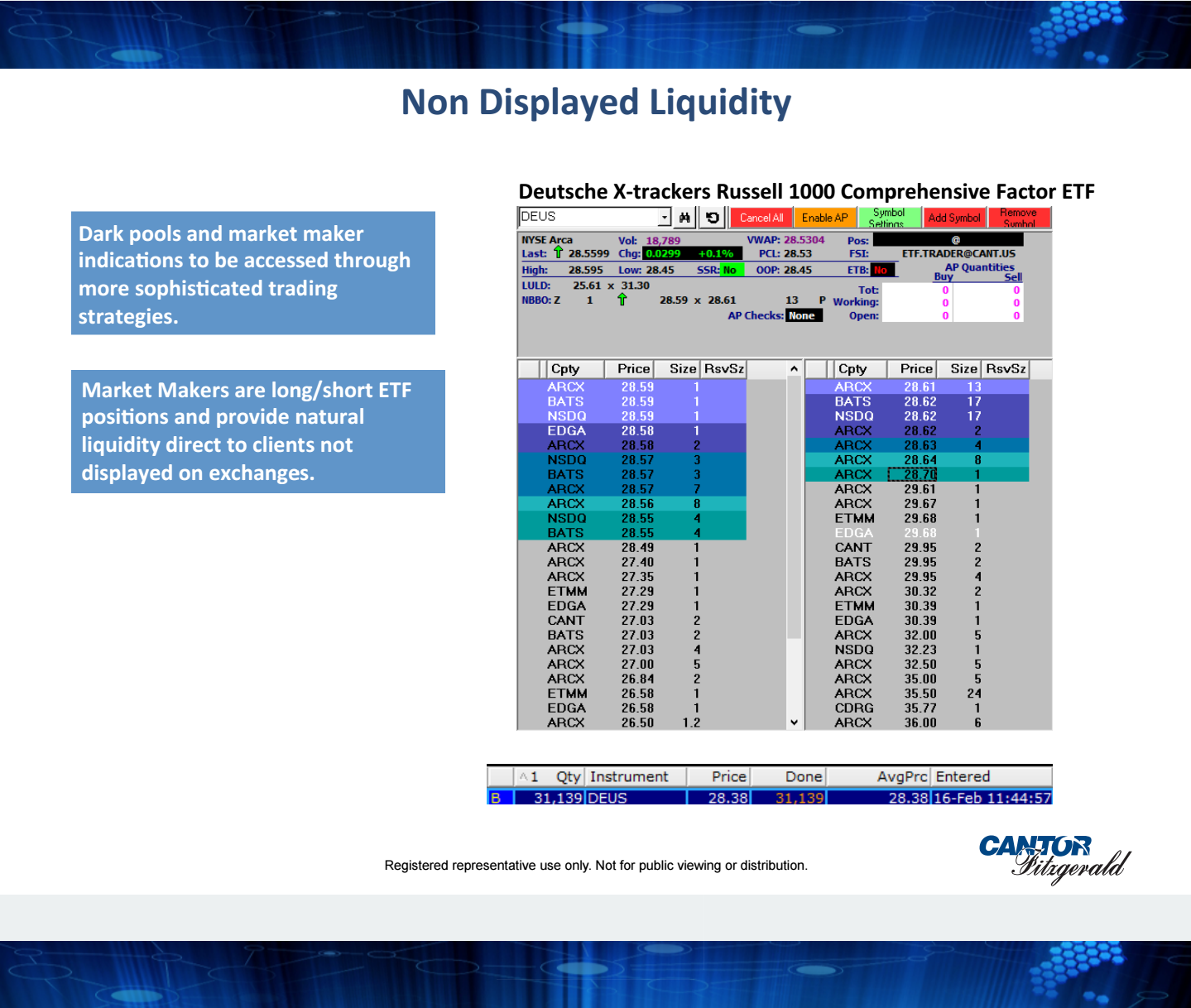

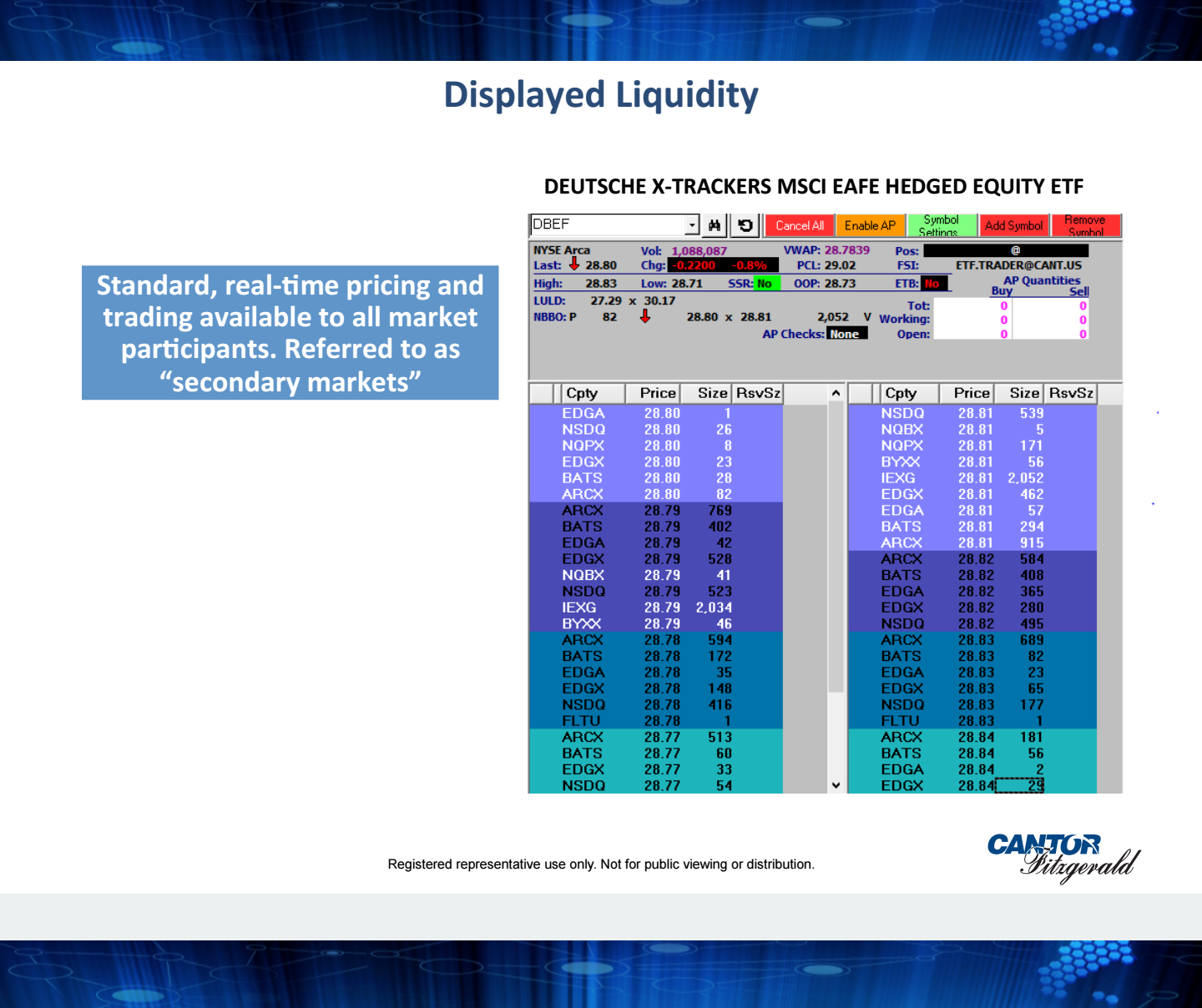

What Oliver and Zraly are talking about here is really a look under the hood of your average ETF. This goes beyond opening a client’s account and placing a $50,000 bet on the SPDR Financial Select Sector (XLF 41,83 +0,16 +0,38%). That’s ETF 101. This webinar, and the services that Deutsche and 3EDGE are selling, is more ETF master level. It’s about the seen (displayed liquidity) and the unseen (non-displayed liquidity) and how RIAs can make a small profit off of that for their biggest clients.

When demand becomes great enough, ETF prices can deviate from the fair value of the underlying holdings, creating a premium for the ETF. So if you’re buying XLF and its up way more than its chief holdings like Wells Fargo and Bank of America, to put it simply, you might be overpaying. It then becomes attractive for those invisible market makers in the ETF universe, known as authorized participants, to create shares of the ETF by assembling and delivering a basket of the ETF’s constituent securities to the ETF issuer in exchange for the shares. Those players can then sell the ETF shares, capturing that premium and make a small profit.

When demand becomes great enough, ETF prices can deviate from the fair value of the underlying holdings, creating a premium for the ETF. So if you’re buying XLF and its up way more than its chief holdings like Wells Fargo and Bank of America, to put it simply, you might be overpaying. It then becomes attractive for those invisible market makers in the ETF universe, known as authorized participants, to create shares of the ETF by assembling and delivering a basket of the ETF’s constituent securities to the ETF issuer in exchange for the shares. Those players can then sell the ETF shares, capturing that premium and make a small profit.

Mike Cafiero, a market maker at a number of ETFs at Cantor Fitzgerald, says advisors with big money in ETFs should try going “directly to a market maker (for certain funds) in order to get you the liquidity you need.”