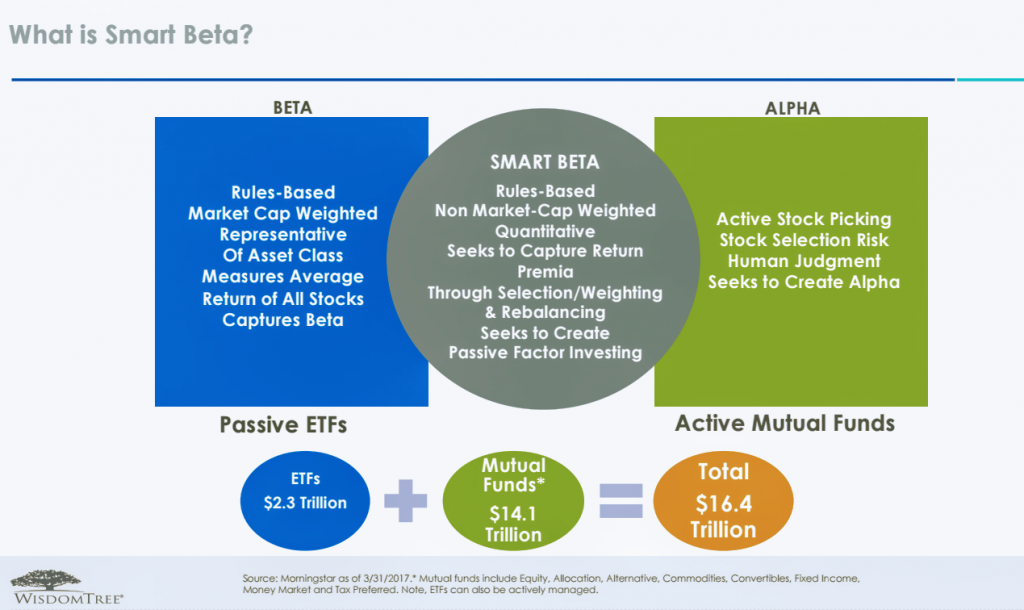

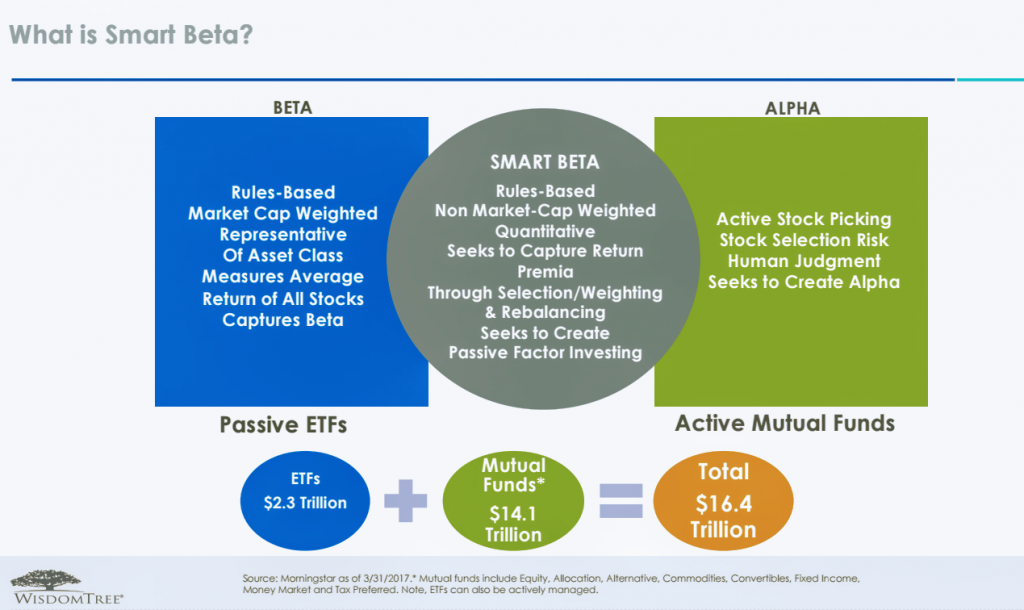

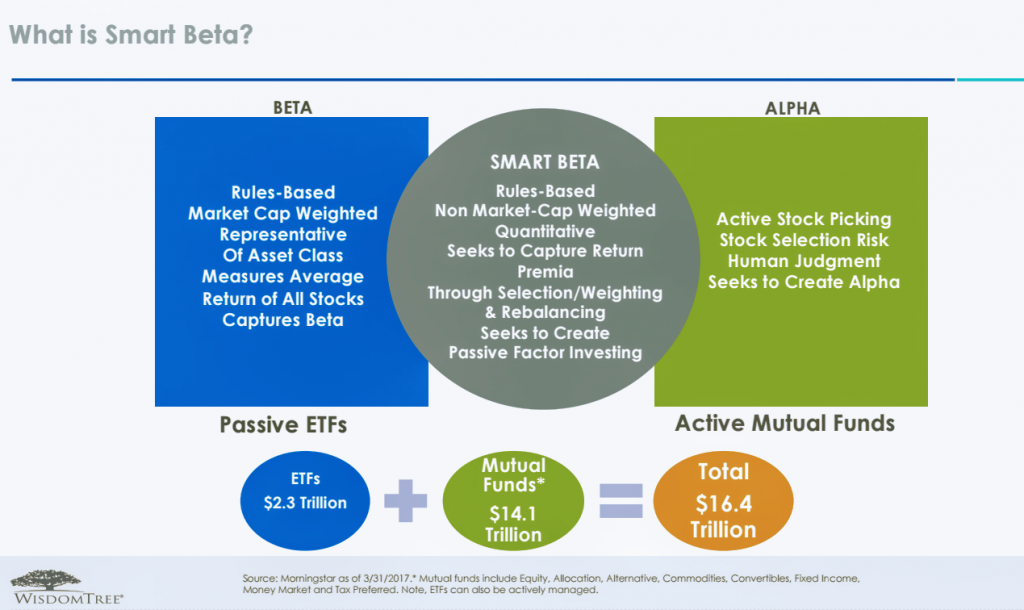

Smart beta defines a set of investment strategies that emphasize the use of alternative index construction rules to traditional market capitalization based indices, or simple benchmarks, like the Russell 2000 for instance. There’s of course a way to buy and hold that index cheaply – the iShares Russell 2000 (IWM 206,10 +4,00 +1,98%) index fund. There’s another way to do it, too. One is Wisdom Tree’s factor-based approach, which culls from the best quality earnings performers in that index that pay the highest dividends. That’s their Small Cap Earnings Fund (EES 49,18 +1,02 +2,12%). EES has IWM beat over a one year period, five year period and a 10 year period.

Siracusano hosted an RIA Channel webcast on April 20 to discuss these strategies and talk briefly about how WisdomTree advises investment professionals on how to incorporate smart beta into a core portfolio. The one hour seminar is available on demand here – WEBCAST REPLAY.

“It used to be that investment advisors would pick stocks, then it went to mutual funds, then to index funds, then to ETFs and now the third option is the smart beta ETF,” he says. For advisors with a bit of an academic bent, this is efficient market hypothesis 101. If clients are sensitive to cost, liquidity, and tax efficiency, smart beta is probably the way to go. “These funds are going to be the new competition for active management. You can now increasingly get multi-factor exposure in ETFs. The idea is you will only want to go active if you’re getting high alpha from your manager,” he says.

The increased popularity of smart beta is linked to a desire for portfolio risk management and diversification along factor dimensions as well as seeking to enhance risk-adjusted returns above the cap-weighted indices.

Professional services firm Towers Watson first coined the term, but institutional investors have used the strategy since the 1970s. The first smart beta ETF launched in 2003. WisdomTree got involved shortly after, launching a bunch of smart-beta ETFs around 2007.

“Beta” measures the volatility of an individual security/portfolio, as compared to the broader market like the S&P 500, which has a beta of one. Individual stocks are then ranked according to how much they deviate from that beta.

A stock with a beta of two is way better than the S&P in an up market, but really bad in a down market.

Smart beta as a portfolio construct refers to the use of an alternative methodology to build a fund based on key investing factors like valuation and market cap. A smart beta investment strategy will also rebalance as its rules-based model weeds out the stocks that no longer “play by the rules” so to speak.

As these more sophisticated ETFs become better understood, they are expected to take a bigger chunk of the mutual fund industry’s market share as new products get introduced.

Nasdaq ran a similar event, the Nasdaq Smart Beta Virtual Symposium on April 19, where they asked advisors in attendance whether or not they used factor based ETFs in their client portfolios. Nearly two thirds (70.2%) said no, with 29.8% saying yes. Of the no vote, 22.4% said they were interested in learning more about smart beta ETFs.

In the open end mutual fund market, there is roughly $5.6 trillion in assets under management and most of it is large cap blend and large cap growth oriented, with fees of 90 to 100 basis points. As everyone knows, very few of them consistently beat the index on an annual basis, and even over a longer period of time. After fees, even funds that employ smart-beta strategies of picking momentum plays and low volatility names, for example, will not beat the market with any regularity after fees are accounted for. The more sophisticated the strategy, the more likely it is that a mutual fund will charge a load fee of 5% to retail clients.

“If you’re wanting to move clients out of mutual funds and into ETFs, there is now a third choice beyond basic benchmark ETFs. But you have to think in terms of factors and understand the methodology of the fund, so you know what factors are being invested in and when the fund will rotate out of those stocks and why,” Siracusano explains.

John Feyerer, director of equity ETF product strategy for PowerShares by Invesco says there are five key factors. He calls them the Mount Rushmore factors: low volatility, momentum, quality, value and size.

“They offer a premium across long time horizons and across many different market cycles,” he says.

Over 10 years of risk adjusted returns from March 1, 2007 to February 28, 2017, only quality beat the SPDR S&P 500 (SPY 515,71 +2,85 +0,56%). Momentum, size and value all got beat, based on a study by WisdomTree.

The underlying indexes of these smart beta funds don’t have a long enough history to really show performance. That makes it harder to predict their future.

WisdomTree created a hypothetical portfolio using a Fama and French Three Factor Model equal weighted and it beat the benchmark by about 15 basis points. Average excess return of smart beta is 1.82% over the long haul. Dating back to 1963, value did best, followed by high earnings yield (meaning low multiple stocks) and high dividend yielding stocks.

Most smart-beta ETFs focus on only one of the “Mount Rushmore” factors. Some will do two or three. Most are doing two. WisdomTree has single and dual-factor for the most part.

A quick look gives a sense of their performance since inception against the main benchmarks. Their Earnings 500 Fund (EPS 55,13 +0,53 +0,96%) has the SPDR SPY beat this year and over the last 12 months. Their Mid Cap Earnings (EZM 56,38 -0,36 -0,63%) is slightly trailing the SPDR S&P Midcap (MDY 544,00 +7,21 +1,34%) this year, but has it beat over the last year.

WisdomTree also has a U.S. Quality Dividend Growth Fund (DGRW 75,81 +0,66 +0,88%) and the WisdomTree Small Cap Quality Dividend Growth Fund (DGRS 48,99 +0,67 +1,39%) whose multi-factors include the obvious – blue chip stocks that are growing their dividends.

“Smart-beta is not a niche strategy,” Siracusano says. “It’s a way to own the U.S. market and exclude companies that are not profitable in the benchmark. You’re loading up on the value and quality factor in large, middle and small cap space in hopes to beat the index. That’s the goal overall, to cost effectively beat the market over time instead of just owning the index.”

Smart beta defines a set of investment strategies that emphasize the use of alternative index construction rules to traditional market capitalization based indices, or simple benchmarks, like the Russell 2000 for instance. There’s of course a way to buy and hold that index cheaply – the iShares Russell 2000 (IWM 206,10 +4,00 +1,98%) index fund. There’s another way to do it, too. One is Wisdom Tree’s factor-based approach, which culls from the best quality earnings performers in that index that pay the highest dividends. That’s their Small Cap Earnings Fund (EES 49,18 +1,02 +2,12%). EES has IWM beat over a one year period, five year period and a 10 year period.

Siracusano hosted an RIA Channel webcast on April 20 to discuss these strategies and talk briefly about how WisdomTree advises investment professionals on how to incorporate smart beta into a core portfolio. The one hour seminar is available on demand here – WEBCAST REPLAY.

“It used to be that investment advisors would pick stocks, then it went to mutual funds, then to index funds, then to ETFs and now the third option is the smart beta ETF,” he says. For advisors with a bit of an academic bent, this is efficient market hypothesis 101. If clients are sensitive to cost, liquidity, and tax efficiency, smart beta is probably the way to go. “These funds are going to be the new competition for active management. You can now increasingly get multi-factor exposure in ETFs. The idea is you will only want to go active if you’re getting high alpha from your manager,” he says.

The increased popularity of smart beta is linked to a desire for portfolio risk management and diversification along factor dimensions as well as seeking to enhance risk-adjusted returns above the cap-weighted indices.

Professional services firm Towers Watson first coined the term, but institutional investors have used the strategy since the 1970s. The first smart beta ETF launched in 2003. WisdomTree got involved shortly after, launching a bunch of smart-beta ETFs around 2007.

“Beta” measures the volatility of an individual security/portfolio, as compared to the broader market like the S&P 500, which has a beta of one. Individual stocks are then ranked according to how much they deviate from that beta.

A stock with a beta of two is way better than the S&P in an up market, but really bad in a down market.

Smart beta as a portfolio construct refers to the use of an alternative methodology to build a fund based on key investing factors like valuation and market cap. A smart beta investment strategy will also rebalance as its rules-based model weeds out the stocks that no longer “play by the rules” so to speak.

As these more sophisticated ETFs become better understood, they are expected to take a bigger chunk of the mutual fund industry’s market share as new products get introduced.

Nasdaq ran a similar event, the Nasdaq Smart Beta Virtual Symposium on April 19, where they asked advisors in attendance whether or not they used factor based ETFs in their client portfolios. Nearly two thirds (70.2%) said no, with 29.8% saying yes. Of the no vote, 22.4% said they were interested in learning more about smart beta ETFs.

In the open end mutual fund market, there is roughly $5.6 trillion in assets under management and most of it is large cap blend and large cap growth oriented, with fees of 90 to 100 basis points. As everyone knows, very few of them consistently beat the index on an annual basis, and even over a longer period of time. After fees, even funds that employ smart-beta strategies of picking momentum plays and low volatility names, for example, will not beat the market with any regularity after fees are accounted for. The more sophisticated the strategy, the more likely it is that a mutual fund will charge a load fee of 5% to retail clients.

“If you’re wanting to move clients out of mutual funds and into ETFs, there is now a third choice beyond basic benchmark ETFs. But you have to think in terms of factors and understand the methodology of the fund, so you know what factors are being invested in and when the fund will rotate out of those stocks and why,” Siracusano explains.

John Feyerer, director of equity ETF product strategy for PowerShares by Invesco says there are five key factors. He calls them the Mount Rushmore factors: low volatility, momentum, quality, value and size.

“They offer a premium across long time horizons and across many different market cycles,” he says.

Over 10 years of risk adjusted returns from March 1, 2007 to February 28, 2017, only quality beat the SPDR S&P 500 (SPY 515,71 +2,85 +0,56%). Momentum, size and value all got beat, based on a study by WisdomTree.

The underlying indexes of these smart beta funds don’t have a long enough history to really show performance. That makes it harder to predict their future.

WisdomTree created a hypothetical portfolio using a Fama and French Three Factor Model equal weighted and it beat the benchmark by about 15 basis points. Average excess return of smart beta is 1.82% over the long haul. Dating back to 1963, value did best, followed by high earnings yield (meaning low multiple stocks) and high dividend yielding stocks.

Most smart-beta ETFs focus on only one of the “Mount Rushmore” factors. Some will do two or three. Most are doing two. WisdomTree has single and dual-factor for the most part.

A quick look gives a sense of their performance since inception against the main benchmarks. Their Earnings 500 Fund (EPS 55,13 +0,53 +0,96%) has the SPDR SPY beat this year and over the last 12 months. Their Mid Cap Earnings (EZM 56,38 -0,36 -0,63%) is slightly trailing the SPDR S&P Midcap (MDY 544,00 +7,21 +1,34%) this year, but has it beat over the last year.

WisdomTree also has a U.S. Quality Dividend Growth Fund (DGRW 75,81 +0,66 +0,88%) and the WisdomTree Small Cap Quality Dividend Growth Fund (DGRS 48,99 +0,67 +1,39%) whose multi-factors include the obvious – blue chip stocks that are growing their dividends.

“Smart-beta is not a niche strategy,” Siracusano says. “It’s a way to own the U.S. market and exclude companies that are not profitable in the benchmark. You’re loading up on the value and quality factor in large, middle and small cap space in hopes to beat the index. That’s the goal overall, to cost effectively beat the market over time instead of just owning the index.” Smart Beta Will Lead A ‘Great Migration’ Out Of Mutual Funds

“The great migration is a shift from active to passive fund management; higher fee to lower; less transparent to more transparent; less tax efficient to more tax efficient,” says Luciano Siracusano, chief investment strategist at WisdomTree Asset Management. “The challenge is mixing low fee beta with funds that are generating alpha.”

That’s where the smart beta ETFs comes into play.

Smart beta defines a set of investment strategies that emphasize the use of alternative index construction rules to traditional market capitalization based indices, or simple benchmarks, like the Russell 2000 for instance. There’s of course a way to buy and hold that index cheaply – the iShares Russell 2000 (IWM 206,10 +4,00 +1,98%) index fund. There’s another way to do it, too. One is Wisdom Tree’s factor-based approach, which culls from the best quality earnings performers in that index that pay the highest dividends. That’s their Small Cap Earnings Fund (EES 49,18 +1,02 +2,12%). EES has IWM beat over a one year period, five year period and a 10 year period.

Siracusano hosted an RIA Channel webcast on April 20 to discuss these strategies and talk briefly about how WisdomTree advises investment professionals on how to incorporate smart beta into a core portfolio. The one hour seminar is available on demand here – WEBCAST REPLAY.

“It used to be that investment advisors would pick stocks, then it went to mutual funds, then to index funds, then to ETFs and now the third option is the smart beta ETF,” he says. For advisors with a bit of an academic bent, this is efficient market hypothesis 101. If clients are sensitive to cost, liquidity, and tax efficiency, smart beta is probably the way to go. “These funds are going to be the new competition for active management. You can now increasingly get multi-factor exposure in ETFs. The idea is you will only want to go active if you’re getting high alpha from your manager,” he says.

The increased popularity of smart beta is linked to a desire for portfolio risk management and diversification along factor dimensions as well as seeking to enhance risk-adjusted returns above the cap-weighted indices.

Professional services firm Towers Watson first coined the term, but institutional investors have used the strategy since the 1970s. The first smart beta ETF launched in 2003. WisdomTree got involved shortly after, launching a bunch of smart-beta ETFs around 2007.

“Beta” measures the volatility of an individual security/portfolio, as compared to the broader market like the S&P 500, which has a beta of one. Individual stocks are then ranked according to how much they deviate from that beta.

A stock with a beta of two is way better than the S&P in an up market, but really bad in a down market.

Smart beta as a portfolio construct refers to the use of an alternative methodology to build a fund based on key investing factors like valuation and market cap. A smart beta investment strategy will also rebalance as its rules-based model weeds out the stocks that no longer “play by the rules” so to speak.

As these more sophisticated ETFs become better understood, they are expected to take a bigger chunk of the mutual fund industry’s market share as new products get introduced.

Nasdaq ran a similar event, the Nasdaq Smart Beta Virtual Symposium on April 19, where they asked advisors in attendance whether or not they used factor based ETFs in their client portfolios. Nearly two thirds (70.2%) said no, with 29.8% saying yes. Of the no vote, 22.4% said they were interested in learning more about smart beta ETFs.

In the open end mutual fund market, there is roughly $5.6 trillion in assets under management and most of it is large cap blend and large cap growth oriented, with fees of 90 to 100 basis points. As everyone knows, very few of them consistently beat the index on an annual basis, and even over a longer period of time. After fees, even funds that employ smart-beta strategies of picking momentum plays and low volatility names, for example, will not beat the market with any regularity after fees are accounted for. The more sophisticated the strategy, the more likely it is that a mutual fund will charge a load fee of 5% to retail clients.

“If you’re wanting to move clients out of mutual funds and into ETFs, there is now a third choice beyond basic benchmark ETFs. But you have to think in terms of factors and understand the methodology of the fund, so you know what factors are being invested in and when the fund will rotate out of those stocks and why,” Siracusano explains.

John Feyerer, director of equity ETF product strategy for PowerShares by Invesco says there are five key factors. He calls them the Mount Rushmore factors: low volatility, momentum, quality, value and size.

“They offer a premium across long time horizons and across many different market cycles,” he says.

Over 10 years of risk adjusted returns from March 1, 2007 to February 28, 2017, only quality beat the SPDR S&P 500 (SPY 515,71 +2,85 +0,56%). Momentum, size and value all got beat, based on a study by WisdomTree.

The underlying indexes of these smart beta funds don’t have a long enough history to really show performance. That makes it harder to predict their future.

WisdomTree created a hypothetical portfolio using a Fama and French Three Factor Model equal weighted and it beat the benchmark by about 15 basis points. Average excess return of smart beta is 1.82% over the long haul. Dating back to 1963, value did best, followed by high earnings yield (meaning low multiple stocks) and high dividend yielding stocks.

Most smart-beta ETFs focus on only one of the “Mount Rushmore” factors. Some will do two or three. Most are doing two. WisdomTree has single and dual-factor for the most part.

A quick look gives a sense of their performance since inception against the main benchmarks. Their Earnings 500 Fund (EPS 55,13 +0,53 +0,96%) has the SPDR SPY beat this year and over the last 12 months. Their Mid Cap Earnings (EZM 56,38 -0,36 -0,63%) is slightly trailing the SPDR S&P Midcap (MDY 544,00 +7,21 +1,34%) this year, but has it beat over the last year.

WisdomTree also has a U.S. Quality Dividend Growth Fund (DGRW 75,81 +0,66 +0,88%) and the WisdomTree Small Cap Quality Dividend Growth Fund (DGRS 48,99 +0,67 +1,39%) whose multi-factors include the obvious – blue chip stocks that are growing their dividends.

“Smart-beta is not a niche strategy,” Siracusano says. “It’s a way to own the U.S. market and exclude companies that are not profitable in the benchmark. You’re loading up on the value and quality factor in large, middle and small cap space in hopes to beat the index. That’s the goal overall, to cost effectively beat the market over time instead of just owning the index.”

Smart beta defines a set of investment strategies that emphasize the use of alternative index construction rules to traditional market capitalization based indices, or simple benchmarks, like the Russell 2000 for instance. There’s of course a way to buy and hold that index cheaply – the iShares Russell 2000 (IWM 206,10 +4,00 +1,98%) index fund. There’s another way to do it, too. One is Wisdom Tree’s factor-based approach, which culls from the best quality earnings performers in that index that pay the highest dividends. That’s their Small Cap Earnings Fund (EES 49,18 +1,02 +2,12%). EES has IWM beat over a one year period, five year period and a 10 year period.

Siracusano hosted an RIA Channel webcast on April 20 to discuss these strategies and talk briefly about how WisdomTree advises investment professionals on how to incorporate smart beta into a core portfolio. The one hour seminar is available on demand here – WEBCAST REPLAY.

“It used to be that investment advisors would pick stocks, then it went to mutual funds, then to index funds, then to ETFs and now the third option is the smart beta ETF,” he says. For advisors with a bit of an academic bent, this is efficient market hypothesis 101. If clients are sensitive to cost, liquidity, and tax efficiency, smart beta is probably the way to go. “These funds are going to be the new competition for active management. You can now increasingly get multi-factor exposure in ETFs. The idea is you will only want to go active if you’re getting high alpha from your manager,” he says.

The increased popularity of smart beta is linked to a desire for portfolio risk management and diversification along factor dimensions as well as seeking to enhance risk-adjusted returns above the cap-weighted indices.

Professional services firm Towers Watson first coined the term, but institutional investors have used the strategy since the 1970s. The first smart beta ETF launched in 2003. WisdomTree got involved shortly after, launching a bunch of smart-beta ETFs around 2007.

“Beta” measures the volatility of an individual security/portfolio, as compared to the broader market like the S&P 500, which has a beta of one. Individual stocks are then ranked according to how much they deviate from that beta.

A stock with a beta of two is way better than the S&P in an up market, but really bad in a down market.

Smart beta as a portfolio construct refers to the use of an alternative methodology to build a fund based on key investing factors like valuation and market cap. A smart beta investment strategy will also rebalance as its rules-based model weeds out the stocks that no longer “play by the rules” so to speak.

As these more sophisticated ETFs become better understood, they are expected to take a bigger chunk of the mutual fund industry’s market share as new products get introduced.

Nasdaq ran a similar event, the Nasdaq Smart Beta Virtual Symposium on April 19, where they asked advisors in attendance whether or not they used factor based ETFs in their client portfolios. Nearly two thirds (70.2%) said no, with 29.8% saying yes. Of the no vote, 22.4% said they were interested in learning more about smart beta ETFs.

In the open end mutual fund market, there is roughly $5.6 trillion in assets under management and most of it is large cap blend and large cap growth oriented, with fees of 90 to 100 basis points. As everyone knows, very few of them consistently beat the index on an annual basis, and even over a longer period of time. After fees, even funds that employ smart-beta strategies of picking momentum plays and low volatility names, for example, will not beat the market with any regularity after fees are accounted for. The more sophisticated the strategy, the more likely it is that a mutual fund will charge a load fee of 5% to retail clients.

“If you’re wanting to move clients out of mutual funds and into ETFs, there is now a third choice beyond basic benchmark ETFs. But you have to think in terms of factors and understand the methodology of the fund, so you know what factors are being invested in and when the fund will rotate out of those stocks and why,” Siracusano explains.

John Feyerer, director of equity ETF product strategy for PowerShares by Invesco says there are five key factors. He calls them the Mount Rushmore factors: low volatility, momentum, quality, value and size.

“They offer a premium across long time horizons and across many different market cycles,” he says.

Over 10 years of risk adjusted returns from March 1, 2007 to February 28, 2017, only quality beat the SPDR S&P 500 (SPY 515,71 +2,85 +0,56%). Momentum, size and value all got beat, based on a study by WisdomTree.

The underlying indexes of these smart beta funds don’t have a long enough history to really show performance. That makes it harder to predict their future.

WisdomTree created a hypothetical portfolio using a Fama and French Three Factor Model equal weighted and it beat the benchmark by about 15 basis points. Average excess return of smart beta is 1.82% over the long haul. Dating back to 1963, value did best, followed by high earnings yield (meaning low multiple stocks) and high dividend yielding stocks.

Most smart-beta ETFs focus on only one of the “Mount Rushmore” factors. Some will do two or three. Most are doing two. WisdomTree has single and dual-factor for the most part.

A quick look gives a sense of their performance since inception against the main benchmarks. Their Earnings 500 Fund (EPS 55,13 +0,53 +0,96%) has the SPDR SPY beat this year and over the last 12 months. Their Mid Cap Earnings (EZM 56,38 -0,36 -0,63%) is slightly trailing the SPDR S&P Midcap (MDY 544,00 +7,21 +1,34%) this year, but has it beat over the last year.

WisdomTree also has a U.S. Quality Dividend Growth Fund (DGRW 75,81 +0,66 +0,88%) and the WisdomTree Small Cap Quality Dividend Growth Fund (DGRS 48,99 +0,67 +1,39%) whose multi-factors include the obvious – blue chip stocks that are growing their dividends.

“Smart-beta is not a niche strategy,” Siracusano says. “It’s a way to own the U.S. market and exclude companies that are not profitable in the benchmark. You’re loading up on the value and quality factor in large, middle and small cap space in hopes to beat the index. That’s the goal overall, to cost effectively beat the market over time instead of just owning the index.”

Smart beta defines a set of investment strategies that emphasize the use of alternative index construction rules to traditional market capitalization based indices, or simple benchmarks, like the Russell 2000 for instance. There’s of course a way to buy and hold that index cheaply – the iShares Russell 2000 (IWM 206,10 +4,00 +1,98%) index fund. There’s another way to do it, too. One is Wisdom Tree’s factor-based approach, which culls from the best quality earnings performers in that index that pay the highest dividends. That’s their Small Cap Earnings Fund (EES 49,18 +1,02 +2,12%). EES has IWM beat over a one year period, five year period and a 10 year period.

Siracusano hosted an RIA Channel webcast on April 20 to discuss these strategies and talk briefly about how WisdomTree advises investment professionals on how to incorporate smart beta into a core portfolio. The one hour seminar is available on demand here – WEBCAST REPLAY.

“It used to be that investment advisors would pick stocks, then it went to mutual funds, then to index funds, then to ETFs and now the third option is the smart beta ETF,” he says. For advisors with a bit of an academic bent, this is efficient market hypothesis 101. If clients are sensitive to cost, liquidity, and tax efficiency, smart beta is probably the way to go. “These funds are going to be the new competition for active management. You can now increasingly get multi-factor exposure in ETFs. The idea is you will only want to go active if you’re getting high alpha from your manager,” he says.

The increased popularity of smart beta is linked to a desire for portfolio risk management and diversification along factor dimensions as well as seeking to enhance risk-adjusted returns above the cap-weighted indices.

Professional services firm Towers Watson first coined the term, but institutional investors have used the strategy since the 1970s. The first smart beta ETF launched in 2003. WisdomTree got involved shortly after, launching a bunch of smart-beta ETFs around 2007.

“Beta” measures the volatility of an individual security/portfolio, as compared to the broader market like the S&P 500, which has a beta of one. Individual stocks are then ranked according to how much they deviate from that beta.

A stock with a beta of two is way better than the S&P in an up market, but really bad in a down market.

Smart beta as a portfolio construct refers to the use of an alternative methodology to build a fund based on key investing factors like valuation and market cap. A smart beta investment strategy will also rebalance as its rules-based model weeds out the stocks that no longer “play by the rules” so to speak.

As these more sophisticated ETFs become better understood, they are expected to take a bigger chunk of the mutual fund industry’s market share as new products get introduced.

Nasdaq ran a similar event, the Nasdaq Smart Beta Virtual Symposium on April 19, where they asked advisors in attendance whether or not they used factor based ETFs in their client portfolios. Nearly two thirds (70.2%) said no, with 29.8% saying yes. Of the no vote, 22.4% said they were interested in learning more about smart beta ETFs.

In the open end mutual fund market, there is roughly $5.6 trillion in assets under management and most of it is large cap blend and large cap growth oriented, with fees of 90 to 100 basis points. As everyone knows, very few of them consistently beat the index on an annual basis, and even over a longer period of time. After fees, even funds that employ smart-beta strategies of picking momentum plays and low volatility names, for example, will not beat the market with any regularity after fees are accounted for. The more sophisticated the strategy, the more likely it is that a mutual fund will charge a load fee of 5% to retail clients.

“If you’re wanting to move clients out of mutual funds and into ETFs, there is now a third choice beyond basic benchmark ETFs. But you have to think in terms of factors and understand the methodology of the fund, so you know what factors are being invested in and when the fund will rotate out of those stocks and why,” Siracusano explains.

John Feyerer, director of equity ETF product strategy for PowerShares by Invesco says there are five key factors. He calls them the Mount Rushmore factors: low volatility, momentum, quality, value and size.

“They offer a premium across long time horizons and across many different market cycles,” he says.

Over 10 years of risk adjusted returns from March 1, 2007 to February 28, 2017, only quality beat the SPDR S&P 500 (SPY 515,71 +2,85 +0,56%). Momentum, size and value all got beat, based on a study by WisdomTree.

The underlying indexes of these smart beta funds don’t have a long enough history to really show performance. That makes it harder to predict their future.

WisdomTree created a hypothetical portfolio using a Fama and French Three Factor Model equal weighted and it beat the benchmark by about 15 basis points. Average excess return of smart beta is 1.82% over the long haul. Dating back to 1963, value did best, followed by high earnings yield (meaning low multiple stocks) and high dividend yielding stocks.

Most smart-beta ETFs focus on only one of the “Mount Rushmore” factors. Some will do two or three. Most are doing two. WisdomTree has single and dual-factor for the most part.

A quick look gives a sense of their performance since inception against the main benchmarks. Their Earnings 500 Fund (EPS 55,13 +0,53 +0,96%) has the SPDR SPY beat this year and over the last 12 months. Their Mid Cap Earnings (EZM 56,38 -0,36 -0,63%) is slightly trailing the SPDR S&P Midcap (MDY 544,00 +7,21 +1,34%) this year, but has it beat over the last year.

WisdomTree also has a U.S. Quality Dividend Growth Fund (DGRW 75,81 +0,66 +0,88%) and the WisdomTree Small Cap Quality Dividend Growth Fund (DGRS 48,99 +0,67 +1,39%) whose multi-factors include the obvious – blue chip stocks that are growing their dividends.

“Smart-beta is not a niche strategy,” Siracusano says. “It’s a way to own the U.S. market and exclude companies that are not profitable in the benchmark. You’re loading up on the value and quality factor in large, middle and small cap space in hopes to beat the index. That’s the goal overall, to cost effectively beat the market over time instead of just owning the index.”

Smart beta defines a set of investment strategies that emphasize the use of alternative index construction rules to traditional market capitalization based indices, or simple benchmarks, like the Russell 2000 for instance. There’s of course a way to buy and hold that index cheaply – the iShares Russell 2000 (IWM 206,10 +4,00 +1,98%) index fund. There’s another way to do it, too. One is Wisdom Tree’s factor-based approach, which culls from the best quality earnings performers in that index that pay the highest dividends. That’s their Small Cap Earnings Fund (EES 49,18 +1,02 +2,12%). EES has IWM beat over a one year period, five year period and a 10 year period.

Siracusano hosted an RIA Channel webcast on April 20 to discuss these strategies and talk briefly about how WisdomTree advises investment professionals on how to incorporate smart beta into a core portfolio. The one hour seminar is available on demand here – WEBCAST REPLAY.

“It used to be that investment advisors would pick stocks, then it went to mutual funds, then to index funds, then to ETFs and now the third option is the smart beta ETF,” he says. For advisors with a bit of an academic bent, this is efficient market hypothesis 101. If clients are sensitive to cost, liquidity, and tax efficiency, smart beta is probably the way to go. “These funds are going to be the new competition for active management. You can now increasingly get multi-factor exposure in ETFs. The idea is you will only want to go active if you’re getting high alpha from your manager,” he says.

The increased popularity of smart beta is linked to a desire for portfolio risk management and diversification along factor dimensions as well as seeking to enhance risk-adjusted returns above the cap-weighted indices.

Professional services firm Towers Watson first coined the term, but institutional investors have used the strategy since the 1970s. The first smart beta ETF launched in 2003. WisdomTree got involved shortly after, launching a bunch of smart-beta ETFs around 2007.

“Beta” measures the volatility of an individual security/portfolio, as compared to the broader market like the S&P 500, which has a beta of one. Individual stocks are then ranked according to how much they deviate from that beta.

A stock with a beta of two is way better than the S&P in an up market, but really bad in a down market.

Smart beta as a portfolio construct refers to the use of an alternative methodology to build a fund based on key investing factors like valuation and market cap. A smart beta investment strategy will also rebalance as its rules-based model weeds out the stocks that no longer “play by the rules” so to speak.

As these more sophisticated ETFs become better understood, they are expected to take a bigger chunk of the mutual fund industry’s market share as new products get introduced.

Nasdaq ran a similar event, the Nasdaq Smart Beta Virtual Symposium on April 19, where they asked advisors in attendance whether or not they used factor based ETFs in their client portfolios. Nearly two thirds (70.2%) said no, with 29.8% saying yes. Of the no vote, 22.4% said they were interested in learning more about smart beta ETFs.

In the open end mutual fund market, there is roughly $5.6 trillion in assets under management and most of it is large cap blend and large cap growth oriented, with fees of 90 to 100 basis points. As everyone knows, very few of them consistently beat the index on an annual basis, and even over a longer period of time. After fees, even funds that employ smart-beta strategies of picking momentum plays and low volatility names, for example, will not beat the market with any regularity after fees are accounted for. The more sophisticated the strategy, the more likely it is that a mutual fund will charge a load fee of 5% to retail clients.

“If you’re wanting to move clients out of mutual funds and into ETFs, there is now a third choice beyond basic benchmark ETFs. But you have to think in terms of factors and understand the methodology of the fund, so you know what factors are being invested in and when the fund will rotate out of those stocks and why,” Siracusano explains.

John Feyerer, director of equity ETF product strategy for PowerShares by Invesco says there are five key factors. He calls them the Mount Rushmore factors: low volatility, momentum, quality, value and size.

“They offer a premium across long time horizons and across many different market cycles,” he says.

Over 10 years of risk adjusted returns from March 1, 2007 to February 28, 2017, only quality beat the SPDR S&P 500 (SPY 515,71 +2,85 +0,56%). Momentum, size and value all got beat, based on a study by WisdomTree.

The underlying indexes of these smart beta funds don’t have a long enough history to really show performance. That makes it harder to predict their future.

WisdomTree created a hypothetical portfolio using a Fama and French Three Factor Model equal weighted and it beat the benchmark by about 15 basis points. Average excess return of smart beta is 1.82% over the long haul. Dating back to 1963, value did best, followed by high earnings yield (meaning low multiple stocks) and high dividend yielding stocks.

Most smart-beta ETFs focus on only one of the “Mount Rushmore” factors. Some will do two or three. Most are doing two. WisdomTree has single and dual-factor for the most part.

A quick look gives a sense of their performance since inception against the main benchmarks. Their Earnings 500 Fund (EPS 55,13 +0,53 +0,96%) has the SPDR SPY beat this year and over the last 12 months. Their Mid Cap Earnings (EZM 56,38 -0,36 -0,63%) is slightly trailing the SPDR S&P Midcap (MDY 544,00 +7,21 +1,34%) this year, but has it beat over the last year.

WisdomTree also has a U.S. Quality Dividend Growth Fund (DGRW 75,81 +0,66 +0,88%) and the WisdomTree Small Cap Quality Dividend Growth Fund (DGRS 48,99 +0,67 +1,39%) whose multi-factors include the obvious – blue chip stocks that are growing their dividends.

“Smart-beta is not a niche strategy,” Siracusano says. “It’s a way to own the U.S. market and exclude companies that are not profitable in the benchmark. You’re loading up on the value and quality factor in large, middle and small cap space in hopes to beat the index. That’s the goal overall, to cost effectively beat the market over time instead of just owning the index.”