“Save the whales! Save those snails…,” George Carlin famously spoofed the environmentally conscious in one of his many HBO specials. Whose buying the bonds of entities saving the planet? A lot of institutions, for sure. And retail investors are catching on.

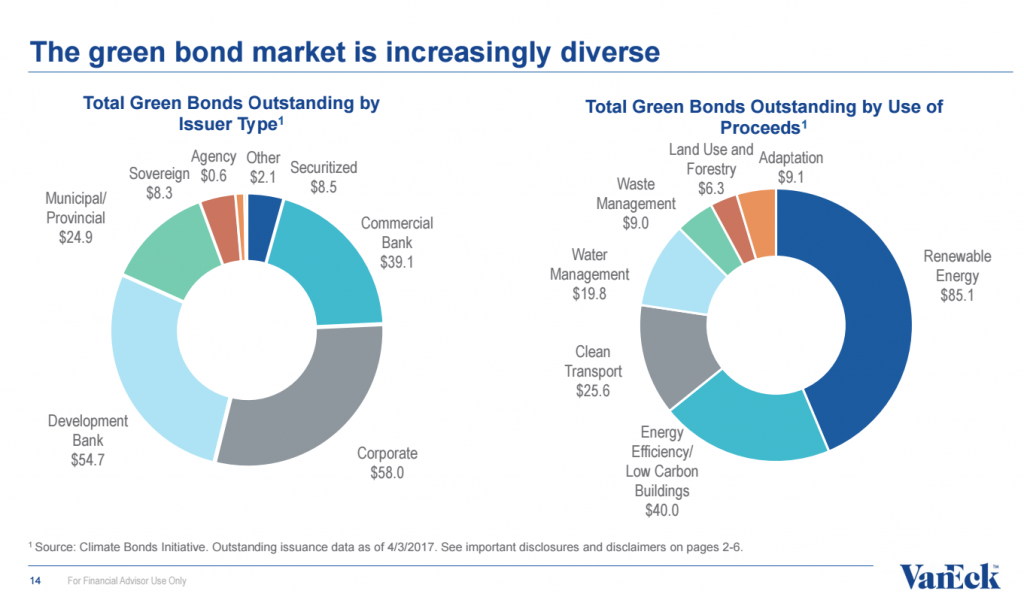

Ten years ago, “green bonds” issuance was around $800 million. This year is expected to close out at $150 billion after a record $82 billion in issuance last year, according to the Climate Bonds Initiative in London. So far this year, some $28 billion has been issued in these environmentally friendly fixed income securities.

What does it all mean? Well, for starters it means there is an appetite on behalf of investors to hold the debt of companies and countries deemed to be acting as good stewards of the environment. It also means that the demand explosion is leading to a whole new product line.

Introducing…the green bond exchange traded fund, by the New York ETF heavy weights at VanEck Global.

RIA Channel recently ran a webinar about green bond investing with VanEck, Climate Bonds Initiative and the S&P Dow Jones Indices which sought to give advisors a sense of why go green in fixed income, and how to sell these new products to investors. A replay of the webinar is available here.

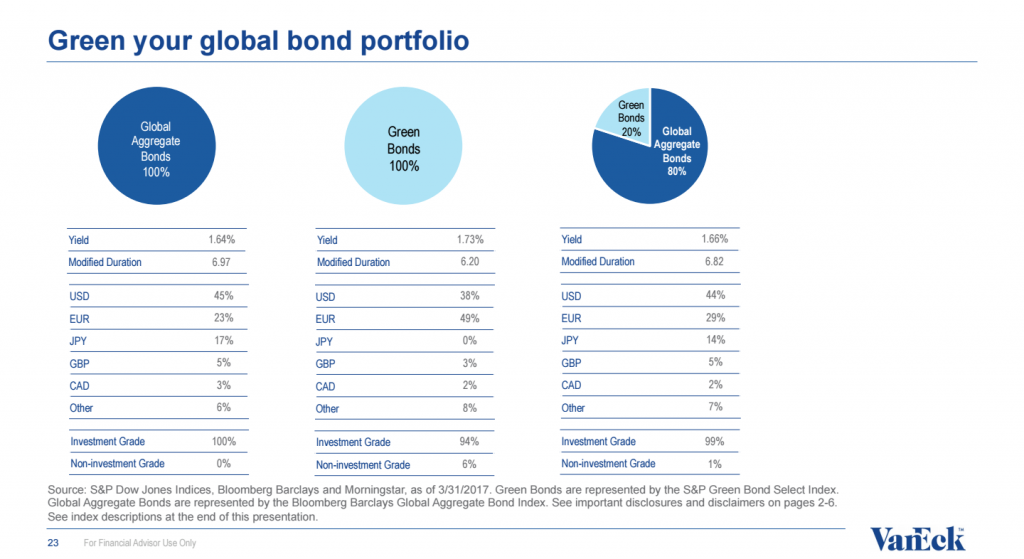

So why go green here? They’re structured the same as any conventional global aggregate bond fund. They pay (low) interest like every other investment grade bond. What’s so great about them, other than appealing to the moral compass of retail investors?

“Any kind of bond can be a green bond,” admits Sean Kidney, the CEO of Climate Bonds Initiative (CBI 16,39 0,00 0,00%). “The main thing is that the investor has some comfort that the proceeds are linked or tied to qualifying green assets.”

That’s where the CBI comes in. They develop the rules for certification of green bonds. There are rules around corporate reporting and transparency, and requirements that the debt is going into a broad area of environmentally sound projects (think smart grid or even high speed rail) even if the company as a whole is not necessarily known to be the Greenpeace of their particular sector.

“The sustainable investment market itself is growing,” says Martina Macpherson, global head of sustainability indexing at the S&P Dow Jones Indices.

Investors into new products like to know if there is a market here. Is there demand for these securities, or is the spread between bid and ask so wide that they start looking like risky penny stocks, or even illiquid. Institutional investors are the main driver of green bonds, particularly the European insurance firms like Swiss Re. Trillions of dollars are committed to sustainable investing practices overall. It’s a very liquid market, and here is why you own it:

Two simple reasons, really…

First, your client is a little less worried about yield and a bit more worried about climate change. They have a soft spot for polar bears and prefer organic milk in the morning.

Second, you have this type of investor in a global bond fund that may be investing in everything from defense contractors to Arctic ice drillers. For the same amount of yield, a global green bond fund is probably better for the planet, and a better fit for that conscientious investor.

But fair warning here. The same company that issues bonds to finance drilling for oil in the dolphin swimming waters of the Gulf of Mexico may also issue a bond to finance construction of EV plug-ins at their gasoline stations. In this regard, if the capital being raised in a bond offering is for EV hook ups at Shell, it gets a green bond blessing.

On the call, RIAs were mostly curious about muni-bonds in this space. Munis are a nice way to buy single plays in this trend. The infrastructure story was placed front and center, as we have noted here before. More than two-thirds of the muni issuance is in the U.S., with the biggest issuance for the green bond class being in Massachusetts and New York infrastructure (think MTA subway financing, for example).

“These are solid investments,” says Kidney. “If you have a concern about the environment…these address those concerns.”

Under the Hood of the Newest Green Bond Fund

VanEck are the masters of ETFs. They run the two biggest BRIC-focused ETFs on Russia and are one of the early entrants into the green bond space with their Vectors branded product, under the ticker GRNB. The fund tracks the S&P Green Bond Select Index and pays around 1% in yield. The fund just launched on March 3, making it the newest bond fund ETF at VanEck.

The fund’s initial holdings out of the gate are all investment grade, and mainly priced in euros, dollars and Swedish Krona. Seeing how their top holdings are in euros, one can imagine the yield. VanEck had to go to China in order to find anything over 2.2%.

Some of the top 10 holdings include sovereign French 2039s yielding 1.7%; ING Bank 2018s yielding 2%; Bank of China 2021s at 2.25% and Transport for London’s 2025s yielding 2.12%. All yield is based on coupon price at time of purchase.

As a single country holding, France tops the list and accounts for 23.8% of the 41 holdings. The U.S. accounts for 10.2%.

Investors are not exposed to emerging market currency directly, though Brazil and Mexico are part of the fund’s net assets at a little over 2% each. The China bonds, which make up 9.9% of the fund, are priced mainly in dollars. Government bonds, bank bonds and utilities are the bulk of the sector holdings and 93% of the fund is investment grade credit.

“One of the most interesting aspects of green bonds from an investment perspective is that in the majority of cases green bonds are the same as conventional bonds, except that the issuer is disclosing that the debt is going to finance renewable energy, for example,” says William Sokol, ETF product manager at VanEck. “They have the same level of credit risk; no different risk and return profile and the yield is correlated to their global, plain vanilla counterparts,” he admits. Investors who substitute a portion of their global bond allocation into a green bond fund, which is also global, their yield is very similar, their credit risk is similar, but the duration is a little shorter.

For more info on the new fund, see here.