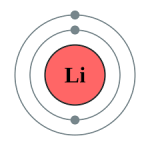

If there is one thing we have learned about Tesla it is that the car maker is more of an alternative energy company than a car company. It’s banking on green machines to eventually power passed the gas powered engines we’ve been driving for over a hundred years; and it is investing in home energy solutions as well. Tesla’s future isn’t powered by sunshine. It’s powered by lithium.

If there is one thing we have learned about Tesla it is that the car maker is more of an alternative energy company than a car company. It’s banking on green machines to eventually power passed the gas powered engines we’ve been driving for over a hundred years; and it is investing in home energy solutions as well. Tesla’s future isn’t powered by sunshine. It’s powered by lithium.

David Sidoo, CEO of Advantage Lithium (AAL 13,85 -0,01 -0,07%), a Vancouver-based small-cap, is betting big on batteries. They recently completed a $20 million financing deal to fund some of their lithium mining projects in Argentina with an Australian multi-national called Orocobre and think investors should pay close attention to the lithium trade.

“Most of the world’s lithium is found in Chile, Bolivia and Argentina and out of those three countries we feel Argentina has the best business climate,” he says. “Argentina is rapidly becoming one of the best emerging markets to invest in.”

How do investors get in on this?

One way is the Global X Lithium (LIT 46,00 +0,37 +0,81%) ETF, says Sidoo. It holds Tesla (TSLA 181,19 +1,18 +0,66%) and Orocobre. “We plan on being included on that list soon,” he says. U.S. investors can also buy Advantage Lithium in the pink sheets under the ticker (AVLIF 0,19 -0,01 -5,03%).

Sidoo knows a thing or two about the energy business. He was the founder of American Oil & Gas, which one of the early entrants into the Bakken region of North Dakota. They sold to Hess (HES 158,86 +0,30 +0,19%) for $600 million a while back.

He is also CEO of East West Petroleum — which operates out of New Zealand and Romania. Back at Advantage, his chief geologist, Ross McElroy, has been in the mining business for 30 years and is the technical director for Fission Uranium, a Canadian listed uranium miner.

Goldman Sachs Research calls lithium the “new gasoline”.

“We think lithium ion batteries will help fuel a dramatic increase in electric vehicles,” says Bob Koort, head of industrial and materials research for Goldman.

As it now stands, demand is exceeding supply due to the lengthy process it takes to produce lithium. Lithium costs somewhere between $3,500 to $4,000 per ton to produce. Most of the price is due to the lack of producers. Only a handful of mining companies producing lithium, with Orocobre being one of them.

Tesla and other battery manufacturers are getting better at mass producing those products, so prices will eventually fall and that will make electric vehicles more attractive to Americans whose wheelhouse price for new sedans tends to be between $18,000 and $25,000.

Tesla says it will mass produce 500,000 electric vehicles by 2018. They’re ramping up production of electric vehicles, which Sidoo believes will hit critical mass even with gasoline priced at under $2.50 a gallon. Many companies are producing electric vehicles, including the luxury car makers that see a threat from Tesla. Worth noting, Toyota pulled the plug on its all electric Prius two years ago.

A little down market, the Chevy Bolt (not the Volt) was named the Car of the Year at the 2017 Detroit Auto Show.

The infrastructure to charge electric vehicles is becoming more common in big city parking garages and even in some small towns. Charging stations are popping up all over the place.

And that’s just in America alone.

China may be the lynchpin. The country is concerned about air quality. BYD Auto has sold more EVs than Tesla. Like the U.S., China also allows for subsidies and rebates to lower the cost of these higher tech vehicles.

For companies like Advantage Lithium, and to some extent, the Global X Lithium ETF, profit depends on lithium demand and pricing. The Lithium fund is up 30.7% over the last 12 months. Advantage Lithium has gone the other way in Canadian dollar terms.

“Our revenue depends on our success in bringing lithium to the market,” says Sidoo. “We are still in the beginning phases of that.”

These guys are early entrants; investors are banking on their know-how and their ties to Orocobre. Their $20 million financing they raised will help them deliver more lithium “very soon,” Sidoo says. They also have projects in Nevada. They begin a 17 hole drill program in Argentina this month. “We definitely feel that we are many steps ahead of the game,” he says.