There’s actually a sweet spot for high yield in a portfolio that can nearly pinpoint exactly where a portfolio is taking on way too much risk for the yield its receiving. It’s right around 4%. Anything over that and things can go haywire in a downturn.

Andrew Lapthorne, head of quantitative equity research at Societe Generale spends a lot of his time using in-house models and other, more well-known financial models to figure out at which point is the chase for yield in bonds and in dividend stocks increasing an income fund’s potential for bigger losses.

“We are trying to desperately avoid the type of assets that are highly volatile and highly leveraged where drawdowns in market downturns can be over 60% for the lowest quality, compared to a max draw down of 35% for the highest quality companies,” Lapthorne says, citing the Merton Model, a credit risk evaluation model developed in the 1970s by economist Robert Merton.

Societe Generale’s take on credit risk is packaged in the Janus SG Global Quality Income (SGQI 27,55 -0,46 -1,64%) exchange traded fund. It’s not a fund designed to clobber benchmarks. It’s a fund designed for income and capital preservation, hoping to get some bang for their investors’ bucks in equity and currency upside.

The idea behind the ETF, in the simplest of terms, is this: over the last decade investors have turned to higher yielding instruments even for a conservative fixed income fund. In their hunt for income, investors may be taking on unintended degrees of interest rate or credit risk to achieve their yield goals.

So what Lapthorne is trying to do is pick securities that meet certain criteria, based on at least three models, from Merton to Stanford University professor Joseph Piotroski, creator of the Piotroski Score which reflects 9 criteria used to determine the strength of a firms financials.

There are basically a handful of factors that help predict dividend cuts. And if those cuts are coming, then Societe Generale cuts those equities from their ETF.

These include:

- Poor 12 month share price performance

- Share price volatility

- Low return on equity, low return on assets, and high accruals

- Poor balance sheet

“Nobody wants to be the CFO that cuts dividends, but if the balance sheet is shaky, then it is the balance sheet that will over rule the executive in terms of a dividend decision,” says Lapthorne.

If a company is cutting dividends it’s getting cut from SGQI.

To help assess the situation, they’re using a credit model called the Merton Distance to Default model, which effectively measures the chance of default for a given equity in six month’s time.

“What’s important to us as investors is not how much leverage you have but how volatile your equity is,” Lapthorne says. “If you have a business with hardly any leverage, then it can afford to be volatile. But if you’re highly levered, you cannot be volatile. So you’re trying to find companies with sensible leverage and low volatility and good yield.”

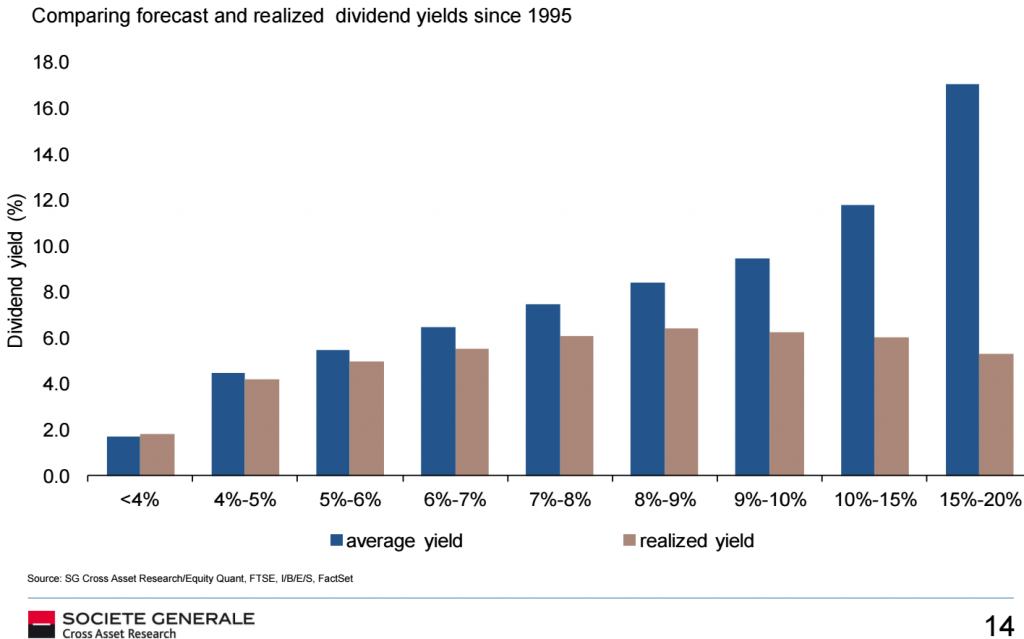

The fund is designed to avoid the worst yield in the highest yielding universe so they are not stuck with poor quality companies during a major market downturn. Four percent is the sweet spot in down markets, where that income is reinvested back into equities in a declining market at a depressed price. Yield any higher than that is often stuck in poorer quality securities in an ever-declining, free-falling market.

“Yield chasing has forced people into the higher risk part of the bond market,” Lapthorne says in a Janus and Societe Generale webinar titled “The Hunt for Yield Does Not Have to be a Challenge”. A replay of the webinar can be found here.

“The thing that is important to us is what happens if things go wrong,” he says. “By introducing leverage to get yield, you’re exposing yourself to more downside risk and that is what we want to avoid. We would never buy a company just because it has a high yield dividend,” he says, sticking religiously to their financial models. “The company has to have a strong balance sheet to get picked up by us. If I had to choose between a high yield REIT and a boring company like Unilever, I would always favor Unilever.”

SGQI tracks the SGI Global Quality Income Index, a rules-based index that evaluates global developed equities for both dividend yield and quality. The index uses factors that may help predict dividend cuts, like balance sheet strength, profitability and price stability. The index tries to find quality dividend-paying stocks by evaluating the universe of eligible holdings for these factors, using the aforementioned economic models.

According to Morningstar, some of the fund’s current top 10 holdings include:

| Company | Dividend Yield | Currency |

|---|---|---|

| AGL Energy | 2.74% | AUD |

| Philip Morris International | 3.67% | USD |

| Transurban Group | 4.02% | AUD |

| CLP Holdings | 3.45% | HKD |

| Endessa | 6.08% | EUR |