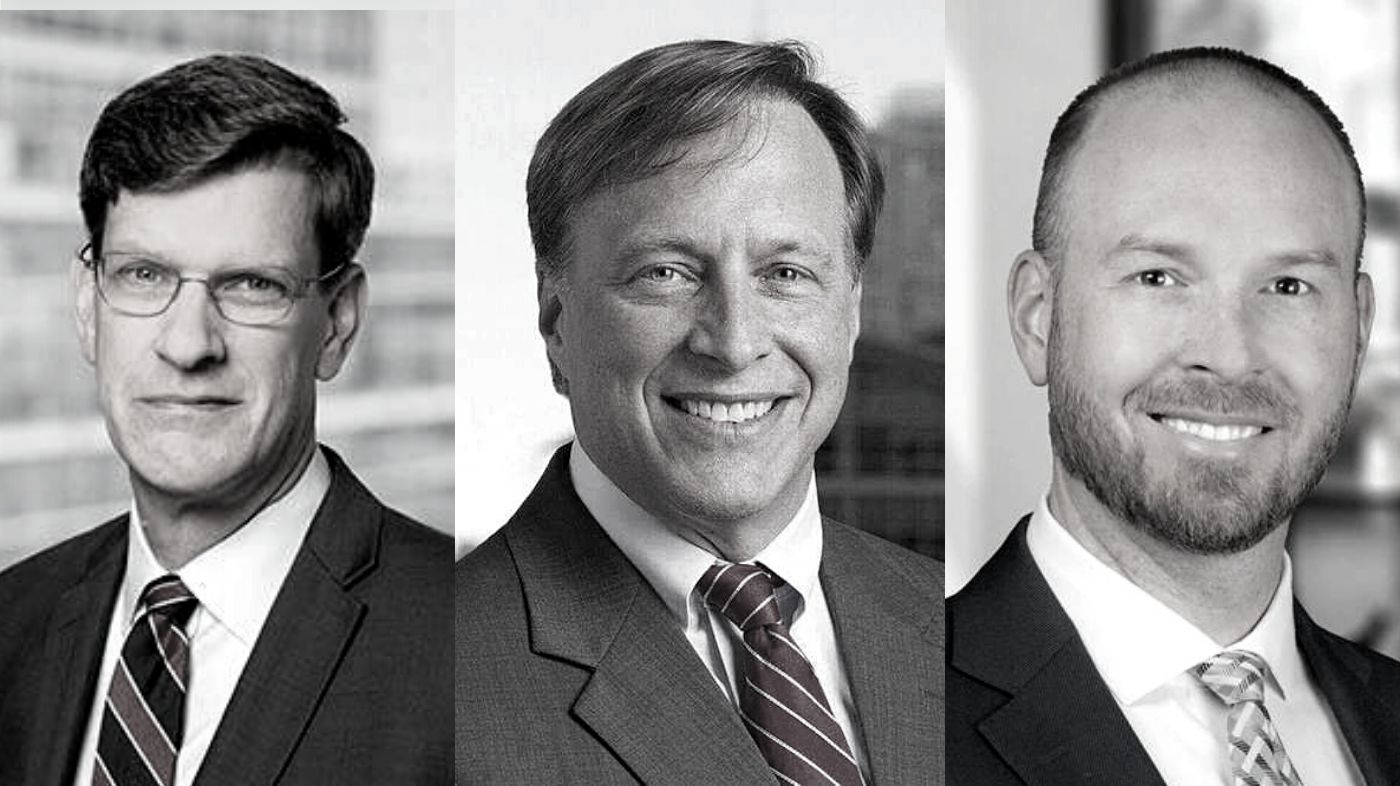

Michael Townsend, Managing Director of Legislative and Regulatory Affairs, Charles Schwab Co., Inc., Fred Kaynor, Managing Director of Marketing and Business Development, Schwab Charitable, and Hayden Adams, Director of Tax and Financial Planning, Schwab Center for Financial Research, weigh in on tax reform and strategies to maximize giving in 2021.

Michael Townsend, Managing Director of Legislative and Regulatory Affairs, Charles Schwab Co., Inc., Fred Kaynor, Managing Director of Marketing and Business Development, Schwab Charitable, and Hayden Adams, Director of Tax and Financial Planning, Schwab Center for Financial Research, weigh in on tax reform and strategies to maximize giving in 2021.

To learn more, register for their upcoming webcast on Tax reform and charitable giving: strategies for clients to maximize their philanthropic impact.

Despite continued uncertainty and heightened market volatility, total charitable giving is trending up. In 2020 alone, charitable giving in the U.S. reached an all-time high of $471.44 billion, according to Giving USA. In the most recent fiscal year, ending in June 30, 2021, Schwab Charitable donors gave record-breaking amounts as well, awarding a total of $3.7 billion in grants to over 113,000 charities. Incorporating charitable giving into end-of-year tax planning conversations can be a great way for advisors to deliver differentiated value and help clients contribute more to the causes they care most about. Given historic market performance, existing tax laws, and now with tax reform on the horizon, the environment remains favorable for charitable giving. Those factors and more make 2021 an especially great year for clients to give.

Schwab Charitable offers several strategies for tax-efficient giving including:

-

- Giving appreciated non-cash assets instead of assets

- Leveraging a charitable deduction strategy

- Giving more by donating retirement assets

- Recommend recurring grants for unrestricted use.

For example, one of the most powerful tax-smart strategies is donating appreciated non-cash assets held for more than one year. Advisors might be familiar with this concept, but many clients don’t realize that it’s more tax-efficient to give appreciated assets instead of cash. Clients who use this strategy can generally eliminate the capital gains tax they would otherwise incur if they sold the assets first and then donated the proceeds, potentially increasing the amount available for charity by up to 20%. Helping clients identify opportunities to minimize their taxes and give more to the causes they care about through other strategies like “bunching their giving” or leveraging retirement assets, can also help advisors build deeper, long-term relationships.

Schwab Charitable is an independent public charity with a mission to increase giving in the U.S. Through donor-advised funds, contributors can donate both cash and appreciated securities for a tax advantage. With no account minimums and lower costs relative to private foundations, this strategic and tax-efficient way of giving is accessible to the every-day-investor.

Schwab Charitable’s upcoming webcast on Tax reform and charitable giving will explore tax-smart strategies to help your clients boost their giving power. As we near December, Congress is still wrestling with major economic legislation and a package of tax changes to pay for it. In this webcast, specialists from Charles Schwab and Schwab Charitable will discuss how the latest tax proposals on Capitol Hill may impact your clients and charitable giving. They will review the current giving environment and suggest some compelling tax-smart giving strategies to consider as clients make their year-end philanthropy decisions. Topics include:

- An overview of the proposed tax code changes and ways to possibly reduce tax exposure

- Why 2021 is a favorable environment for charitable giving

- Tax-efficient giving strategies to consider for philanthropically-minded clients