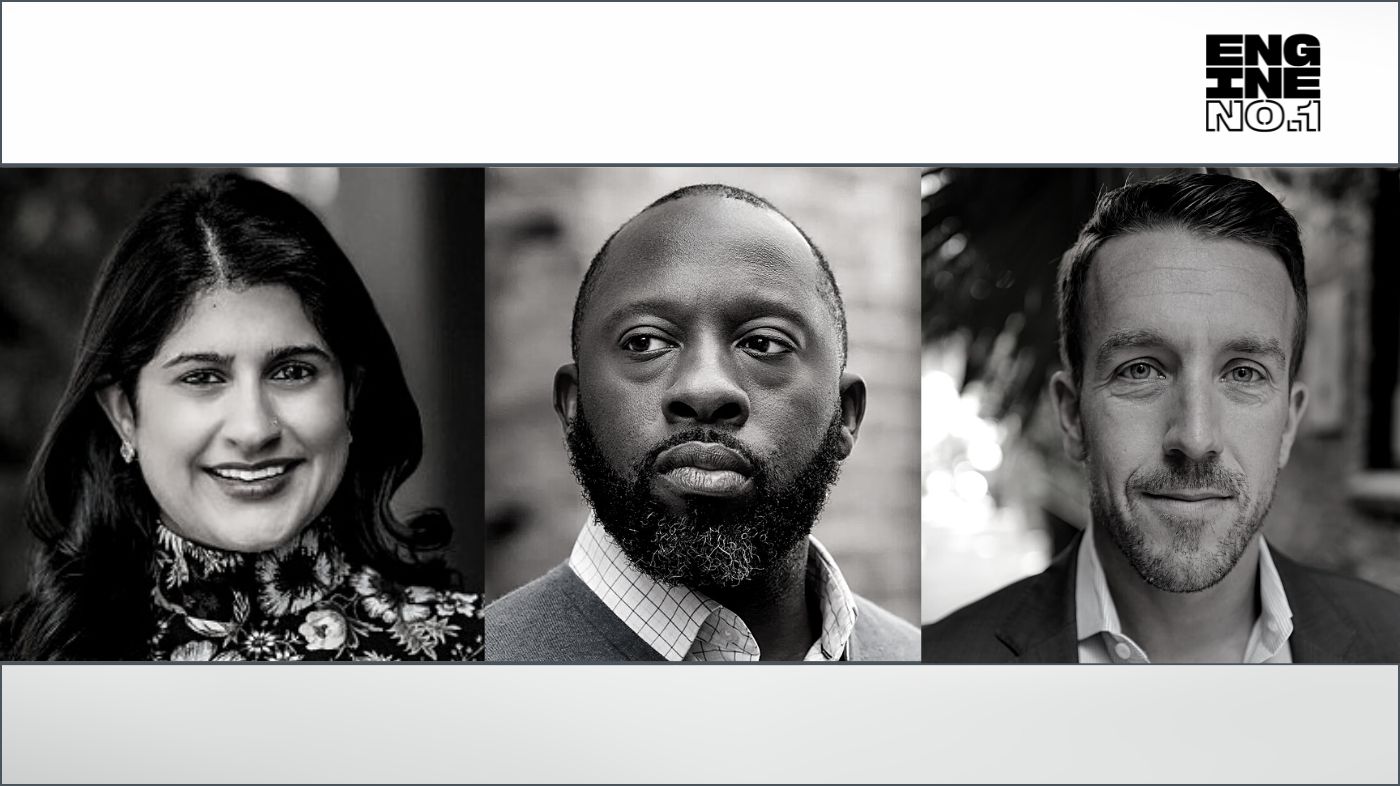

Yasmin Dahya Bilger, Head of ETFs, Eli Horton Senior Portfolio Manager and Yusuf George, Managing Director of Active Ownership at Engine No. 1 discuss the power of active ownership to make an impact.

Yasmin Dahya Bilger, Head of ETFs, Eli Horton Senior Portfolio Manager and Yusuf George, Managing Director of Active Ownership at Engine No. 1 discuss the power of active ownership to make an impact.

WEBCAST – Engine No. 1: Active Ownership Drives Transformation In a Transitioning World

The energy, food, and transportation industries and the supply chain structure that supports them, are systems in various stages of transition on a path to more sustainable models. Driving these transitions is the demand around the world for new solutions to the challenges of climate change as well as food and energy security.

In our view, the best way to address a problem—is to confront it directly. Through proxy voting and constructive engagements, investors can help drive the largest companies in America to long-term value creation.

Join Yasmin Dahya Bilger, Eli Horton, and Yusuf George from Engine No. 1 to learn why these transformation themes should matter to you and your clients.

- Epic transitions will drive tremendous shifts in value—The transition to a net zero emissions economy will require between $4-5 trillion of new investment per year. That represents an enormous opportunity for those willing to drive change rather than just react to it.

- Constructive engagement is necessary to drive tangible results—Divestment is not the answer to solving the world’s largest problems. With fewer than 200 companies that account for over 80% of corporate industrial greenhouse gas emissions—there is no path to decarbonization at scale that doesn’t go directly through those companies.

- Investors should not be passive holders—Investors can drive positive impact as active owners by using their votes to hold the largest U.S. companies accountable for creating value over time.