Robo-advisors continue to dominate the headlines. For better or worse, that means the public is more educated than ever about the ability of a rules-based, data-driven investing approach to outperform the market. It has many investors—including your valued clients—asking which can offer them the best possible financial outcome: man or machine? Unfortunately, it’s a question that may put your trusted advice in question. As you strive to maintain investor confidence and client loyalty, you face a critical choice: to stick to a traditional, subjective approach to portfolio management or beat robo-advisors at their own game by making the leap to a quantitative investing model that has historically outperformed the market.

Making that choice can be harder than it sounds. If you’re like many advisors, shifting to a rules-based approach feels like turning your back on all the tools you’ve relied on for years to drive your investment decisions. Market analysis. Expert opinions. Internal debates. Your own intuition. And even if you do apply hard data to the process, it’s likely you’re using it primarily as a screen to glean insights, develop hypotheses, or back up your most promising certain theories. But regardless of what the data shows (or perhaps in spite of it) your final decision is subjective.

Behavioral finance is a field of finance that proposes psychology-based theories to explain stock market anomalies such as severe rises or falls in stock price1. It shows that such subjective decisions are ripe for human error. As humans, it’s all too easy for our decisions to be influenced—consciously or subconsciously—to economic, political, and market shifts, as well as our own personal preferences and ideologies. While we inherently strive to maximize wealth through rational decision-making, emotion and psychology often cause us to behave in ways that can lead to irrational decisions that often drive poor outcomes. That’s true for individual investors as well as trained and experienced advisors. Knowing that, it makes sense that hard data might support more consistent investing behavior.

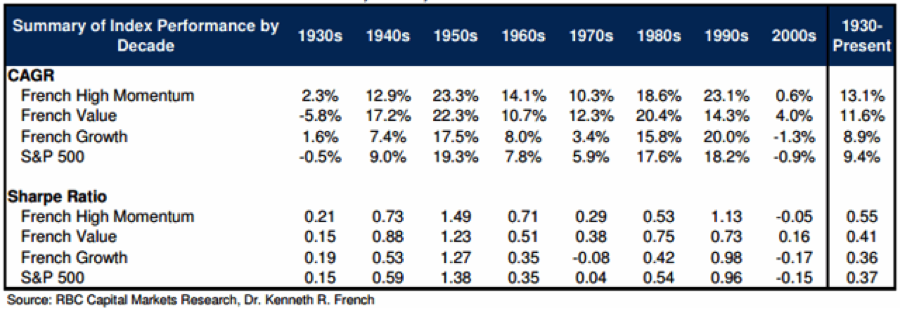

James O’Shaughnessy certainly believes so. In his book What Works on Wall Street, which many consider “the bible” on numbers-driven investing, he compares the historical performance of three qualitative investment approaches—Momentum and Relative Strength, Value, and Growth—over the past 80 years. The findings paint a clear picture of what actually “works” when it comes to investing. What does the data show? That applying quantitative factors consistently over time is the key to success. While it’s certainly true that past success is no guarantee of future performance, if the past eight decades are indicative of anything at all, it’s that, when it comes to investing, consistent, rules-based investment decisions far outshine human intuition.

Performance data from 2016 confirms O’Shaughnessy’s hypothesis. According to the S&P Dow Jones SPIVA scorecard, last year 84.62% of large-cap managers, 87.89% of mid-cap managers, and 88.77% of small-cap managers underperformed the major market indices. The numbers are even worse over a rolling 10-year period, with 85.36% of large-cap managers, 91.27% of mid-cap managers, and 90.75% of small-cap managers failing to outperform on a relative basis. That’s a problem when investors pay investment managers quite a bit of money with the singular goal of beating the market. If you’re among these professionals who aren’t outperforming the Dow and the S&P 500, ask yourself what value are you bringing to your clients?

Adding value with a rules-based model

While it’s true that an alarming majority of investment managers fail to outperform major indices over rolling 10-year periods, there is still a meaningful percentage of active managers who have demonstrated the ability to generate outperformance over time.

Nasdaq Dorsey Wright offers investors a free demo of the DWA Research Platform, which provides turnkey research and analysis for stock selection, portfolio management and asset allocation. For questions about the DWA strategies, contact us here.

You already know that O’Shaughnessy’s research showed that quantitative factors have historically had a positive impact on returns. Going one step further, the research also showed that of the three key factors—Value, Growth, and Momentum—the factor that demonstrated the greatest rate of long-term success was Momentum. A recent white paper published by RBC Capital Markets supports those results, showing that Momentum outperformed the S&P 500 in every decade since the 1930s. And while both Value and Growth experienced decades of underperformance in that period, Momentum outperformed in every single decade.

As an active manager, your primary goals are to outperform the benchmarks and, as a result, to deliver the highest possible value to your clients. The data is clear that a rules-based approach that leverages Momentum as a driving factor is the most promising approach available to achieve those goals. Are you ready to make the leap?

Sure, the shift to rules-based investing can be challenging, especially if you’ve built your business on a foundation of traditional, subjective investment management. But with 80 years of data showing the effectiveness of a consistent, quantitative, factor-based approach—and knowing that subjective human behavior can be the biggest drag on performance over time—suddenly that leap doesn’t look quite so daunting after all.

To learn more about the value of quantitative investing, download the research paper here: Man vs. Machine: Dissecting the Real Value of a Quantitative Investing Model.

Past performance, hypothetical or actual, does not guarantee future results. In all securities trading there is a potential for loss as well as profit. It should not be assumed that recommendations made in the future will be profitable or will equal the performance as shown. Investors should have long-term financial objectives. Advice from a financial professional is strongly advised.

Dorsey, Wright & Associates, LLC, a Nasdaq Company, is a registered investment advisory firm. Neither the information within this article, nor any opinion expressed shall constitute an offer to sell or a solicitation or an offer to buy any securities, commodities, or exchange traded products. This article does not purport to be complete description of the securities or commodities, markets or developments to which reference is made.