The 2024 Real Estate iSummit is now available for viewing on demand. Over 83% of advisors attending the live event rated it as four or five stars.

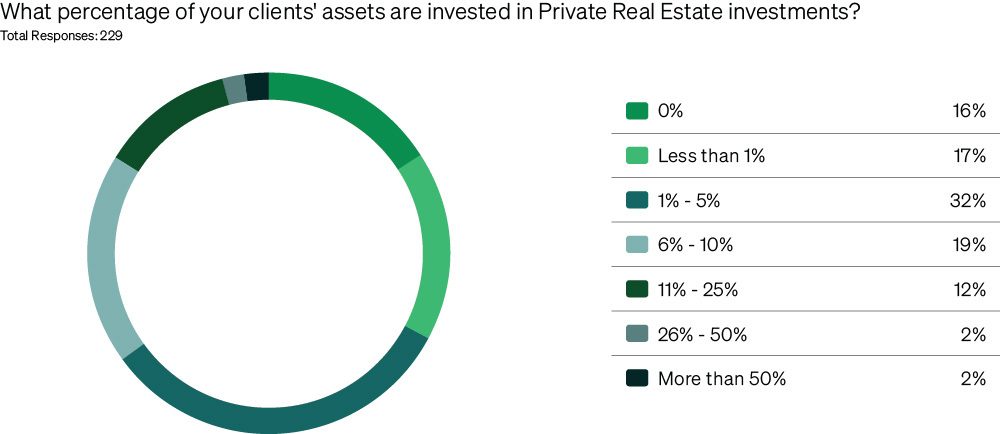

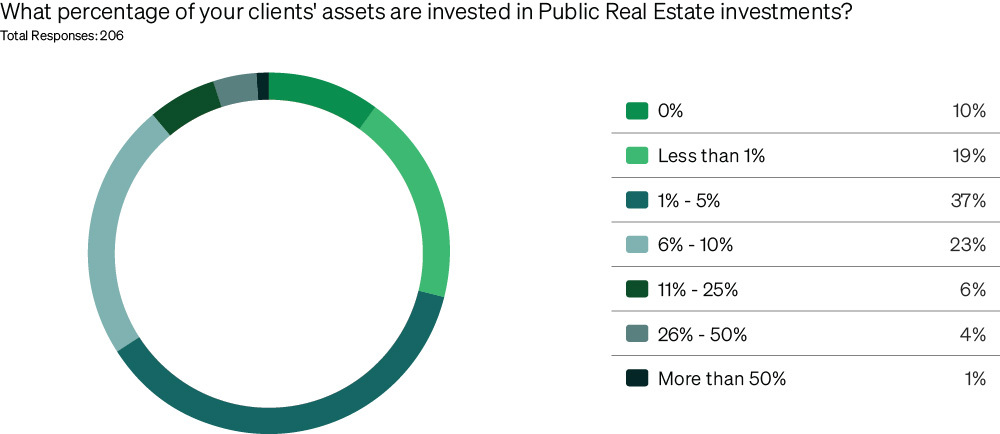

Many advisors note that real estate is a core asset class in their client’s portfolios. 35% of advisors report that client allocations to private real estate exceed 6% of assets, while 34% of advisors report that client allocations to public real estate exceed 6% of assets. 16% and 11% of advisors allocate greater than 11% to private and public real estate, respectively. In addition, 45% of advisors noted that they intend to add new allocations to real estate investments in 2024.

Of course, advisors have significant concerns about how the inflation and interest rate environment are likely to impact real estate markets. Clients want to add new allocations, but advisors worry about the timing of trying to buy the bottom of the market. Advisors are cautious about the commercial real estate market and the impact of cap rates converging with mortgage rates.

However, as cap rates have risen, property prices have declined. In today’s higher-rate environment, investors may also be interested in purchasing mortgages rather than holding equity in real estate properties.

WEBCAST – Real Estate iSummit

Registration is now open for on-demand viewing of the 2024 Real Estate iSummit.

This complimentary online event provides 2 CE credits.

Topics to be covered during this event include:

- State of the Real Estate Market

- Why Choose a Build-to-Rent 1031 Exchange

- Oil and Gas Property Opportunities

- Equity & Debt Real Estate Opportunities

- Navigating the Risks and Opportunities of Real Estate Investing

Accepted for 2 CFP® / IWI / CFA CE Credits