You don’t want to think of managed commodity futures as a get rich quick scheme. We’ve all heard of all the money hedge funds tend to lose by investing in short-term commodity futures contracts. But that all depends on trend timing – are you looking January to January, or January to March, for example?

Despite their reputation as being a long-term loser compared to equities, over the course of shorter periods of time, these commodity trading strategies do work. They can be complicated. But the vast majority of Commodity Trading Advisors (CTAs) are momentum driven funds, so when a market is showing technical signs of a high, the CTAs are long. That’s where the money is made. Over the last six months, the S&P Commodity Trading Strategy Index (SIS 14,13 +0,13 +0,93%) is up 23%, clobbering the SPDR Gold (GLD 211,52 -1,22 -0,57%), iPath S&P GSCI Crude Oil Return, and the SPDR S&P 500 (SPY 515,71 +2,85 +0,56%) ETFs hands down. Over the course of 12 month’s ending April 5, it’s done even better.

Dr. Ajay Dravid, CIO of Equinox Funds says that for newcomers, CTAs aren’t only trading commodities futures. CTAs are trading six sectors, including physical markets like base metals, stock indexes, currencies and bond rates. Most are liquid, exchange traded markets, so it’s very different than just buying a few futures contracts.

Mostly all of these funds are using quantitative models, exiting positions based on what their proprietary models tell them about the markets.

“If you think of a mutual fund, the mandate for the manager is generally to be long, but CTAs have the benefit of being able to go short just as easily as they can go long, so that means potentially they can take advantage of up trends and down trends in one fund,” he says. “This is the main feature that provides diversification. So if the market is falling out of bed, you would expect all of these systematic trend followers to be short while your standard mutual fund is long and losing money.”

“If you think of a mutual fund, the mandate for the manager is generally to be long, but CTAs have the benefit of being able to go short just as easily as they can go long, so that means potentially they can take advantage of up trends and down trends in one fund,” he says. “This is the main feature that provides diversification. So if the market is falling out of bed, you would expect all of these systematic trend followers to be short while your standard mutual fund is long and losing money.”

Trend followers are the majority of CTAs, but there are different types. Equinox tries to blend the trading styles – diversified trend following, relative value, for instance — into one portfolio. They run a number of CTA strategies like their Equinox Aspect Core Diversified Strategy (EQAAX 7,76 -0,01 -0,13%), which has not yet beat the market on an annualized basis.

The funds top three holdings as of Dec. 31 were Sterling futures, Stockholm OMXS 30 Dividend futures and mini-MSCI Emerging Markets Index.

This is not for the feint at heart.

CTA investing, however, is not a lesson in futility. The CISDM CTA Equal Weighted Index rose 21.76% in 2008, thanks to long oil and then long gold. But if the CTA was worth his weight in gold, then they went short oil in August 2008 and long gold right around the time Lehman Brothers and Bear Stearns went belly up.

Last year, the index rose 4.15%.

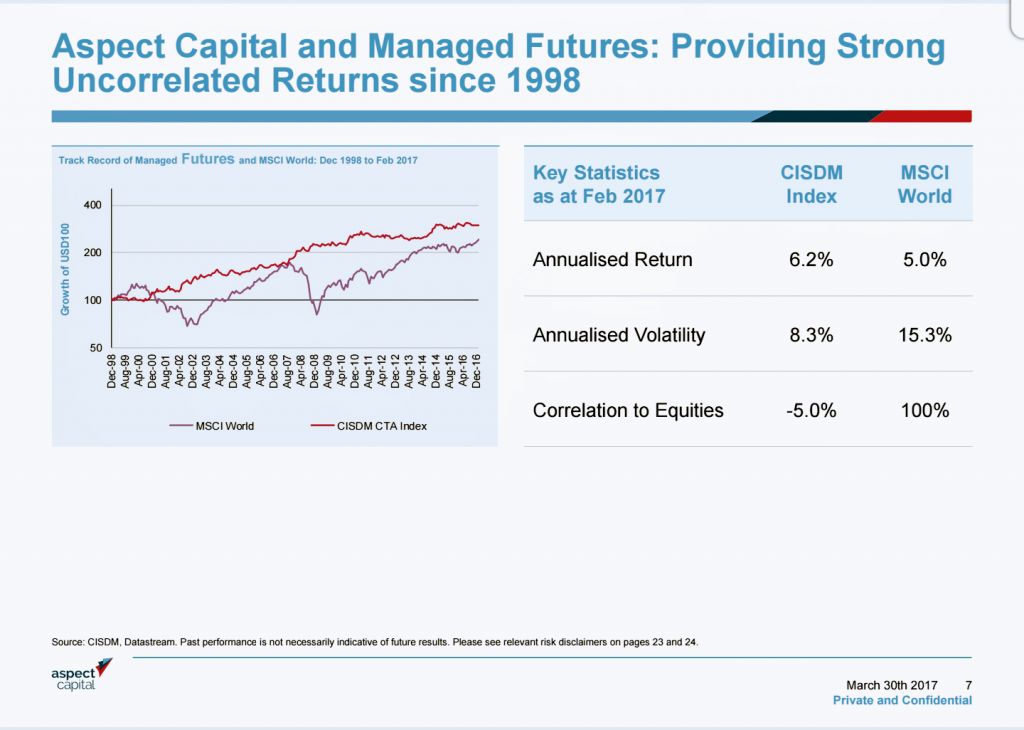

Aspect Capital in London is another CTA player. They’ve been in the market since 1998 and last year won Hedge Fund Magazine Europe’s award for best performance for a U.S. and European hedge fund. Their co-founder pointed out in a conference call with investors on March 30 that as of Feb. 2017, the CISDM Index produced an annualized return of 6.2% versus 5% for the MSCI World. It has a negative correlation to equity, so it gives portfolios some insurance. For example, large cap and small cap stocks have a roughly 90% correlation.

By design, managed futures seek to adapt to the market but over time tries to be uncorrelated to any one asset class. In an ideal world, managers are building funds, or funds of funds that hold securities and derivatives, long or short, at the right time.

“These are useful returns compared with equities and notable you will see positive returns over miserable returns for equities,” says Martin Lueck, co-founder and research director of Aspect Capital.

Spotting trends is a lot like rocket science. Only harder, because there are too many moving targets. It’s a bit like landing a module on an asteroid perhaps.

“We try to pick the best managers for our funds, we look at things like pedigree, long term track record, quality of research and execution,” says Dravid about their CTA funds. Their Equinox Chesapeake Strategy Fund(EQCHX 11,84 -0,02 -0,17%) was given a five star rating by Morningstar in January.

“We rebalance periodically and are not trying to time by overweighting a certain style, or predict what manager will do well…we really take a long-term view and stick with it.”

Even though short-term performance may be more attractive for CTA funds, Equinox is picking their CTA managers to put in their fund based on long term track record.

Some investors on the call wanted to know what happens to these funds in a rising yield environment. Managed futures are scenario and directionally agnostic, and of course they can profit off bond index futures. Any quant fund is able to capitalize on a rising yield environment and CTA funds are no different, Lueck says.

The RIA Channel ran a webinar on March 30 hosted by Equinox Funds and Aspect Capital. The hour long presentation focused on CTA funds. A replay is available online.