We asked Nicholas Houle, Principal of Icon Alternatives, for his thoughts on the market. When does this turnaround for oil investors?

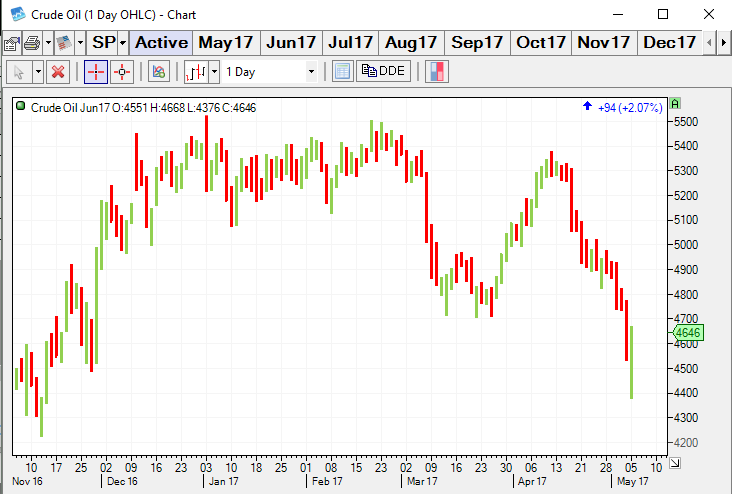

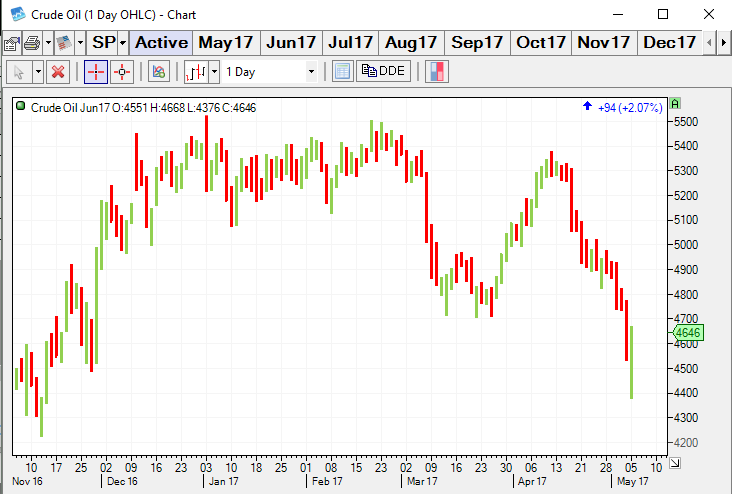

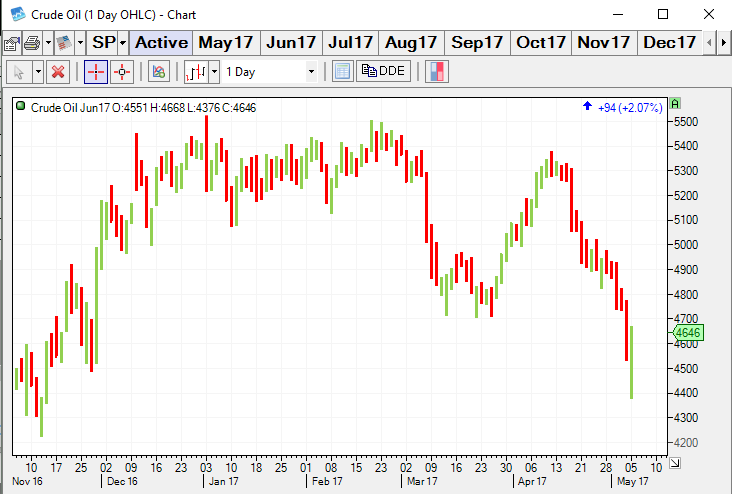

This largely has to deal with OPEC losing its control over supply, Houle tells us. Many thought crude would remain at higher levels after the 2016 OPEC production cut agreement, led by the Saudis and the Russians, which is non-OPEC but a major supplier nonetheless. The 2016 agreement to cut production has opened the door for Russia to overtake the OPEC nations as the largest producer of crude. With the forecasted increase in production from the United States, OPEC could be facing an even smaller share of the global market. Currently, the supply of crude is continuously trending upward, and OPEC is struggling to control the supply. It seems the only way oil goes back into the $50s is if there is an escalation in tensions overseas with North Korea, Syria and Russia and/or OPEC somehow gains back control.

On May 25, OPEC members will meet to discuss supply. How should investors position for this short term?

“Typically, when OPEC spoke it created fear in the markets, leading to immediate action. The world accepted that the OPEC nations would stick to their agreements. However, increased world trade and economics has stretched OPEC agreements causing a greater chance for cheating,” Houle says.

In the first quarter of 2017, Iran broke the 2016 agreement by trading with Asia, for instance.

Icon’s Idea

While doubt remains, OPEC’s influence as market manager will continue to weaken. “Investors should position themselves for volatility,” says Houle.

Icon Alternatives has a platform that allows for clients to buy commodities futures. Through various third party partners, they also provide analysis and investing support. Icon also has their own in-house investment research team.

“Where our value really comes in is in our one on one assistance with clients. A majority of our clients we speak with daily to discuss market analysis, current positions, education on new markets or strategies, and mitigating risk,” he says. “Market analysis is only as good as the strategy used to capture it.”

Icon analysts think crude stays in a $10 range between $50 and $40 a barrel for the near future.

“We suggest speculating with option strategies,” Houle says. “Look for a Bull Call Spread to lessen the upfront cost of buying an out right call. It’s not unreasonable to think we will have a mild rebound after reaching oversold levels. Especially considering the last push down was likely due to margin calls being met. Options provide the opportunity to stomach some of the volatility crude can provide,” he says.

Icon’s managed futures program has a different set of rates and fees depending on the product. Figure 2% management fee and a 20% incentive fee. Commission is flexible, depending on service.

“Investors need more assistance in the beginning, but after further education, they may eventually do more on their own,” he says.

We asked Nicholas Houle, Principal of Icon Alternatives, for his thoughts on the market. When does this turnaround for oil investors?

This largely has to deal with OPEC losing its control over supply, Houle tells us. Many thought crude would remain at higher levels after the 2016 OPEC production cut agreement, led by the Saudis and the Russians, which is non-OPEC but a major supplier nonetheless. The 2016 agreement to cut production has opened the door for Russia to overtake the OPEC nations as the largest producer of crude. With the forecasted increase in production from the United States, OPEC could be facing an even smaller share of the global market. Currently, the supply of crude is continuously trending upward, and OPEC is struggling to control the supply. It seems the only way oil goes back into the $50s is if there is an escalation in tensions overseas with North Korea, Syria and Russia and/or OPEC somehow gains back control.

On May 25, OPEC members will meet to discuss supply. How should investors position for this short term?

“Typically, when OPEC spoke it created fear in the markets, leading to immediate action. The world accepted that the OPEC nations would stick to their agreements. However, increased world trade and economics has stretched OPEC agreements causing a greater chance for cheating,” Houle says.

In the first quarter of 2017, Iran broke the 2016 agreement by trading with Asia, for instance.

Icon’s Idea

While doubt remains, OPEC’s influence as market manager will continue to weaken. “Investors should position themselves for volatility,” says Houle.

Icon Alternatives has a platform that allows for clients to buy commodities futures. Through various third party partners, they also provide analysis and investing support. Icon also has their own in-house investment research team.

“Where our value really comes in is in our one on one assistance with clients. A majority of our clients we speak with daily to discuss market analysis, current positions, education on new markets or strategies, and mitigating risk,” he says. “Market analysis is only as good as the strategy used to capture it.”

Icon analysts think crude stays in a $10 range between $50 and $40 a barrel for the near future.

“We suggest speculating with option strategies,” Houle says. “Look for a Bull Call Spread to lessen the upfront cost of buying an out right call. It’s not unreasonable to think we will have a mild rebound after reaching oversold levels. Especially considering the last push down was likely due to margin calls being met. Options provide the opportunity to stomach some of the volatility crude can provide,” he says.

Icon’s managed futures program has a different set of rates and fees depending on the product. Figure 2% management fee and a 20% incentive fee. Commission is flexible, depending on service.

“Investors need more assistance in the beginning, but after further education, they may eventually do more on their own,” he says. Withering Oil? How To Trade It

It’s another lousy year for energy investors, thanks to the supply and demand equation in the oil and gas markets. The iPath S&P Crude (OIL 28,42 0,00 0,00%) fund is down nearly 19%. The SPDR Energy (XLE 83,31 -1,30 -1,54%) ETF is down 10.7%. And if you were a bit of a renegade and bought the ProShares Oil & Gas ETF (DIG 37,69 0,00 0,00%) believing in the return of some Trump-inspired energy renaissance, boy did you get disappointed. That ETF is down almost 18%.

We asked Nicholas Houle, Principal of Icon Alternatives, for his thoughts on the market. When does this turnaround for oil investors?

This largely has to deal with OPEC losing its control over supply, Houle tells us. Many thought crude would remain at higher levels after the 2016 OPEC production cut agreement, led by the Saudis and the Russians, which is non-OPEC but a major supplier nonetheless. The 2016 agreement to cut production has opened the door for Russia to overtake the OPEC nations as the largest producer of crude. With the forecasted increase in production from the United States, OPEC could be facing an even smaller share of the global market. Currently, the supply of crude is continuously trending upward, and OPEC is struggling to control the supply. It seems the only way oil goes back into the $50s is if there is an escalation in tensions overseas with North Korea, Syria and Russia and/or OPEC somehow gains back control.

On May 25, OPEC members will meet to discuss supply. How should investors position for this short term?

“Typically, when OPEC spoke it created fear in the markets, leading to immediate action. The world accepted that the OPEC nations would stick to their agreements. However, increased world trade and economics has stretched OPEC agreements causing a greater chance for cheating,” Houle says.

In the first quarter of 2017, Iran broke the 2016 agreement by trading with Asia, for instance.

Icon’s Idea

While doubt remains, OPEC’s influence as market manager will continue to weaken. “Investors should position themselves for volatility,” says Houle.

Icon Alternatives has a platform that allows for clients to buy commodities futures. Through various third party partners, they also provide analysis and investing support. Icon also has their own in-house investment research team.

“Where our value really comes in is in our one on one assistance with clients. A majority of our clients we speak with daily to discuss market analysis, current positions, education on new markets or strategies, and mitigating risk,” he says. “Market analysis is only as good as the strategy used to capture it.”

Icon analysts think crude stays in a $10 range between $50 and $40 a barrel for the near future.

“We suggest speculating with option strategies,” Houle says. “Look for a Bull Call Spread to lessen the upfront cost of buying an out right call. It’s not unreasonable to think we will have a mild rebound after reaching oversold levels. Especially considering the last push down was likely due to margin calls being met. Options provide the opportunity to stomach some of the volatility crude can provide,” he says.

Icon’s managed futures program has a different set of rates and fees depending on the product. Figure 2% management fee and a 20% incentive fee. Commission is flexible, depending on service.

“Investors need more assistance in the beginning, but after further education, they may eventually do more on their own,” he says.

We asked Nicholas Houle, Principal of Icon Alternatives, for his thoughts on the market. When does this turnaround for oil investors?

This largely has to deal with OPEC losing its control over supply, Houle tells us. Many thought crude would remain at higher levels after the 2016 OPEC production cut agreement, led by the Saudis and the Russians, which is non-OPEC but a major supplier nonetheless. The 2016 agreement to cut production has opened the door for Russia to overtake the OPEC nations as the largest producer of crude. With the forecasted increase in production from the United States, OPEC could be facing an even smaller share of the global market. Currently, the supply of crude is continuously trending upward, and OPEC is struggling to control the supply. It seems the only way oil goes back into the $50s is if there is an escalation in tensions overseas with North Korea, Syria and Russia and/or OPEC somehow gains back control.

On May 25, OPEC members will meet to discuss supply. How should investors position for this short term?

“Typically, when OPEC spoke it created fear in the markets, leading to immediate action. The world accepted that the OPEC nations would stick to their agreements. However, increased world trade and economics has stretched OPEC agreements causing a greater chance for cheating,” Houle says.

In the first quarter of 2017, Iran broke the 2016 agreement by trading with Asia, for instance.

Icon’s Idea

While doubt remains, OPEC’s influence as market manager will continue to weaken. “Investors should position themselves for volatility,” says Houle.

Icon Alternatives has a platform that allows for clients to buy commodities futures. Through various third party partners, they also provide analysis and investing support. Icon also has their own in-house investment research team.

“Where our value really comes in is in our one on one assistance with clients. A majority of our clients we speak with daily to discuss market analysis, current positions, education on new markets or strategies, and mitigating risk,” he says. “Market analysis is only as good as the strategy used to capture it.”

Icon analysts think crude stays in a $10 range between $50 and $40 a barrel for the near future.

“We suggest speculating with option strategies,” Houle says. “Look for a Bull Call Spread to lessen the upfront cost of buying an out right call. It’s not unreasonable to think we will have a mild rebound after reaching oversold levels. Especially considering the last push down was likely due to margin calls being met. Options provide the opportunity to stomach some of the volatility crude can provide,” he says.

Icon’s managed futures program has a different set of rates and fees depending on the product. Figure 2% management fee and a 20% incentive fee. Commission is flexible, depending on service.

“Investors need more assistance in the beginning, but after further education, they may eventually do more on their own,” he says.

We asked Nicholas Houle, Principal of Icon Alternatives, for his thoughts on the market. When does this turnaround for oil investors?

This largely has to deal with OPEC losing its control over supply, Houle tells us. Many thought crude would remain at higher levels after the 2016 OPEC production cut agreement, led by the Saudis and the Russians, which is non-OPEC but a major supplier nonetheless. The 2016 agreement to cut production has opened the door for Russia to overtake the OPEC nations as the largest producer of crude. With the forecasted increase in production from the United States, OPEC could be facing an even smaller share of the global market. Currently, the supply of crude is continuously trending upward, and OPEC is struggling to control the supply. It seems the only way oil goes back into the $50s is if there is an escalation in tensions overseas with North Korea, Syria and Russia and/or OPEC somehow gains back control.

On May 25, OPEC members will meet to discuss supply. How should investors position for this short term?

“Typically, when OPEC spoke it created fear in the markets, leading to immediate action. The world accepted that the OPEC nations would stick to their agreements. However, increased world trade and economics has stretched OPEC agreements causing a greater chance for cheating,” Houle says.

In the first quarter of 2017, Iran broke the 2016 agreement by trading with Asia, for instance.

Icon’s Idea

While doubt remains, OPEC’s influence as market manager will continue to weaken. “Investors should position themselves for volatility,” says Houle.

Icon Alternatives has a platform that allows for clients to buy commodities futures. Through various third party partners, they also provide analysis and investing support. Icon also has their own in-house investment research team.

“Where our value really comes in is in our one on one assistance with clients. A majority of our clients we speak with daily to discuss market analysis, current positions, education on new markets or strategies, and mitigating risk,” he says. “Market analysis is only as good as the strategy used to capture it.”

Icon analysts think crude stays in a $10 range between $50 and $40 a barrel for the near future.

“We suggest speculating with option strategies,” Houle says. “Look for a Bull Call Spread to lessen the upfront cost of buying an out right call. It’s not unreasonable to think we will have a mild rebound after reaching oversold levels. Especially considering the last push down was likely due to margin calls being met. Options provide the opportunity to stomach some of the volatility crude can provide,” he says.

Icon’s managed futures program has a different set of rates and fees depending on the product. Figure 2% management fee and a 20% incentive fee. Commission is flexible, depending on service.

“Investors need more assistance in the beginning, but after further education, they may eventually do more on their own,” he says.

We asked Nicholas Houle, Principal of Icon Alternatives, for his thoughts on the market. When does this turnaround for oil investors?

This largely has to deal with OPEC losing its control over supply, Houle tells us. Many thought crude would remain at higher levels after the 2016 OPEC production cut agreement, led by the Saudis and the Russians, which is non-OPEC but a major supplier nonetheless. The 2016 agreement to cut production has opened the door for Russia to overtake the OPEC nations as the largest producer of crude. With the forecasted increase in production from the United States, OPEC could be facing an even smaller share of the global market. Currently, the supply of crude is continuously trending upward, and OPEC is struggling to control the supply. It seems the only way oil goes back into the $50s is if there is an escalation in tensions overseas with North Korea, Syria and Russia and/or OPEC somehow gains back control.

On May 25, OPEC members will meet to discuss supply. How should investors position for this short term?

“Typically, when OPEC spoke it created fear in the markets, leading to immediate action. The world accepted that the OPEC nations would stick to their agreements. However, increased world trade and economics has stretched OPEC agreements causing a greater chance for cheating,” Houle says.

In the first quarter of 2017, Iran broke the 2016 agreement by trading with Asia, for instance.

Icon’s Idea

While doubt remains, OPEC’s influence as market manager will continue to weaken. “Investors should position themselves for volatility,” says Houle.

Icon Alternatives has a platform that allows for clients to buy commodities futures. Through various third party partners, they also provide analysis and investing support. Icon also has their own in-house investment research team.

“Where our value really comes in is in our one on one assistance with clients. A majority of our clients we speak with daily to discuss market analysis, current positions, education on new markets or strategies, and mitigating risk,” he says. “Market analysis is only as good as the strategy used to capture it.”

Icon analysts think crude stays in a $10 range between $50 and $40 a barrel for the near future.

“We suggest speculating with option strategies,” Houle says. “Look for a Bull Call Spread to lessen the upfront cost of buying an out right call. It’s not unreasonable to think we will have a mild rebound after reaching oversold levels. Especially considering the last push down was likely due to margin calls being met. Options provide the opportunity to stomach some of the volatility crude can provide,” he says.

Icon’s managed futures program has a different set of rates and fees depending on the product. Figure 2% management fee and a 20% incentive fee. Commission is flexible, depending on service.

“Investors need more assistance in the beginning, but after further education, they may eventually do more on their own,” he says.