It seems safer now to assume there will be no Trump-inspired blow-outs of U.S.-China relations. For the market, it’s all about Wilbur Ross and to a smaller extent, Trump confidante and son-in-law Jared Kushner. Both have Trump’s trust. Both are pragmatic. Neither want to blow up the most important relationship. This is true not only for the future of the American job market (imagine rich Chinese buying more here than just luxury real estate), but also for global trade.

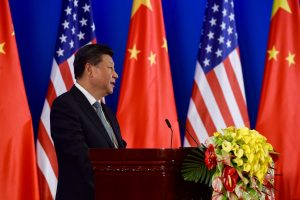

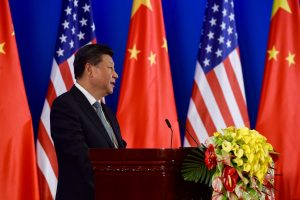

There will be changes, of course. But if we are to take Trump at his word, the U.S. is going to get better trade deals that help U.S. companies, particularly mid-sized and smaller ones based here at home. Friday’s meet-and-greet between President Trump and his Chinese counterpart Xi Jinping suggest the wheels are now in motion. We are heading in a direction now, which is much better than not heading anywhere. It looks like an OK direction.

Trump and Xi agreed to a 100 day plan for trade talks. Commerce Secretary Ross said the plan will boost U.S. exports and reduce the U.S. deficit with China. Ross further commented, “Given the range of issues and the magnitude, reducing the deficit may be ambitious, but it’s a very big sea change in the pace of discussion. I think that’s a very important symbolization of the growing rapport between the two countries.”

In Trump typical fashion, the meeting was deemed “outstanding”.

“These are all positive signs toward improved bi-lateral relations,” says Stephen Simonis Sr., chief currency consultant for FXDD Global and former Managing Director of Global FX Markets at BNY Mellon. “Investors will look at this as a solid beginning to the new U.S. administration’s relationship with China moving forward,” he says. Look for the yuan and the dollar to gain ground across a basket of currencies, Simonis says.

The BNY Mellon China Select ADR Index (Unfortunately, we could not get stock quote BKTCN this time.) is up 15.9% so far this year, beating the iShares FTSE China (FXI 24,02 -0,11 -0,46%) fund.

Three China-bound fixed income funds*:

Guinness Atkinson Renminbi Yuan & Bond (GARBX 11,16 +0,01 +0,09%)

WisdomTree Chinese Yuan Strategy (CYB 24,27 0,00 0,00%)

PowerShares Chinese Yuan Dim Sum (DSUM 22,18 -0,12 -0,54%)

*Funds were randomly chosen and based on previous contact with fund managers, or ETF brand familiarity.

It seems safer now to assume there will be no Trump-inspired blow-outs of U.S.-China relations. For the market, it’s all about Wilbur Ross and to a smaller extent, Trump confidante and son-in-law Jared Kushner. Both have Trump’s trust. Both are pragmatic. Neither want to blow up the most important relationship. This is true not only for the future of the American job market (imagine rich Chinese buying more here than just luxury real estate), but also for global trade.

There will be changes, of course. But if we are to take Trump at his word, the U.S. is going to get better trade deals that help U.S. companies, particularly mid-sized and smaller ones based here at home. Friday’s meet-and-greet between President Trump and his Chinese counterpart Xi Jinping suggest the wheels are now in motion. We are heading in a direction now, which is much better than not heading anywhere. It looks like an OK direction.

Trump and Xi agreed to a 100 day plan for trade talks. Commerce Secretary Ross said the plan will boost U.S. exports and reduce the U.S. deficit with China. Ross further commented, “Given the range of issues and the magnitude, reducing the deficit may be ambitious, but it’s a very big sea change in the pace of discussion. I think that’s a very important symbolization of the growing rapport between the two countries.”

In Trump typical fashion, the meeting was deemed “outstanding”.

“These are all positive signs toward improved bi-lateral relations,” says Stephen Simonis Sr., chief currency consultant for FXDD Global and former Managing Director of Global FX Markets at BNY Mellon. “Investors will look at this as a solid beginning to the new U.S. administration’s relationship with China moving forward,” he says. Look for the yuan and the dollar to gain ground across a basket of currencies, Simonis says.

The BNY Mellon China Select ADR Index (Unfortunately, we could not get stock quote BKTCN this time.) is up 15.9% so far this year, beating the iShares FTSE China (FXI 24,02 -0,11 -0,46%) fund.

Three China-bound fixed income funds*:

Guinness Atkinson Renminbi Yuan & Bond (GARBX 11,16 +0,01 +0,09%)

WisdomTree Chinese Yuan Strategy (CYB 24,27 0,00 0,00%)

PowerShares Chinese Yuan Dim Sum (DSUM 22,18 -0,12 -0,54%)

*Funds were randomly chosen and based on previous contact with fund managers, or ETF brand familiarity. There Will Be No China-Trump Blow-Outs

It seems safer now to assume there will be no Trump-inspired blow-outs of U.S.-China relations. For the market, it’s all about Wilbur Ross and to a smaller extent, Trump confidante and son-in-law Jared Kushner. Both have Trump’s trust. Both are pragmatic. Neither want to blow up the most important relationship. This is true not only for the future of the American job market (imagine rich Chinese buying more here than just luxury real estate), but also for global trade.

There will be changes, of course. But if we are to take Trump at his word, the U.S. is going to get better trade deals that help U.S. companies, particularly mid-sized and smaller ones based here at home. Friday’s meet-and-greet between President Trump and his Chinese counterpart Xi Jinping suggest the wheels are now in motion. We are heading in a direction now, which is much better than not heading anywhere. It looks like an OK direction.

Trump and Xi agreed to a 100 day plan for trade talks. Commerce Secretary Ross said the plan will boost U.S. exports and reduce the U.S. deficit with China. Ross further commented, “Given the range of issues and the magnitude, reducing the deficit may be ambitious, but it’s a very big sea change in the pace of discussion. I think that’s a very important symbolization of the growing rapport between the two countries.”

In Trump typical fashion, the meeting was deemed “outstanding”.

“These are all positive signs toward improved bi-lateral relations,” says Stephen Simonis Sr., chief currency consultant for FXDD Global and former Managing Director of Global FX Markets at BNY Mellon. “Investors will look at this as a solid beginning to the new U.S. administration’s relationship with China moving forward,” he says. Look for the yuan and the dollar to gain ground across a basket of currencies, Simonis says.

The BNY Mellon China Select ADR Index (Unfortunately, we could not get stock quote BKTCN this time.) is up 15.9% so far this year, beating the iShares FTSE China (FXI 24,02 -0,11 -0,46%) fund.

Three China-bound fixed income funds*:

Guinness Atkinson Renminbi Yuan & Bond (GARBX 11,16 +0,01 +0,09%)

WisdomTree Chinese Yuan Strategy (CYB 24,27 0,00 0,00%)

PowerShares Chinese Yuan Dim Sum (DSUM 22,18 -0,12 -0,54%)

*Funds were randomly chosen and based on previous contact with fund managers, or ETF brand familiarity.

It seems safer now to assume there will be no Trump-inspired blow-outs of U.S.-China relations. For the market, it’s all about Wilbur Ross and to a smaller extent, Trump confidante and son-in-law Jared Kushner. Both have Trump’s trust. Both are pragmatic. Neither want to blow up the most important relationship. This is true not only for the future of the American job market (imagine rich Chinese buying more here than just luxury real estate), but also for global trade.

There will be changes, of course. But if we are to take Trump at his word, the U.S. is going to get better trade deals that help U.S. companies, particularly mid-sized and smaller ones based here at home. Friday’s meet-and-greet between President Trump and his Chinese counterpart Xi Jinping suggest the wheels are now in motion. We are heading in a direction now, which is much better than not heading anywhere. It looks like an OK direction.

Trump and Xi agreed to a 100 day plan for trade talks. Commerce Secretary Ross said the plan will boost U.S. exports and reduce the U.S. deficit with China. Ross further commented, “Given the range of issues and the magnitude, reducing the deficit may be ambitious, but it’s a very big sea change in the pace of discussion. I think that’s a very important symbolization of the growing rapport between the two countries.”

In Trump typical fashion, the meeting was deemed “outstanding”.

“These are all positive signs toward improved bi-lateral relations,” says Stephen Simonis Sr., chief currency consultant for FXDD Global and former Managing Director of Global FX Markets at BNY Mellon. “Investors will look at this as a solid beginning to the new U.S. administration’s relationship with China moving forward,” he says. Look for the yuan and the dollar to gain ground across a basket of currencies, Simonis says.

The BNY Mellon China Select ADR Index (Unfortunately, we could not get stock quote BKTCN this time.) is up 15.9% so far this year, beating the iShares FTSE China (FXI 24,02 -0,11 -0,46%) fund.

Three China-bound fixed income funds*:

Guinness Atkinson Renminbi Yuan & Bond (GARBX 11,16 +0,01 +0,09%)

WisdomTree Chinese Yuan Strategy (CYB 24,27 0,00 0,00%)

PowerShares Chinese Yuan Dim Sum (DSUM 22,18 -0,12 -0,54%)

*Funds were randomly chosen and based on previous contact with fund managers, or ETF brand familiarity.