Private equity conjures images of guys like Wilbur Ross buying steel mills for pennies on the dollar, holding them for about five years, and then selling them, hopefully at a profit. Only a few of private equity managers (like new Commerce Secretary Ross) get any attention. As investors, we love the easy-to-understand and the low cost. Private equity is for multi-millionaires.

Private equity conjures images of guys like Wilbur Ross buying steel mills for pennies on the dollar, holding them for about five years, and then selling them, hopefully at a profit. Only a few of private equity managers (like new Commerce Secretary Ross) get any attention. As investors, we love the easy-to-understand and the low cost. Private equity is for multi-millionaires.

Over the last several years, however, that has changed. Investment firms have created products much like real estate investment trusts, allowing retail investors access to the same type of investments that have made people like Wilbur Ross billionaires.

Much like a REIT, investment firms create shares to invest in private equity managers – many private equity managers to be exact – and roll them up into a mutual fund. Investors are buying the private equity firm and its underlying businesses, like an investor buys a REIT and its collection of commercial real estate.

“We are not making macro calls when we invest in private equity companies. We are buying the highest quality management firms with the highest quality underlying assets and believe if we are paying a fee for these, we should be generating high alpha,” says Mark Sunderhuse, managing director and portfolio manager of a listed private equity fund (LPEFX 6,68 -0,11 -1,62%) at Red Rocks Capital.

Listed private equity funds allow the RIA to access a market that’s basically been a luxury item for big institutional investors.

The private equity market is growing as more publicly traded companies go private. Less regulatory oversight by the SEC, and no quarterly filings has private sector firms saying they can focus long term instead of three months from now.

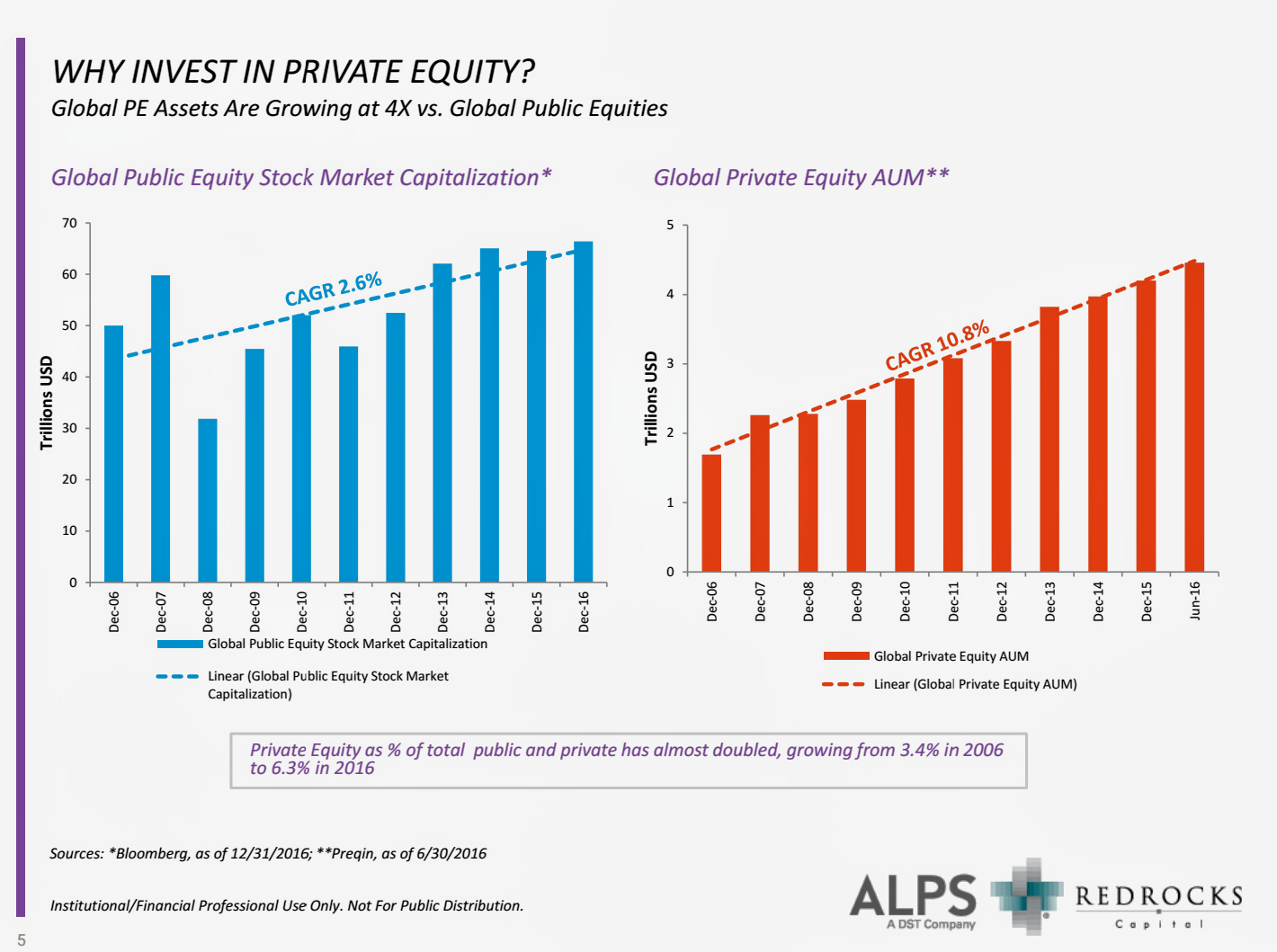

Global public equity stock market capitalization has grown by a compounded annual rate of 2.6% over the last decade, but global private equity has grown by 10.8%, notes Jeremy Held, director of research for Denver-based ALPS Portfolio Solutions.

“This is an 8 year bull market for private equity,” he says.

It’s something RIAs shouldn’t ignore. The $219 million ALPS Red Rocks Listed Private Equity mutual fund has a $500 minimum investment for its tax deferred class of shares and $2,500 for all others. Institutional clients need $1 million.

Investors who do not have at least 6% of their holdings in private equity are missing out on some of America’s most promising turnaround and growth stories, says Held.

Private equity accounts for 6.3% of overall market cap. Those that have invested in this space have beaten the stock market.

According to the Cambridge Associates Buyout and Growth index, private equity has beat the S&P 500 and the MSCI World over a 10, 15, 20 and 25 year period.

Until the advent of listed private equity mutual funds, this has been a world for the institutional client. Endowments and public pension plans have been increasing their allocation to private equity over the last 10 years.

Yale University had 19% allocated to private equity in 2007. In 2015 it increased their holdings to 30%, according to Yale Corporation Annual Reports for those two years. CalPERS went from 7% to 10% in the same period, based on their annual reports as well.

In an online poll conducted during a recent ALPS webcast hosted by the RIA Channel, 45.5% of participants said they had no money in private equity, with another 37.5% saying they held under 5% in this asset class.

The one hour seminar is available on demand here – WEBCAST REPLAY.

Sunderhuse thinks more private equity firms will participate in funds like Red Rocks. His fund is global, holding Aurelius Equity Opportunities of Germany, HarbourVest Global, a Boston-based fund of funds listed in London, and U.S. firms Brookfield Asset Management (BAM 38,55 -0,83 -2,11%), Blackstone Group (BX 121,17 -2,30 -1,86%) and Ares Capital (ARCC 20,24 -0,04 -0,20%).

“More companies will participate in this because they see that defined contribution plans are allowing for private equity now, too,” says Sunderhuse. “It’s a way to raise permanent capital. I think more companies will get in on this over time.”

The ALPS Red Rocks Fund: A Look Inside

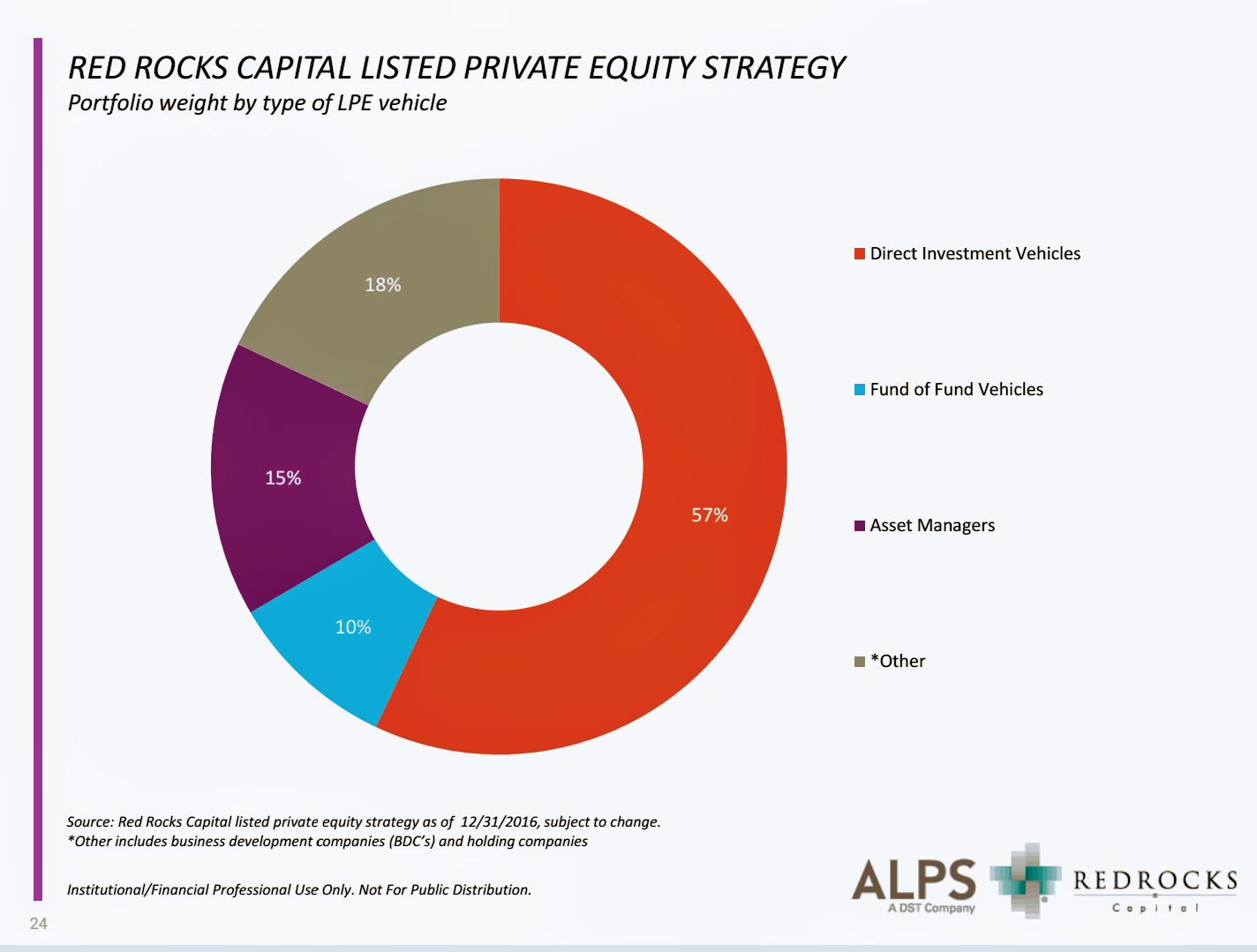

The 10-year old mutual fund gives retail investors exposure to private businesses by investing in publicly-traded private equity companies worldwide. These listed private equity companies have direct ownership, control and influence over the privately held businesses in their portfolios. The fund had 38 holdings going into 2017.

Unlike traditional private equity, listed private equity funds have daily liquidity and valuation.

Last year, the fund’s class A shares rose 7.26%. The fund has under performed the MSCI World in its one year period ending Dec. 31, 2016 and in a three-year period. It beat the MSCI World by 340 basis points over a five year period, up 14.4%.

The fund is off to a good start this year, up 8.28% and outperforming both the MSCI World and the S&P 500.

Some 45% of its holdings are in Europe. The U.S. and Canada combined are the second biggest allocation at 40%. The top three sector holdings are industrials, financials and consumer discretionary.