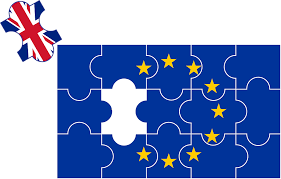

The U.K. is inching closer to formalizing its exit from the European Union, with vast and somewhat unknown implications for Europeans living and working in the country as well as the likelihood of some form of tariffs from both sides.

The U.K. is inching closer to formalizing its exit from the European Union, with vast and somewhat unknown implications for Europeans living and working in the country as well as the likelihood of some form of tariffs from both sides.

Parliament will soon provide formal notice of its intention to withdraw. The period ahead promises to be even more combative, says Fitch Ratings in its latest Global Perspectives commentary.

One of the biggest challenges will be setting the financial terms of their departure from the Union. Investment banks will be watching this closely, especially the British banks and broker/dealers that have already threatened to relocate to Frankfurt or Paris post-Brexit. Many sources have told us that this is still an idle threat. London has been the fixed income and currency trading capital of the world for generations. Setting that culture up in Paris and Frankfurt would take years.

Similar remarks were heard in New York following tax hikes in the 1970s — and most recently after the Sept. 11 terrorist attacks. Yet Wall Street continues to be the undisputed capital of U.S. equity markets. Manhattan has yet to be replaced by Jersey City.

Fitch thinks the main challenges to watch will be domestic. For instance, Scotland may seek a solution to allow continued access to the single market, raising the risk of a second independence referendum if its objects are unmet.

“It will prove challenging for the government to maintain expectations,” Fitch authors wrote. “The biggest associated risk is a decided swing in public opinion toward a more negative view of Brexit, lending support for either a greater Parliamentary role…or another opportunity for the electorate to formally express its view.” Another Brexit vote? It almost sounds like Fitch thinks the U.K. will be like Greece, the European soap opera that keeps on repeating season after season.

The FTSE 100 (Unfortunately, we could not get stock quote UKX this time.) is up 3.14% as of Monday’s close, underperforming the FTSE Europe (VGK 66,41 +0,11 +0,17%) which is up 5.75%.