The investment case for gold rests on three main pillars. First, gold has demonstrated a positive correlation with inflation. Ever since the US dollar was decoupled from the price of gold in 1971, the gold price per ounce has risen by a compounded annual rate of almost 8%, outpacing inflation which has compounded at around 4%.1. The second argument in favor of gold as an investment is its historic correlation with equity markets. Generally, gold exhibits something close to zero correlation with equity markets. Finally, the third rationale for gold investing centers on its historic ‘safe haven’ status. As will be discussed below, research shows that gold can demonstrate negative correlation to equity markets in times of extreme market stress. It is in light of these benefits that we wish to review gold investment, not simply as a pure play investment, but as an addition to equity portfolios through a method we refer to as ‘gold hedged investing’.

What is Gold Hedged investing?

Gold hedged investing is a method of wrapping long gold exposure, as a form of hedge, around long stock positions. An investment in REX’s Gold Hedged S&P 500 ETF (GHS), for example, represents approximately 100% exposure to S&P 500 stocks plus a simultaneous 100% exposure to the price of gold. This is made possible through the use of futures contracts in the ETF’s portfolio.

A gold future is an exchange-traded contract to buy a given quantity of gold at a set price in the future. Because the physical gold is not purchased until the contract matures, a futures contract’s value is represented by the change in price, not by the total value of the contract. As a result, gold futures positions can be established with very little money down, but still offer investors the exposure to gold they would like.

REX puts the ETF’s assets to work by purchasing stocks, as well as gold and stock index futures, effectively making one dollar of investment do the work of two. Let’s imagine an investor buys $10,000 worth of GHS. The fund invests the cash by buying $10,000 worth of S&P exposure through single stocks and index futures, and simultaneously buys gold futures in an equivalent size. The investor now has $10,000 of exposure to S&P stocks as well as $10,000 of exposure to gold, all with just a single $10,000 investment.

There are three main potential benefits to accessing gold returns via gold-hedged investing. First, it can help con- serve capital in an investor’s portfolio, as explained above, which can then be put to work in other investments. Second, the combination of gold with equity in the same fund helps create a more diversified exposure. And third, an embedded gold position in long-term portfolio holdings can mitigate the need to time the market with respect to gold investing.

Gold Hedged Investing Reason #1: Conserve Capital

REX Gold Hedged ETFs are designed to address one of the central criticisms of gold investing – that to invest in gold, which produces no income, an investor is required to forgo other income-producing investments. The gold overlay approach of gold-hedged investing may prove advantageous for investors who already have both gold and equity holdings, as well as for those who do not have, but are considering gold investments.

- Gold and Equity holders – Consolidating gold and equity holdings into a single holding can free up cash to be put to work elsewhere in the Investors with both equities and gold in their portfolios may consider gold-hedged investing as a method of accessing gold exposure. Such an investor could then redeploy those assets to other opportunities.

- Investors considering Gold – For investors looking to make a potential allocation to gold, REX Gold Hedged ETFs can provide the opportunity to add a gold component without reducing exposure to equity Investors can maintain their exposure to large cap U.S. equities or emerging market equities by utilizing GHS (for large cap U.S. equities) and GHE (for emerging market equities), either of which simultaneously add long exposure to gold. The addition of gold exposure is thereby achieved without watering down equity exposure.

The exposure you get when you invest in GHS (the REX Gold Hedged S&P 500 ETF) and GHE (the REX Gold Hedged FTSE Emerging Markets ETF) can be approximately illustrated as follows:

Gold Hedged Investing Reason #2: Diversified Exposure in one investment

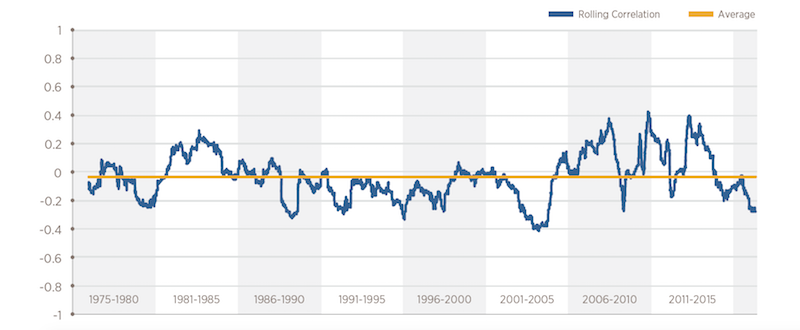

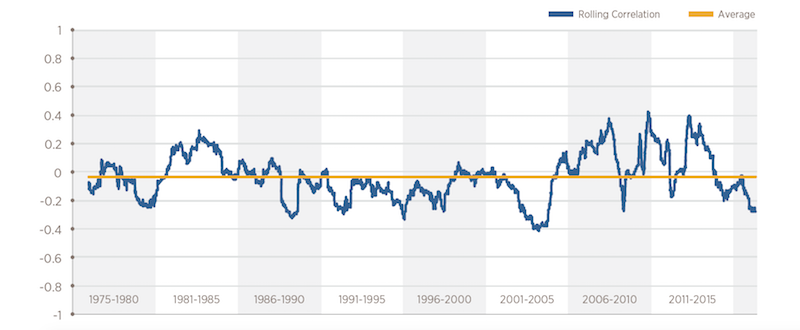

Empirical research has shown that gold can exhibit both ‘hedging’ and ‘safe haven’ properties.2 In this context, ‘hedging’ occurs if gold exhibits a zero or sometimes negative correlation to equities during normal market condi- tions, whereas ‘safe haven’ would indicate that gold exhibits a zero or sometimes negative correlation to equities during extreme market stress. As a result, a gold allocation within the equities sleeve of a portfolio has the potential to offer significant diversification and hedging benefits.

1 Year Rolling Correlation of Daily S&P 500 and Gold Returns

Source: Bloomberg, November 14, 2016. Date range: 1/2/75 – 11/11/16

Gold Hedged Investing Reason #3: Avoid Market Timing Mistakes

Gold price movements can be “jumpy” and overall gold tends be “up” less consistently than equities. For example, in the 40-year period ended June 30, 2016, gold was up in 86 of 160 quarters (54%) whereas the S&P 500 price index was up 105 of 160 quarters (66%) . Because of this tendency, and because of the lack of yield or earnings power inherent in gold, investors can be tempted to “market time” their gold investments. Embedding a long gold position via gold-hedged investing can be a way of combatting the natural tendency of many market timers to be late to the party. A gold-hedged allocation means that the gold exposure is always present in that portion of the portfolio. However, because the exposure is taken via a futures position, the investment is still allocated to equities as well. This can allow investors to maintain their original asset allocation mix with their gold allocation coming alongside existing positions.

Conclusion

REX Shares Gold Hedged ETFs are a new and intriguing way to access gold exposure via ETFs.

- They are designed to be tools that help investors use their capital more

- They offer important hedging and diversification

- They can help avoid market timing

In these important ways gold hedged investing can address the ultimate investment objectives of preserving and increasing wealth.

1 Data from Bloomberg (CPI YOY and XAU) annually compounded from December 31, 1971 to September 30, 2016.

2 Baur, D.G. and Lucey, B.M., 2010. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Review, 45(2), pp.217-229.

DISCLOSURE

The material is not intended to be individual or personalized investment advice.

Carefully consider the Funds’ investment objectives, risk factors, charges and expenses before investing. This and addi- tional information can be found in the Funds’ full and summary prospectuses, which may be obtained by calling 1-844-REX- 1414. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal.

The price of gold is volatile and may be affected by a variety of factors, including the global gold supply and demand and investors’ expec- tations with respect to the rate of inflation. Developments affecting the value of gold may have a significant impact on the Fund. There is no assurance that gold will maintain its long-term value

Fixed-income assets will decline in value because of rising interest rates.

The use of derivatives presents risks different from, and possibly greater than, the risks associated with investing directly in traditional securities. Changes in the value of a derivative may not correlate perfectly with the underlying security, asset, rate or index. Gains or losses in a derivative may be magnified and may be much greater than the derivative’s original cost. The derivatives may not always be liquid. This could have a negative effect on the Funds’ ability to achieve its investment objective and may result in losses.

In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluc- tuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. In emerging markets, these risks are heightened, and lower trading volumes may occur. Investments in smaller companies typically exhibit higher volatility.

The Funds will invest in exchange-traded notes and exchange-traded funds, and will be subject to the risks associated with such vehicles. The Funds’ performance will be directly related to the performance of those investments.

The Funds are non-diversified.

Exchange Traded Concepts, LLC serves as the investment advisor and Vident Vident Investment Advisory, LLC serves as sub advisor to the fund. The Funds are distributed by SEI Investments Distribution Co., which is not affiliated with Exchange Traded Concepts, LLC or any of its affiliates.

Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and subli- censed for certain purposes by REX Shares, LLC, the sponsor of the REX Gold Hedged S&P 500 ETF (the “Licensee”). The S&P 500 Dynam- ic Gold Hedged Index is a product of S&P Dow Jones Indices LLC or its affiliates and has been licensed for use by the Licensee. The REX Gold Hedged S&P 500 ETF is not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, their respective affiliates, or any third party licensor and none of S&P Dow Jones Indices LLC, Dow Jones, S&P, their respective affiliates or any third party licensor makes any representation regarding the advisability of investing in such product(s).

The REX Gold Hedged FTSE Emerging Markets ETF is not in any way sponsored, endorsed, sold or promoted by the London Stock Exchange Group companies, which include FTSE International Limited (“FTSE”), Frank Russell Company (“Russell”), MTS Next Limited (“MTS”) and FTSE TMX Global Debt Capital Markets Inc (“FTSE TMX”) (together “LSEG”). LSEG makes no claim, prediction, warranty or representation whatsoever, expressly or implied- ly, either as to (i) the results to be obtained from the use of the FTSE Emerging Gold Overlay Index (the “FTSE Benchmark”) (upon which the Fund is based), (ii) the figure at which the FTSE Benchmark is said to stand at any particular time on any particular day or otherwise, or (iii) the suitability of the Index for the purpose to which it is being put in connection with the Fund. LSEG has not provided nor will provide any financial or investment advice or recommendation in relation to the FTSE Benchmark to the adviser or to its clients. The FTSE Benchmark is cal- culated by FTSE or its agent. LSEG shall not be (a) liable (whether in negligence or otherwise) to any person for any error in the Index or (b) under any obligation to advise any person of any error therein.

All rights in the FTSE Benchmark vest in FTSE. “FTSE®”, “Russell®”, “MTS®”, “FTSE TMX®” and “FTSE Russell” and other service marks and trademarks related to the FTSE or Russell indexes are trade marks of the London Stock Exchange Group companies and are used by FTSE, MTS, FTSE TMX and Russell under licence.

January 2017