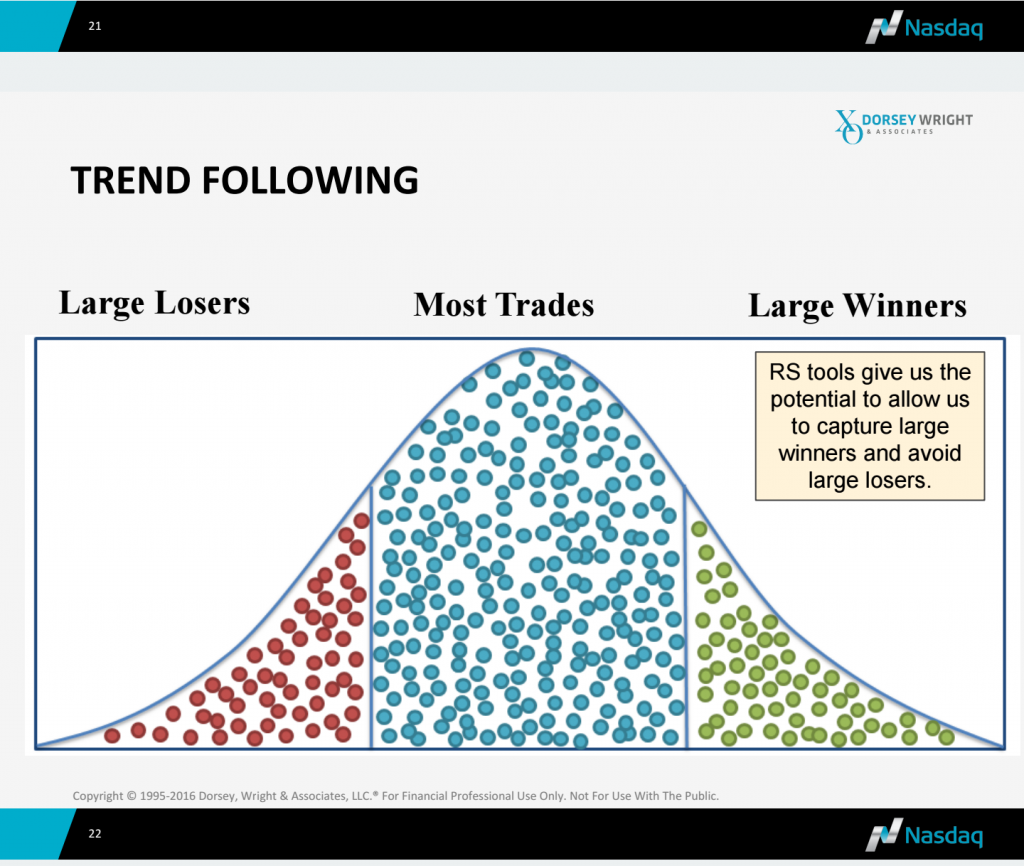

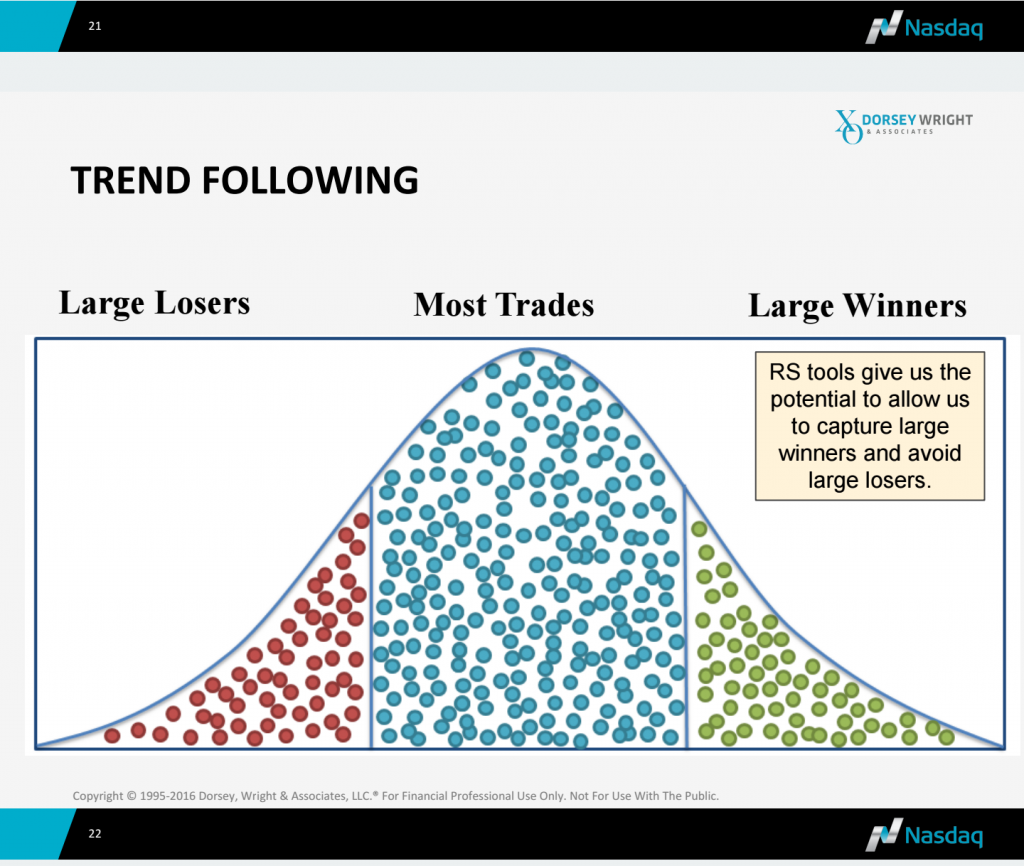

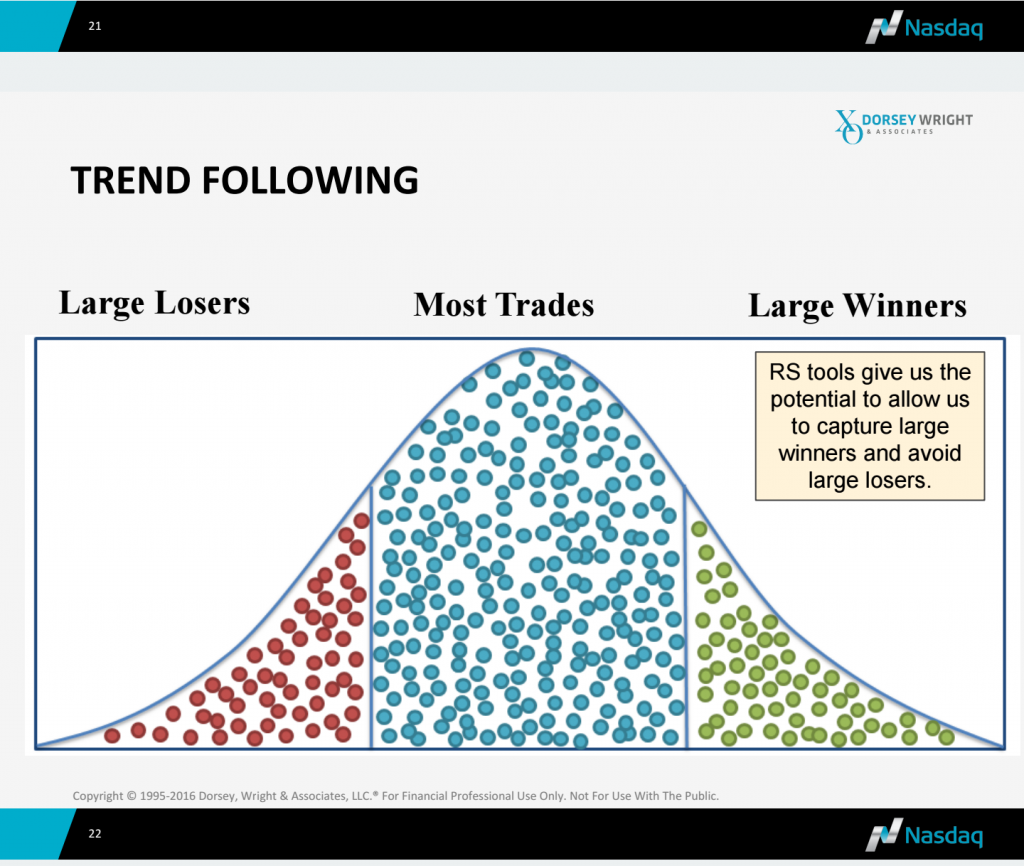

Lewis says that most of their returns based on their relative strength investing model will be generated by a handful of winners (the green dots) that are longer term holds, driving the portfolio’s overall returns. But the bulk of trades will be average performers.

“What you’re really looking to do with this system is ignore the losers,” he says. “We will live with the blue dots, but we want to get rid of the red dots. You wind up with a lot of short term losers, but then your big gainers are the long term holdings and from a capital gains standpoint, that is more efficient.”

Right now their best ETFs in their ranking system are Powershares QQQ Trust (QQQ 437,48 +3,56 +0,82%), a Nasdaq ETF; iShares S&P Latin America (ILF 28,50 -0,08 -0,28%) and the Vanguard Small Cap Index (VB 218,12 -0,65 -0,30%).

Although this looks a bit U.S.-centric, Dorsey’s technical research model analyzes across assets, borders and sectors. It shows that the S&P is still the out-performer, but with Latin America creeping in, it seems that the U.S. will give way to global securities.

Lewis gives us a clue. “It’s time to start shifting into other areas outside of our borders.”

The goal with the Dorsey model is to hold things that are trending up and sell things that are trending down.

Joseph Barrato, CEO of Arrow Funds, has two Dorsey Wright styled ETFs.

Their Arrow DW Tactical ETF (DWAT) is a fund of funds whose top holdings include the PowerShares High Yield Dividend Achievers (PEY 19,72 +0,15 +0,77%); Vanguard Mid-Cap Value (VOE 149,31 +0,77 +0,52%) and the Vanguard Small Cap Value (VBR 183,45 +0,86 +0,47%) ETFs. Over the last five days they have pretty much moved in tandem with the index, but over the last four weeks, the S&P 500 has them beat.

Tactical funds depend a lot on timing. DWAT uses the technical tools from Dorsey Wright to enter in and out of ETF trades believe to have peaked, or about to hit their stride.

“For us right now, we see world momentum getting stronger,” says Barrato. “You have to use relative strength to find these asset classes to take advantage of the trend.”

Lewis says that most of their returns based on their relative strength investing model will be generated by a handful of winners (the green dots) that are longer term holds, driving the portfolio’s overall returns. But the bulk of trades will be average performers.

“What you’re really looking to do with this system is ignore the losers,” he says. “We will live with the blue dots, but we want to get rid of the red dots. You wind up with a lot of short term losers, but then your big gainers are the long term holdings and from a capital gains standpoint, that is more efficient.”

Right now their best ETFs in their ranking system are Powershares QQQ Trust (QQQ 437,48 +3,56 +0,82%), a Nasdaq ETF; iShares S&P Latin America (ILF 28,50 -0,08 -0,28%) and the Vanguard Small Cap Index (VB 218,12 -0,65 -0,30%).

Although this looks a bit U.S.-centric, Dorsey’s technical research model analyzes across assets, borders and sectors. It shows that the S&P is still the out-performer, but with Latin America creeping in, it seems that the U.S. will give way to global securities.

Lewis gives us a clue. “It’s time to start shifting into other areas outside of our borders.”

The goal with the Dorsey model is to hold things that are trending up and sell things that are trending down.

Joseph Barrato, CEO of Arrow Funds, has two Dorsey Wright styled ETFs.

Their Arrow DW Tactical ETF (DWAT) is a fund of funds whose top holdings include the PowerShares High Yield Dividend Achievers (PEY 19,72 +0,15 +0,77%); Vanguard Mid-Cap Value (VOE 149,31 +0,77 +0,52%) and the Vanguard Small Cap Value (VBR 183,45 +0,86 +0,47%) ETFs. Over the last five days they have pretty much moved in tandem with the index, but over the last four weeks, the S&P 500 has them beat.

Tactical funds depend a lot on timing. DWAT uses the technical tools from Dorsey Wright to enter in and out of ETF trades believe to have peaked, or about to hit their stride.

“For us right now, we see world momentum getting stronger,” says Barrato. “You have to use relative strength to find these asset classes to take advantage of the trend.” Dorsey Wright On Buying Into Momentum

The trend really is your friend.

Investors who bought into trending stocks with momentum generated more alpha in their portfolio over the long term than the market, says John Lewis, senior portfolio manager with Dorsey Wright Money Management. Relative strength alpha versus the market from 1927 to 2016 shows the following: the short term average performance was 3.54% better than market; intermediate performance was 5.04% better and over the long haul, relative strength alpha was 6.23% better.

Charles Dow was right, the public tends to buy at the wrong time and sells at the wrong time. That usually means retail investors buy at the top, instead of at the bottom when securities are cheap. If you’re chasing relative strength, how do you know you’re not paying too much?

Lewis walked investors through how they do this at Dorsey Wright during an hour long webinar on Tuesday on the RIA Channel called Global Macro Strategy: Capitalizing on Global Trends. The firm was built by Tom Dorsey, a technical trading guru known for his pioneering work on technical analysis of the stock market. Dorsey Wright put that brain power to work in creating their own solution that tracks momentum, and adjusts a portfolio accordingly without the standard emotional bias.

Lewis explained the firm’s relative strength ranking system by using sports analogies.

“It’s like college football,” Lewis says. “You play out the season and you have rankings at the end of the year. We don’t know if the number one team is better than the number four team, but we do know that the top four are better than the ones ranked fifty.” Lewis says that most of their returns based on their relative strength investing model will be generated by a handful of winners (the green dots) that are longer term holds, driving the portfolio’s overall returns. But the bulk of trades will be average performers.

“What you’re really looking to do with this system is ignore the losers,” he says. “We will live with the blue dots, but we want to get rid of the red dots. You wind up with a lot of short term losers, but then your big gainers are the long term holdings and from a capital gains standpoint, that is more efficient.”

Right now their best ETFs in their ranking system are Powershares QQQ Trust (QQQ 437,48 +3,56 +0,82%), a Nasdaq ETF; iShares S&P Latin America (ILF 28,50 -0,08 -0,28%) and the Vanguard Small Cap Index (VB 218,12 -0,65 -0,30%).

Although this looks a bit U.S.-centric, Dorsey’s technical research model analyzes across assets, borders and sectors. It shows that the S&P is still the out-performer, but with Latin America creeping in, it seems that the U.S. will give way to global securities.

Lewis gives us a clue. “It’s time to start shifting into other areas outside of our borders.”

The goal with the Dorsey model is to hold things that are trending up and sell things that are trending down.

Joseph Barrato, CEO of Arrow Funds, has two Dorsey Wright styled ETFs.

Their Arrow DW Tactical ETF (DWAT) is a fund of funds whose top holdings include the PowerShares High Yield Dividend Achievers (PEY 19,72 +0,15 +0,77%); Vanguard Mid-Cap Value (VOE 149,31 +0,77 +0,52%) and the Vanguard Small Cap Value (VBR 183,45 +0,86 +0,47%) ETFs. Over the last five days they have pretty much moved in tandem with the index, but over the last four weeks, the S&P 500 has them beat.

Tactical funds depend a lot on timing. DWAT uses the technical tools from Dorsey Wright to enter in and out of ETF trades believe to have peaked, or about to hit their stride.

“For us right now, we see world momentum getting stronger,” says Barrato. “You have to use relative strength to find these asset classes to take advantage of the trend.”

Lewis says that most of their returns based on their relative strength investing model will be generated by a handful of winners (the green dots) that are longer term holds, driving the portfolio’s overall returns. But the bulk of trades will be average performers.

“What you’re really looking to do with this system is ignore the losers,” he says. “We will live with the blue dots, but we want to get rid of the red dots. You wind up with a lot of short term losers, but then your big gainers are the long term holdings and from a capital gains standpoint, that is more efficient.”

Right now their best ETFs in their ranking system are Powershares QQQ Trust (QQQ 437,48 +3,56 +0,82%), a Nasdaq ETF; iShares S&P Latin America (ILF 28,50 -0,08 -0,28%) and the Vanguard Small Cap Index (VB 218,12 -0,65 -0,30%).

Although this looks a bit U.S.-centric, Dorsey’s technical research model analyzes across assets, borders and sectors. It shows that the S&P is still the out-performer, but with Latin America creeping in, it seems that the U.S. will give way to global securities.

Lewis gives us a clue. “It’s time to start shifting into other areas outside of our borders.”

The goal with the Dorsey model is to hold things that are trending up and sell things that are trending down.

Joseph Barrato, CEO of Arrow Funds, has two Dorsey Wright styled ETFs.

Their Arrow DW Tactical ETF (DWAT) is a fund of funds whose top holdings include the PowerShares High Yield Dividend Achievers (PEY 19,72 +0,15 +0,77%); Vanguard Mid-Cap Value (VOE 149,31 +0,77 +0,52%) and the Vanguard Small Cap Value (VBR 183,45 +0,86 +0,47%) ETFs. Over the last five days they have pretty much moved in tandem with the index, but over the last four weeks, the S&P 500 has them beat.

Tactical funds depend a lot on timing. DWAT uses the technical tools from Dorsey Wright to enter in and out of ETF trades believe to have peaked, or about to hit their stride.

“For us right now, we see world momentum getting stronger,” says Barrato. “You have to use relative strength to find these asset classes to take advantage of the trend.”

Lewis says that most of their returns based on their relative strength investing model will be generated by a handful of winners (the green dots) that are longer term holds, driving the portfolio’s overall returns. But the bulk of trades will be average performers.

“What you’re really looking to do with this system is ignore the losers,” he says. “We will live with the blue dots, but we want to get rid of the red dots. You wind up with a lot of short term losers, but then your big gainers are the long term holdings and from a capital gains standpoint, that is more efficient.”

Right now their best ETFs in their ranking system are Powershares QQQ Trust (QQQ 437,48 +3,56 +0,82%), a Nasdaq ETF; iShares S&P Latin America (ILF 28,50 -0,08 -0,28%) and the Vanguard Small Cap Index (VB 218,12 -0,65 -0,30%).

Although this looks a bit U.S.-centric, Dorsey’s technical research model analyzes across assets, borders and sectors. It shows that the S&P is still the out-performer, but with Latin America creeping in, it seems that the U.S. will give way to global securities.

Lewis gives us a clue. “It’s time to start shifting into other areas outside of our borders.”

The goal with the Dorsey model is to hold things that are trending up and sell things that are trending down.

Joseph Barrato, CEO of Arrow Funds, has two Dorsey Wright styled ETFs.

Their Arrow DW Tactical ETF (DWAT) is a fund of funds whose top holdings include the PowerShares High Yield Dividend Achievers (PEY 19,72 +0,15 +0,77%); Vanguard Mid-Cap Value (VOE 149,31 +0,77 +0,52%) and the Vanguard Small Cap Value (VBR 183,45 +0,86 +0,47%) ETFs. Over the last five days they have pretty much moved in tandem with the index, but over the last four weeks, the S&P 500 has them beat.

Tactical funds depend a lot on timing. DWAT uses the technical tools from Dorsey Wright to enter in and out of ETF trades believe to have peaked, or about to hit their stride.

“For us right now, we see world momentum getting stronger,” says Barrato. “You have to use relative strength to find these asset classes to take advantage of the trend.”

Lewis says that most of their returns based on their relative strength investing model will be generated by a handful of winners (the green dots) that are longer term holds, driving the portfolio’s overall returns. But the bulk of trades will be average performers.

“What you’re really looking to do with this system is ignore the losers,” he says. “We will live with the blue dots, but we want to get rid of the red dots. You wind up with a lot of short term losers, but then your big gainers are the long term holdings and from a capital gains standpoint, that is more efficient.”

Right now their best ETFs in their ranking system are Powershares QQQ Trust (QQQ 437,48 +3,56 +0,82%), a Nasdaq ETF; iShares S&P Latin America (ILF 28,50 -0,08 -0,28%) and the Vanguard Small Cap Index (VB 218,12 -0,65 -0,30%).

Although this looks a bit U.S.-centric, Dorsey’s technical research model analyzes across assets, borders and sectors. It shows that the S&P is still the out-performer, but with Latin America creeping in, it seems that the U.S. will give way to global securities.

Lewis gives us a clue. “It’s time to start shifting into other areas outside of our borders.”

The goal with the Dorsey model is to hold things that are trending up and sell things that are trending down.

Joseph Barrato, CEO of Arrow Funds, has two Dorsey Wright styled ETFs.

Their Arrow DW Tactical ETF (DWAT) is a fund of funds whose top holdings include the PowerShares High Yield Dividend Achievers (PEY 19,72 +0,15 +0,77%); Vanguard Mid-Cap Value (VOE 149,31 +0,77 +0,52%) and the Vanguard Small Cap Value (VBR 183,45 +0,86 +0,47%) ETFs. Over the last five days they have pretty much moved in tandem with the index, but over the last four weeks, the S&P 500 has them beat.

Tactical funds depend a lot on timing. DWAT uses the technical tools from Dorsey Wright to enter in and out of ETF trades believe to have peaked, or about to hit their stride.

“For us right now, we see world momentum getting stronger,” says Barrato. “You have to use relative strength to find these asset classes to take advantage of the trend.”